Cryptocurrency, like Bitcoin, CAN be used for funds for closing on a home as long as the cryptocurrency (i.e. virtual currency) meets certain criteria. Fannie Mae and Freddie Mac require that the funds be exchanged into U.S. dollars and that held in a U.S. regulated financial institution. In order to use conventional financing, there needs to be enough documentation to meet conventional guidelines, including: [Read more…]

Cryptocurrency, like Bitcoin, CAN be used for funds for closing on a home as long as the cryptocurrency (i.e. virtual currency) meets certain criteria. Fannie Mae and Freddie Mac require that the funds be exchanged into U.S. dollars and that held in a U.S. regulated financial institution. In order to use conventional financing, there needs to be enough documentation to meet conventional guidelines, including: [Read more…]

Using Cryptocurrency for a Down Payment

Gimme your Best Interest Rate with NO Closing Cost

The other day, a Redmond homeowner contacted me for a quote to refinance their home. They specifically requested scenarios for “lowest possible interest rate without paying any points or closing costs“. [Read more…]

The other day, a Redmond homeowner contacted me for a quote to refinance their home. They specifically requested scenarios for “lowest possible interest rate without paying any points or closing costs“. [Read more…]

Honoring our Hometown Heroes

Mortgage Master Service Corporation recently started a program to honor our local heroes. We are now offering a $625 credit towards closing cost for a home purchase or refinance when we provide the mortgage.

Mortgage Master Service Corporation recently started a program to honor our local heroes. We are now offering a $625 credit towards closing cost for a home purchase or refinance when we provide the mortgage.

Mortgage Master Service Corporation’s Hometown Heroes program is available for:

- Police Officers

- Firefighters and EMTs

- Doctors and Nurses

- Teachers

- Military

We thank our heroes for taking care of our community and hope we can take care of you with your mortgage needs. Please feel free to share this! I’m am honored to help you with any home purchase or refi on homes located in Washington state.

Note: This program cannot be combined with any WSHFC program. Program and pricing subject to change.

How Much Cash Do I Need to Buy a Home besides the Down Payment and Closing Cost?

Fannie Mae HomePath offering 3.5% towards closing costs!

Fannie Mae HomePath has announced they will offer up to 3.5% towards the buyers closing cost through March 31, 2014. Fannie Mae HomePath properties are homes that Fannie Mae owns through foreclosure. Fannie Mae offers special financing on these homes with reduced down payment, no mortgage insurance and no appraisal required. You can learn more about the Fannie Mae HomePath Mortgage by clicking here.

Fannie Mae HomePath has announced they will offer up to 3.5% towards the buyers closing cost through March 31, 2014. Fannie Mae HomePath properties are homes that Fannie Mae owns through foreclosure. Fannie Mae offers special financing on these homes with reduced down payment, no mortgage insurance and no appraisal required. You can learn more about the Fannie Mae HomePath Mortgage by clicking here.

Reader Question: Can Closing Cost be financed with a VA Loan?

I received this email from one of our subscribers:

”…with a VA mortgage, can you finance buyer closing costs in excess of the purchase price (e.g. not ask for seller financing contributions, but just borrow them in excess of the purchase price)”

With a VA mortgage, the buyers closing cost cannot be financed, with exception to the VA funding fee, regardless of the appraised value.

The VA loan amount is limited to the purchase price, appraised value or VA county loan limit (or VA jumbo loan amount)*, whichever is less.

*NOTE: VA does not set actual loan limits on counties. They do set a limit as to their maximum guarantee (meaning zero down financing). In the greater Seattle/King-County area, the loan limit for zero down financing is currently $500,000. Click here for a complete list of VA loan amounts per county. VA loan amounts exceeding $500,000 in the Seattle/King County area are considered VA Jumbos and will require some down payment depending on the difference between the sales price and county loan limit.

USDA loans, on the other hand, will allow for buyers closing cost to be financed IF the appraised value is higher than the sales price. The loan amount is limited to the appraised value and must be applied to bona fide closing cost.

USDA loans are also zero down programs and are only eligible in specific designated rural areas, like Snoqualmie, Carnation or Duvall, and to borrowers who meet certain household income limits.

Sellers can contribute towards closing cost for both of these mortgage programs and currently, low mortgage rates are often paired with enough rebate pricing to cover a majority of the closing cost.

Thanks for your question!

Comparing Closing Cost

Sometimes I see quotes from competitors that befuddle me. This morning, a home owner in Maple Valley asked me to review their FHA streamlined refinance quote that they received from a big bank.

The great big bank not only has a much higher interest rate, their closing cost are more expensive too. In fact, when I review the closing cost, it makes me wonder if the loan officer has originated many FHA loans.

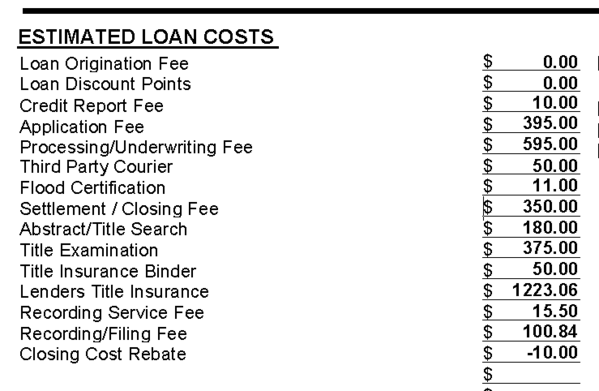

Here are the bank’s closing cost for an FHA streamline refi…

Big Bank’s Closing Costs

…and there’s only a $10 closing cost rebate with an interest rate that is 0.5% higher than mine!

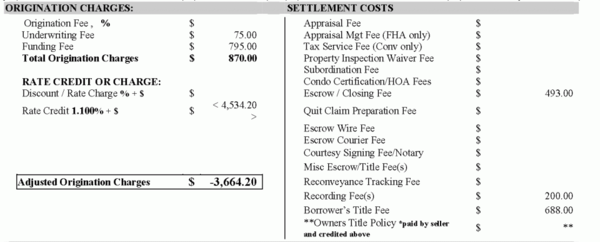

Compare this to my closing cost (BELOW), which are covered with a rebate credit (which also pays for my clients prepaids and reserves).

My closing costs

I really don’t understand how our quotes could be so far apart…but you can see, they are. Many consumers would trust their bank would provide the most competitive rates and closing cost. The quotes I’m looking at today illustrate this isn’t always true. If this Maple Valley homeowner did not shop his rate quote and only trusted his big bank, he would be paying a much higher rate over the life of the loan and overpaying in fees.

Yet those in Congress feel that mortgage originators who work for banks can be held to lower standards per the SAFE Act. Remember, bank mortgage originators are not required to be licensed, they are only registered. I recently met a nice loan officer who works for a different big bank and who presented herself to be NMLS licensed, when I asked her directly if she was “registered” or “licensed” she did correct herself. Believe me, there is a difference.

If you are considering refinancing or buying a home anywhere in Washington state and have a rate quote from another lender or bank, I’m happy to review it to see if I can offer a better rate and/or lower closing cost. Send me an email with a pdf of the rate quote you would like me to review. Remember, I can only help with homes located in Washington state, where I’m Licensed to originate mortgages.

Recent Comments