I hope you had a great weekend. Here’s what may impact the direction of mortgage rates this week!

If you would like a mortgage interest rate quote with current mortgage rates based on your personal scenario, please contact me!

Mortgage Rate Update for the week of May 27, 2024

Comparing Closing Cost

Sometimes I see quotes from competitors that befuddle me. This morning, a home owner in Maple Valley asked me to review their FHA streamlined refinance quote that they received from a big bank.

The great big bank not only has a much higher interest rate, their closing cost are more expensive too. In fact, when I review the closing cost, it makes me wonder if the loan officer has originated many FHA loans.

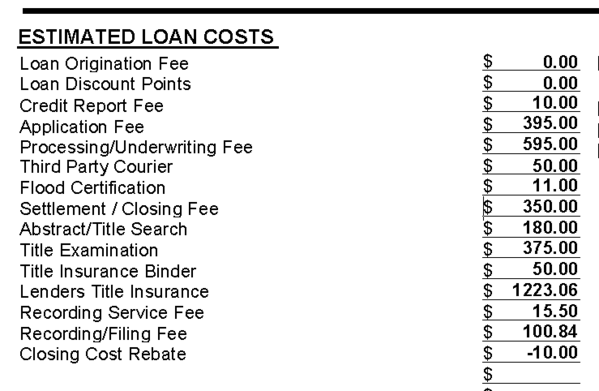

Here are the bank’s closing cost for an FHA streamline refi…

Big Bank’s Closing Costs

…and there’s only a $10 closing cost rebate with an interest rate that is 0.5% higher than mine!

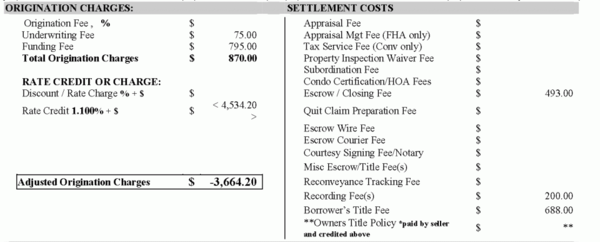

Compare this to my closing cost (BELOW), which are covered with a rebate credit (which also pays for my clients prepaids and reserves).

My closing costs

I really don’t understand how our quotes could be so far apart…but you can see, they are. Many consumers would trust their bank would provide the most competitive rates and closing cost. The quotes I’m looking at today illustrate this isn’t always true. If this Maple Valley homeowner did not shop his rate quote and only trusted his big bank, he would be paying a much higher rate over the life of the loan and overpaying in fees.

Yet those in Congress feel that mortgage originators who work for banks can be held to lower standards per the SAFE Act. Remember, bank mortgage originators are not required to be licensed, they are only registered. I recently met a nice loan officer who works for a different big bank and who presented herself to be NMLS licensed, when I asked her directly if she was “registered” or “licensed” she did correct herself. Believe me, there is a difference.

If you are considering refinancing or buying a home anywhere in Washington state and have a rate quote from another lender or bank, I’m happy to review it to see if I can offer a better rate and/or lower closing cost. Send me an email with a pdf of the rate quote you would like me to review. Remember, I can only help with homes located in Washington state, where I’m Licensed to originate mortgages.

How Much Reserves are Required When Refinancing?

I had a great question yesterday from a potential client who asked how come my Good Faith Estimate was showing more reserves being required than the other lenders he was comparing me to. [Read more…]

Recent Comments