Welcome back to Mortgage Porter Weekly!

After an amazing three-week road trip down to California, the Grand Canyon, and back home to Seattle, I’m officially back in the office and watching the markets closely. And what a week to return — we’re seeing something we haven’t consistently seen in a while…

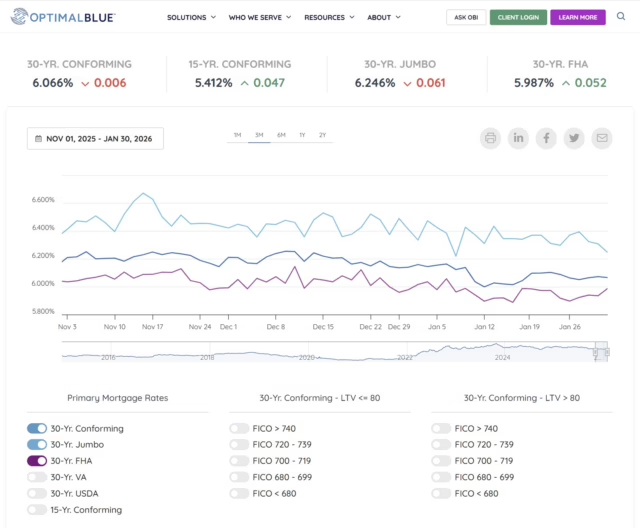

30-year conforming mortgage rates are trending lower!

That’s getting attention.

What Lower Mortgage Rates Could Mean for the Greater Seattle Area

What Lower Mortgage Rates Could Mean for the Greater Seattle Area

Recent Comments