Since mortgage rates have returned to a more historically “normal” level, many are surprised that mortgage rates a bit higher than they may have been over the past few years. Mortgage rates have been pushed higher largely due to inflation. It’s expected by many industry experts that mortgage rates should improve to the mid-5% range somewhere between this summer to sometime next year. I do not expect to see mortgage rates for the 30 year fixed 4% anytime soon. [Read more…]

Since mortgage rates have returned to a more historically “normal” level, many are surprised that mortgage rates a bit higher than they may have been over the past few years. Mortgage rates have been pushed higher largely due to inflation. It’s expected by many industry experts that mortgage rates should improve to the mid-5% range somewhere between this summer to sometime next year. I do not expect to see mortgage rates for the 30 year fixed 4% anytime soon. [Read more…]

Should You Pay Points to Buy Your Interest Rate Down?

How Much Money Do You Need to Buy a Home?

Did you know that you don’t need a 20% down payment to buy a home? In this video, I discuss what funds are needed during the home buying process.

If you’re interested in buying or refinancing a home, please contact me!

Using Cryptocurrency for a Down Payment

Cryptocurrency, like Bitcoin, CAN be used for funds for closing on a home as long as the cryptocurrency (i.e. virtual currency) meets certain criteria. Fannie Mae and Freddie Mac require that the funds be exchanged into U.S. dollars and that held in a U.S. regulated financial institution. In order to use conventional financing, there needs to be enough documentation to meet conventional guidelines, including: [Read more…]

Cryptocurrency, like Bitcoin, CAN be used for funds for closing on a home as long as the cryptocurrency (i.e. virtual currency) meets certain criteria. Fannie Mae and Freddie Mac require that the funds be exchanged into U.S. dollars and that held in a U.S. regulated financial institution. In order to use conventional financing, there needs to be enough documentation to meet conventional guidelines, including: [Read more…]

Gimme your Best Interest Rate with NO Closing Cost

The other day, a Redmond homeowner contacted me for a quote to refinance their home. They specifically requested scenarios for “lowest possible interest rate without paying any points or closing costs“. [Read more…]

The other day, a Redmond homeowner contacted me for a quote to refinance their home. They specifically requested scenarios for “lowest possible interest rate without paying any points or closing costs“. [Read more…]

Honoring our Hometown Heroes

Mortgage Master Service Corporation recently started a program to honor our local heroes. We are now offering a $625 credit towards closing cost for a home purchase or refinance when we provide the mortgage.

Mortgage Master Service Corporation recently started a program to honor our local heroes. We are now offering a $625 credit towards closing cost for a home purchase or refinance when we provide the mortgage.

Mortgage Master Service Corporation’s Hometown Heroes program is available for:

- Police Officers

- Firefighters and EMTs

- Doctors and Nurses

- Teachers

- Military

We thank our heroes for taking care of our community and hope we can take care of you with your mortgage needs. Please feel free to share this! I’m am honored to help you with any home purchase or refi on homes located in Washington state.

Note: This program cannot be combined with any WSHFC program. Program and pricing subject to change.

Want to stop your rent from increasing? Buy a home.

It’s no secret that rents, along with home prices, in the greater Seattle area have been trending higher. Rent Jungle reports that as of March 2015, the average rent for a 2 bedroom apartment within a 10 mile radius of Seattle is $1907. This is up 4% in the last six months.

How Much Cash Do I Need to Buy a Home besides the Down Payment and Closing Cost?

Comparing Closing Cost

Sometimes I see quotes from competitors that befuddle me. This morning, a home owner in Maple Valley asked me to review their FHA streamlined refinance quote that they received from a big bank.

The great big bank not only has a much higher interest rate, their closing cost are more expensive too. In fact, when I review the closing cost, it makes me wonder if the loan officer has originated many FHA loans.

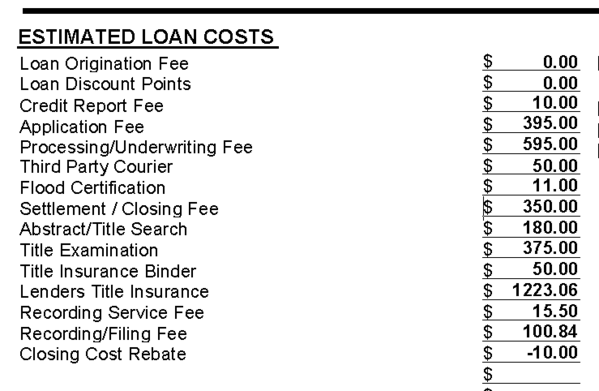

Here are the bank’s closing cost for an FHA streamline refi…

Big Bank’s Closing Costs

…and there’s only a $10 closing cost rebate with an interest rate that is 0.5% higher than mine!

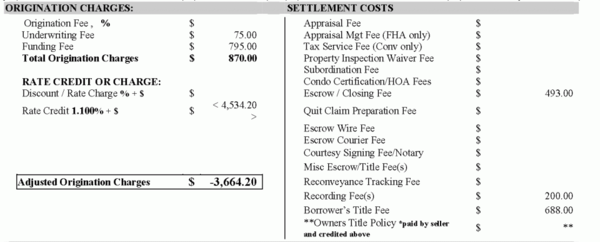

Compare this to my closing cost (BELOW), which are covered with a rebate credit (which also pays for my clients prepaids and reserves).

My closing costs

I really don’t understand how our quotes could be so far apart…but you can see, they are. Many consumers would trust their bank would provide the most competitive rates and closing cost. The quotes I’m looking at today illustrate this isn’t always true. If this Maple Valley homeowner did not shop his rate quote and only trusted his big bank, he would be paying a much higher rate over the life of the loan and overpaying in fees.

Yet those in Congress feel that mortgage originators who work for banks can be held to lower standards per the SAFE Act. Remember, bank mortgage originators are not required to be licensed, they are only registered. I recently met a nice loan officer who works for a different big bank and who presented herself to be NMLS licensed, when I asked her directly if she was “registered” or “licensed” she did correct herself. Believe me, there is a difference.

If you are considering refinancing or buying a home anywhere in Washington state and have a rate quote from another lender or bank, I’m happy to review it to see if I can offer a better rate and/or lower closing cost. Send me an email with a pdf of the rate quote you would like me to review. Remember, I can only help with homes located in Washington state, where I’m Licensed to originate mortgages.

Recent Comments