NOTE: I originally published this article in February when HUD published the Mortgagee Letter. However with the increase to mortgage insurance on FHA insured loans just around the corner, I thought I should re-post this. If you are purchasing a home or refinanacing using an FHA insured loan, you will want to be in contract and have your loan application complete no later than April 13, 2011 to insure having an FHA Case Number issued in time.

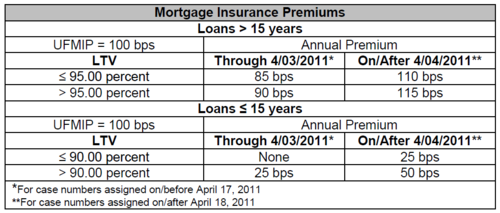

Yesterday HUD issued Mortgagee Letter 11-10, making it official that FHA annual mortgage insurance will increase another 0.25% basis points on case numbers issued on or after April 18, 2011. The annual mortgage insurance is included in the monthly mortgage payment. There is no change (at this time) to the upfront mortgage insurance which is paid for at closing (typically financed or may be paid as a closing cost). This is in line with the Obama Administration's plan for reforming mortgages which was revealed on Friday.

Here's how this will pencil out for a 30 year fixed mortgage based on a sales price of $400,000 with a minimum down payment of 3.5% (base loan amount of $386,000).

FHA mortgages with a case number issued prior to April 18, 2011 (current as of this post):

386,000 x .90% = 3,474/12 months = $289.50.

FHA mortgages with a case number issued April 18, 2011 or later:

386,000 x 1.10 1.15% = 4,246 4,439/12 months = $353.83 $369.92

Difference in monthly payment: $64.33. $80.42

This will also impact FHA 203k rehab loans.

Remember, FHA annual mortgage insurance remains on the loan for a minimum of 60 payments regardless of loan to value. Even if a home buyer is putting down 20% towards the purchase of their Seattle area home, they will still have FHA mortgage insurance. FHA mortgage insurance will also remain on the home until the loan balance reaches 78% of the loan to value based on the original appraised value or purchase price of the home (which ever was less).

I have been originating FHA insured loans for the past eleven years at Mortgage Master Service Corporation (a Direct Endorsed HUD approved lender). I am licensed to originate mortgages for homes located in the State of Washington. If I can help you with your mortgage needs, please let me know!

Discover more from The Mortgage Porter

Subscribe to get the latest posts sent to your email.

Ok I am confused on the dates – the chart is saying April 4th, your blog words say April 18th and the RTeam newlstter says April 13th? So what is the case #issue deadline? And, what’s needed to issue a case #? An actual loan app? Can a seller who just listed their place today do anything to secure a case # now that will benefit their possible fha buyer? Probably a ‘dumb’ question, but leave it to me to ask one, or two 🙂 Thanks Rhonda!

Hi Di, FHA Case #’s must be issued by April 15th since case numbers issued April 18th or later are at the higher FHA mortgage insurance premiums.

We require an actual loan application and a bona fide transaction to order an FHA case #. The case # sticks with the property for six months and is assigned to the borrower (which is why you need a bona fide transaction).

Excellent question, Di! I apologize for the delay with my response…you wouldn’t believe the spam I get on this site 🙁

Thanks for the chart and the clarification today .. in following your example, I’m thinking the difference is even greater than $64.33. Looks like it goes from .9 to 1.15 (instead of 1.10)? I know, always with the questions.

Di – thanks so much for catching that! Looks like I grabbed the mi from the 5% or more down column instead of the minimum down…my post is corrected now AND it monthly difference is much higher!