18 years ago, I created The Mortgage Porter. I was frustrated with how the news was wrongly reporting that all loan officers were going to be licensed – which simply was wrong. Loan officers who work for depository banks or credit unions are not required to be licensed. We are held to different standards, which is unfortunate…but I digress. I’m here to celebrate the 18th anniversary of my blog, The Mortgage Porter. [Read more…]

18 years ago, I created The Mortgage Porter. I was frustrated with how the news was wrongly reporting that all loan officers were going to be licensed – which simply was wrong. Loan officers who work for depository banks or credit unions are not required to be licensed. We are held to different standards, which is unfortunate…but I digress. I’m here to celebrate the 18th anniversary of my blog, The Mortgage Porter. [Read more…]

Happy 18th Blog-Anniversary to The Mortgage Porter

RIP RainCityGuide

Update: Since the writing of this post, Dustin has brought Rain City Guide back. I believe most of the post are still there… it’s my understanding that it took quite an effort! Thanks, Dustin!

Update: Since the writing of this post, Dustin has brought Rain City Guide back. I believe most of the post are still there… it’s my understanding that it took quite an effort! Thanks, Dustin!

Rain City Guide, back in the day, was a resource for people interested in all things about Seattle…especially real estate. I was beyond honored to join the RCG panel back in 2007 to represent the mortgage industry. [Read more…]

Happy 8th Blogoversary to The Mortgage Porter

Eight years ago today, I published my very first post on this blog. It all began because I was a bit frustrated with the (then) new mortgage originator licensing laws, created from the SAFE Act, having different standards for LO’s based on what type of mortgage institution they worked for. Mortgage loan originators who were employed by banks or credit unions were not held to the same standards, per the SAFE Act, as those who were not employed by a depository institution. Some will argue that this is because banks and credit unions were already regulated…however, one just needs to remember the good ol’ friend of the family to know that those regulations were not enough.

Are you reading this post from Google Reader?

It seems like a bad April Fools joke… except it’s going to take place on the first of July instead of the first of April: Google Reader is going away.

If you are reading the articles I publish at Mortgage Porter via Google Reader, I encourage you to take a few moments to subscribe in the upper left corner of my blog.

You can receive my articles via email or by Feedburner RSS.

Your information is kept private and will never be sold. Subscribing is only for receiving articles that I publish on this blog, The Mortgage Porter.

As always, you can unsubscribe at anytime…but why would you do a silly thing like that? 🙂

Seriously, I do appreciate my readers. Thank you!

Happy Sixth Birthday to The Mortgage Porter

Six years ago today, I published my first post for this blog, The Mortgage Porter. I’m often asked what triggered me to start writing my mortgage blog. I remember the moment as if it were yesterday. Mortgage licensing had just become a requirement for mortgage originators IF they didn’t work for depository bank or credit union. A local evening news reporter was covering a local case of mortgage fraud and ended her story with something along the lines of “thank goodness all mortgage originators will be licensed effective 2007”. If you’re in mortgage lending, you know this isn’t true.

When the SAFE Act was passed, Congress, in all their wisdom, excluded loan originators who work for big banks and credit unions from being licensed; they are only required to be registered (there’s a big difference between licensed and registered requirements). LO’s who work for banks will often insist that they were already being regulated. One just needs to remember how well those regulators did at regulating Washington Mutual, Countrywide and World Savings, just to name a few.

Six years later, and I’m still waiting to see all the day when all residential mortgage originators, regardless of the type of institution they work for, are held to the exact same standards.

My blog has continued to allow me to share important information about mortgage ever-changing mortgage guidelines, to vent every so often about things I’d like to see changed and perhaps share a personal bit on a weekend. Thanks to all for reading and subscribing to The Mortgage Porter.

Happy 6th Birthday!

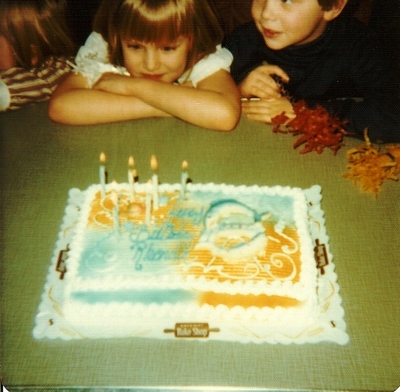

Yep…that’s really me in the photo, celebrating my sixth birthday!

The Mortgage Porter: Comment Policy

Every so often, I start writing a formal comment policy and it seems to wind up on the back burner. A few years ago, I decided to have comments approved before being published on Mortgage Porter due to some very spammy, self-promotional comments that mortgage lenders were leaving. I welcome comments on my blog…but I will not tolerate spam, self-promotional comments or anything vulgar.

