One of my current favorite aps for my Droid has got to be Gas Buddy. Gas Buddy allows me to find the cheapest gas by grade in any area. It confirms that when I'm filling up in my neighborhood of West Seattle, that I'm not paying more than I need to. Gas Buddy helps me when I'm trying to find a gas station that won't ping my wallet more than it needs to.

One of my current favorite aps for my Droid has got to be Gas Buddy. Gas Buddy allows me to find the cheapest gas by grade in any area. It confirms that when I'm filling up in my neighborhood of West Seattle, that I'm not paying more than I need to. Gas Buddy helps me when I'm trying to find a gas station that won't ping my wallet more than it needs to.

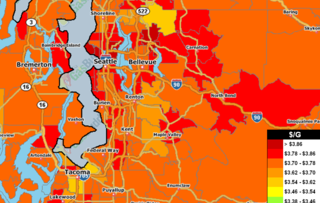

Let's face it, gas is getting very expensive! Gas Buddy's heat map shows some scorching prices in various Seattle and Bellevue neighborhoods.

Here's some good news, you don't need to have a "smart phone" to use Gas Buddy. You can also find out who has the best deals by visiting their site online at www.gasbuddy.com.

We all need to do what we can to save money! What are some of your favorite tips?

Recent Comments