Episode 1 of 2026: What Moves Mortgage Rates & What to Watch Next

Welcome to the first episode of The Mortgage Porter – Mortgage Rates and More for 2026.

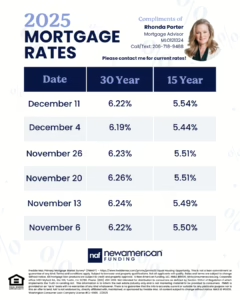

As we begin the new year, this week’s update focuses on one of the most common — and important — questions for homebuyers and homeowners alike: what causes mortgage interest rates to move.

I also share where mortgage rates are currently sitting, how they’re trending, which upcoming economic reports can move the market, and important updates on homebuyer education for the weeks ahead.

When you’re buying a home or refinancing in Seattle, Bellevue, Kirkland, Redmond, Tacoma, or anywhere in Washington State,

When you’re buying a home or refinancing in Seattle, Bellevue, Kirkland, Redmond, Tacoma, or anywhere in Washington State,  Mortgage rates continue to be one of the most talked-about topics for homebuyers and homeowners across Washington State. Whether you’re hoping to buy your first home, move up, or refinance, it’s natural to wonder: where are mortgage rates headed in 2026?

Mortgage rates continue to be one of the most talked-about topics for homebuyers and homeowners across Washington State. Whether you’re hoping to buy your first home, move up, or refinance, it’s natural to wonder: where are mortgage rates headed in 2026? Freddie Mac released the

Freddie Mac released the

Recent Comments