I reserve the right to edit comments if needed…typically this would be removing self-promotional. You do not need to add your url or titles–please use the links provided in your signature line of the comment for that. I may be adding advertising to this blog in the future and if you're interested in paying me to promote yourself, let me know.

I reserve the right to delete comments that are pure spam and that add no value to the conversation or that are vulgar.

In addition, as everything on this blog is my content, I will not tolerate plagiarism. If you wish to refer to my content or use an excerpt from one of my post, I'm flattered, just do so with a link back and proper credit to me. This blog and all content (text, photos, videos, etc.) is protected by US Copyright.

I've been writing Mortgage Porter since late 2006 and it's become a wonderful way for me to connect with readers and to work with new clients who are seeking a mortgage for a home in Washington State.

Bottom line, I would love for this blog to be a place for discussion and conversation. If you have questions, please contact me.

Be nice and we'll all get along.

President Obama Declares April National Financial Literacy Month

Recently President Obama declared April as National Financial Literacy Month.

In recent years, our Nation's financial system has grown increasingly complex. This has left too many Americans behind, unable to build a secure financial future for themselves and their families. During National Financial Literacy Month, we recommit to teaching ourselves and our children about the basics of financial education.

I've always felt that financial education should be taught in high school. I'm not talking home-ec, at least not the the home-ec I attended at Hazen High School where I grew up in Renton, where we made up incomes and came up with a rough budget. I'm talking about a detailed course where students would focus on the benefits and consequences of credit and debt.

I think it's great that the President is bringing attention to Financial Literacy. During the subprime era of mortgage, I met with people who wanted to buy a home because their friend or co-worker just did. They had no idea what financial responsibilities coincide with owning a home. They often wanted to buy as much as they could be qualified for based on guidelines at that time even if the mortgage payment or program was not suitable.

More from President Obama's proclamation:

The new Consumer Financial Protection Agency I have proposed will ensure ordinary Americans get clear and concise financial information…. While our Government has a critical role to play in protecting consumers and promoting financial literacy, we are each responsible for understanding basic concepts….

I wonder what is an "ordinary American" and what if you're not an "ordinary American"? In his proclamation, he also talks about how our "recent economic crisis was the result of irresponsible actions on Wall Street and everyday choices on Main Street" and includes "large banks [that] speculated recklessly". His list of who's at fault no where includes our Congress who mandated that Fannie Mae, Freddie Mac and FHA create programs or different guidelines to help more Americans buy homes.

From the Wall Street Journal:

Fannie and Freddie retained the support of many in Congress, particularly Democrats, and they were allowed to continue unrestrained. Rep. Barney Frank (D., Mass), for example, now the chair of the House Financial Services Committee, openly described the "arrangement" with the GSEs at a committee hearing on GSE reform in 2003: "Fannie Mae and Freddie Mac have played a very useful role in helping to make housing more affordable . . . a mission that this Congress has given them in return for some of the arrangements which are of some benefit to them to focus on affordable housing." The hint to Fannie and Freddie was obvious: Concentrate on affordable housing and, despite your problems, your congressional support is secure.

But I digress…

President Obama is promoting a website they've created for financial literacy which appears to be an assortment of various government links organized on one site. It' looks like it's well meaning advice but I'm not sure it's the best or most practical advice–very similar to HUD's book on buying and financing your home. The site also has information that is very biased, in my opinion, about financial tools such as reverse mortgages, which are not right for everyone but when used in the right situation, can make a huge difference for the better in a seniors life. I also found some information about credit repair that would potentially provide the result a consumer would be looking for.

I highly recommend that you subscribe to Get Rich Slowly. This is a fantastic blog that is packed full of common sense financial information on getting out of debt and building your savings. J.D. Roth's blog was recently named the most inspiring money blog by Money Magazine.

Washington State's Department of Financial Institutions also has a blog that you may find interesting: Money Talks. I'm a new subscriber to this blog and so far, the information seems very good. In fact, it was from DFI's blog that I learned about the Twitter hashtag for April's Financial Literacy Month: #FinLit10.

Of course I hope you're a subscriber to my blog, The Mortgage Porter. I don't only write about mortgages or post interest rates on my blog, you'll also find quite a bit of information about credit scoringwhich impacts your life every day. I cover other topics too. You can subscribe in the upper right corner by entering your email address and you can un-subscribe anytime.

During April, I'll share information in recognition of National Financial Literacy Month…actually I hope that's what I've been doing at Mortgage Porter for the last couple of years!

Recent Comments