What’s influencing mortgage rates this week, what may impact the direction of mortgage rates this (and next) week and 10 factors that impact the pricing of your mortgage rate in this week’s episode.

Washington State Mortgages, Made Clear. Buying or Refinancing? Let's find the right loan together.

What’s influencing mortgage rates this week, what may impact the direction of mortgage rates this (and next) week and 10 factors that impact the pricing of your mortgage rate in this week’s episode.

I’m receiving notices from a couple of the lenders we work with that they are temporarily increasing rate lock extension fees due to Fannie Mae’s increased guarantee fees (LLPA) that will hit us in 2014. An extension fee is an additional cost that may be charged in order to keep a rate locked when the rate lock is expiring.

When a mortgage rate is locked, it’s committed for a certain period of times, such as 30, 45 or 60 days. When a mortgage refi or purchase that has been locked does not close by that date, the lender may charge a fee to extend. The fee is essentially the cost to buy additional days to add to the original lock commitment.

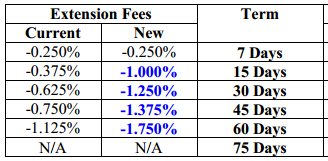

I just received this notice from one of the lenders we work with that they’re dramatically increasing their extension fees and, even worse, they’re only giving us ONE DAY’S NOTICE! Kind of stinky if you ask me. This is the same bank that increased their fees just over a month ago. The bank is doing this as a result of the 0.10% increase to G-Fees by Fannie Mae and Freddie Mac.

Thankfully we work with several lenders and we’re not limited to only working with this bank.

More often than not, it’s better to error on having a longer lock period than a shorter one and paying for an extension.

UPDATE: Another bank just announced they are increasing their pricing by 0.500% basis points to their rates (not extension) as a result of the “G Fees”.

Many families are squeezing in a vacation during the remaining days of summer. I can’t blame them, I’m just back from one myself! If you are in the mortgage process, it’s critical that your let your mortgage originator know of any vacation (or business travel) plans.

If you’re going to be in a spot where you can receive important documents and respond to emails, it may not be a huge issue. If you’re going off the grid, it may impact your rate lock commitment if your loan is currently locked. Your mortgage originator will need to price out a long enough lock period for your loan (if you’re locking) or you may opt to float and not lock in the current rates available. And of course, if you run out of time with your lock, the rate lock commitment may be extended.

Another factor is signing your final loan documents. Escrow companies can email (I do not recommend sending final docs via email) or send your loan documents via something like FedEx or UPS. This can be a bit risky as well as if a signature is missed or something is not notarized properly, your transaction may be delayed.

The more notice you can provide your mortgage originator about vacation or business travel, the more time they will have to prepare your options for the mortgage process.

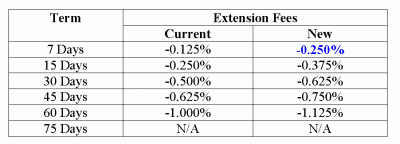

Yesterday we received a memo from one of the big 3 banks notifying us of an increase to extension fees on all conforming mortgages on locks effective August 9, 2012 by 0.125%. An extension fee is an additional cost associated with extending the rate lock period of your mortgage loan. For example, if your loan is locked for 30 days, and it takes more than 30 days to close the loan, there will more than likely be a fee to extend the rate lock commitment long enough to close the transaction. Just like a rate lock, the longer the time period that is needed, the higher the cost is. It is typically more cost effective to have a longer lock period than to pay for an extension.

Each lender we work with has their own rate lock and extension policies. Here is what it cost to extend with this lender:

It’s important to note that this is NOT Mortgage Master Service Corporations general extension fees. We work with several lenders and what ever their fees are to extend are passed on to the transaction. One lender that we work with currently offers extensions on a daily basis (instead of blocks of time) so at a cost of 0.025% per day. If we only need 5 days for an extension, the cost would be 0.125%.

Everyone likes to keep cost down and avoid extension fees. This is why it’s critical to provide your mortgage professional with requested documentation promptly, especially once your loan is locked.

As an established Mortgage Originator in the greater Seattle area, I’m often asked, “what are the current rates” and that’s often answered with “that depends on pricing a mortgage rate”.

As an established Mortgage Originator in the greater Seattle area, I’m often asked, “what are the current rates” and that’s often answered with “that depends on pricing a mortgage rate”.

Mortgage rates have layers of risk factored into them. Fannie Mae refers to them as LLPAs (Loan Level Price Adjustments).

One of my preapproved first-time home buyers asked me if they have the “best rate possible”. The phrase “best rate” can mean different things to different people, in my opinion, the most common definitions to a borrower would be:

Best rate based on qualifying means that your credit scores are as high as they can possibly be and you’re putting enough money down (or have enough equity) to where there are as few price adjustments to your scenario.

With FHA loans, there are no price improvements after a credit score of 720 or higher. There is a slight improvement to mortgage insurance premiums with FHA at 5% down. With FHA a 720 score with 5% down will provide you the “best payment”.

With conventional financing, you can see by Fannie Mae’s chart below that there are different price adjustments based on credit score and loan to value. The best pricing on this chart is with 40% down (or equity) with credit scores of 700 or higher. There are additional charts for conventional depending on program features, such as an adjustable rate or the Home Affordable Refinance.

Below is a chart from a lender showing various adjustments based on program, credit score and loan to value.

If you’re interested in obtaining the best rate possible based on qualifying, consider starting the preapproval process very early so that you have time to work on your credit, debts and/or down payment. I enjoy helping my clients develop a plan to put them in best possible situation based on their scenario. Sometimes this may take a month or two and sometimes it may be a year or more, depending on what my clients situation is.

Best rate based on pricing may be the very lowest rate available at that moment, which would take paying additional discount points and would increase your closing cost. Some might think “best rate” is lowest rate at the least amount of cost (par pricing or using rebate pricing). Whether you want your rate priced with discount (higher fees/lower rate) or rebate credit to pay for closing cost (lower fees/higher rate) is up to the borrower.

Keep in mind that mortgage rates are a moving target, much like buying stocks. Rates often change several times a day. A mortgage interest rate is only secure once it is locked. Once you pull the trigger to lock in a rate, rates may improve or deteriorate. You can lock in a rate once you have a signed around contract with a specific closing date if you’re buying a home. If you’re refinancing a home, you can lock in whenever you know what your approximate closing date should be.

Mortgage originators are restricted from advertising that they have the “best rate” since this is something a lender cannot guarantee. It’s impossible to know what all our competitors are currently offering in pricing and therefore, no lender can truly say they have the “best” or “lowest” rates.

As a correspondent lender, we work with several banks and lenders and utilize a pricing engine which compares their mortgage rates based on a borrower’s specific scenario so that we can select who has the most competitive pricing at that time available to our company for that borrower.

If you’re considering buying a refinancing a home anywhere in Washington, from Redmond to Walla Walla (and everywhere in between), I’m happy to help you with your mortgage needs. Click here for your personal rate quote.

Mortgage rates are priced with rebate, a credit towards closing cost, or discount points, an additional cost paid to reduce the interest rate (Note rate). The amount of the rebate or discount is based on a percentage of the loan amount. The difference in pricing (rebate or credit) varies throughout the day, just as mortgage interest rates change. In fact, it’s not so much that the mortgage rates change throughout the day, it’s actually the cost or credit associated with that rate.

Copyright © 2026 · Education Child Theme on Genesis Framework · WordPress · Log in