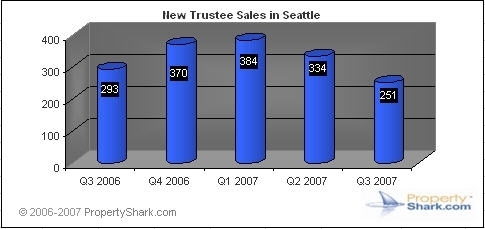

Property Shark reports that foreclosures in King County are down year over year and are down 24.85% from the previous quarter based on trustee sales.

Why have foreclosure numbers improved in our region? Hopefully distressed home owners are contacting their lenders for help before it’s too late. Banks do not want to own homes and many are willing to work with home owners who are facing difficulties with their mortgage and are possibly facing foreclosure. Another possibility is that investors are seeking out and buying “pre-foreclosure” homes.

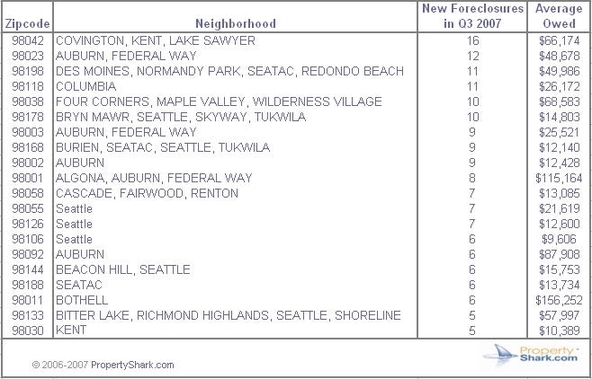

South King County is reporting the most foreclosures for the third quarter.

Don’t wait if you’re having difficulty with your mortgage payments. The earlier you take action, the more options you may have.

Recent Comments