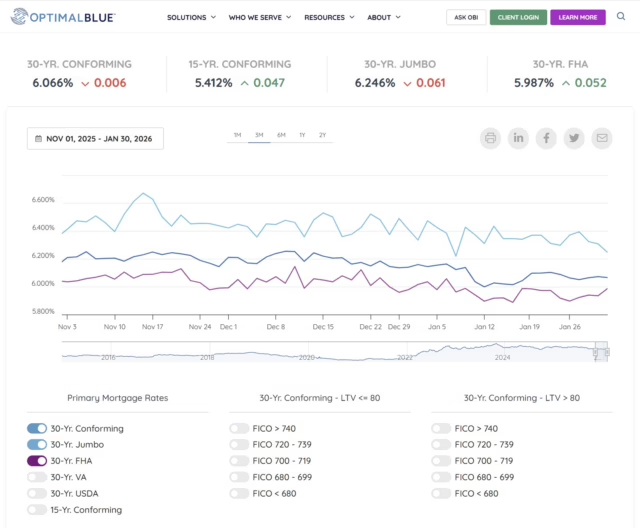

Mortgage rates moved a bit higher last week. As of Friday, February 6, 2026, the average 30-year fixed conforming rate was 6.083% per Optimal Blue. Optimal Blue’s mortage rate index is based on an average from rates that were locked by lenders who utilize OB. We don’t know what the factors are for pricing the rates and these rates are from Friday so they are expired. For current mortgage rates based on your personal scenario, please contact me.

The Mortgage Porter Weekly – Mortgage Rates for the Week of February 9, 2026

Mortgage Rate Update for the Week of December 1, 2025

What’s impacting mortgage rates this week? Check out my latest episode of The Mortgage Porter.

If you’re thinking about buying a home, refinancing or a reverse mortgage, let’s have a conversation – we can start planning, even if it’s months away.

The Mortgage Report Weekly: Mortgage Rate Update for the Week of November 17, 2025

We (finally) have the BLS Jobs Report coming out this week. Will this impact the direction of mortgage rates if the report is for September?

Check out this and more in this week’s episode.

If you’re thinking about buying or refinancing a home, let’s talk!

The Mortgage Porter Weekly: November 3, 2025

How are mortgage rates doing following the Fed rate drop last week and what’s on the calendar this week that could influence the direction of mortgage rates? Check out my latest episode of The Mortgage Porter!

If you would like to see current rates based on your personal financial scenario, I’m happy to provide you with a no-hassle mortgage interest rate quote!

Mortgage Rate Update for the Week of October 6, 2025

What??? No Jobs Report last Friday because of the government shut-down? What did mortgage interest rates do? Check out the latest on The Mortgage Porter.