I love gardening and photography…so taking pictures of my garden is just something I enjoy doing! These photos are from this morning.

New Mortgage Porter Feature: Economic Calendar

I just added an economic calendar to the left side of Mortgage Porter. This intended to give readers a quick glance of what ecomonic events that may impact mortgage rates (mortgage backed securities) in the near future.

You can also get this information (and more) by clicking on the green Mortgage Market Update button above the calendar.

Of course these days, mortgage bonds are reacting to just about anything, including fears of a rice shortage–so take this calendar with a grain of rice salt.

So You’ve Just Become a Home Owner…Feeling Popular?

You will soon feel quite popular if you’ve just bought a home or at least your mail box will be with tons of junk mail. Over the weekend I received an email from one of my clients who closed on their new home last month:

"As I’m sure is typical, we’re being deluged with mortgage junk mail. I see you have several highlights of particularly bad ones you’ve seen, but is there any way to stop the flood? I know there’s a marker you can put on your credit report that stops credit card offers – is there anything similar for mortgages?"

In a nutshell, your Deed and Deed of Trust are recorded at the county which become "public record". There are companies that research, buy and resale this information to those wanting to reach out to new homeowners. You’re more popular than you’ve ever wanted to be…it’s the welcome wagon of junk mail. What’s worse is that some companies will present the information as if they are a part of or teamed up with your lender.

Please check back with your original lender before taking up some of these offers to verify if they are indeed from your mortgage company–the trickery they will resort is amazing and sickening.

Here’s a great article that I read another local blog, A Generous People regarding getting rid of junk mail. I hope it helps! In the meantime, I recommend opening your mail over your recycle bin.

Remember Last Weekend?

Just a week ago, we were soaking in blue skies and warm sunny 70 plus degrees. This photo is probably the last of my cherry blossoms. It was so nice out that we move the last surviving plant (an Angel Trumpet) out of the garage and I pruned my roses.

My husband and I decided to finally get rid of some shrubs that I was never a big fan of. I have no idea what they are–except they have to be pruned back every year and they don’t bloom or change color. I’m sure one of my readers will tell me these are terrific plants and I just didn’t show it the right love. Alas, they’re gone now (we did keep one)!

Our home older and the garden is a little over crowded. We replaced the four "green shrubs" with a variegated hydrangea and two black lace elderberries. A week earlier Gardening with Cisco raved about black lace elderberries and so I was thrilled to find a few at our local nursery. I’ll follow up with an "after" post assuming our new plants made it through our bizarre freezing weather this weekend.

Adorable Ballard Bungalow

This charming bungalow in Ballard could be yours. It’s offered at $530,000 and will be open this Sunday, April 20, 2008 from 1:00 – 4:00 p.m.

I’m not a real estate agent…but I’m happy to help you with financing on this home!

For more information on this home, please contact your real estate agent. This home is listed with Windermere – MLS #28058060.

This listing is posted with the permission of the home owners.

You’ve Got ’til Midnight to File Your Taxes

The only Post Office in the Seattle area opened until midnight is located at 15250 32nd Avenue South (map). And if you need to file an extension, you can find that here.

Hat Tip to West Seattle Blog.

I Love Checking Out ARMs: Reviewing An Existing Mortgage

Recently a friend approached me confessing to having one of those "awful adjustable mortgages"…she thinks she needs to refinance and take advantage of today’s lower rates. Before assuming that someone "needs" to refinance, I like to review their current mortgage and what their financial goals are. Sometimes, people do not need to refinance…they just need to understand their mortgage terms.

Current Mortgage: P&I Payment $3,330 (original balance $520,000).

- 7/1 Adjustable Rate Mortgage: Note Rate 6.625%

- Caps: 2/2/5

- Margin: 2.25

- Index: 1 Year LIBOR (currently 2.637% as of this the date of this post).

There is approx. 65 months remaining with the fixed period rate of 6.625% before the mortgage adjusts. When the mortgage adjusts, the new rate will be 2.25% plus the current 1 year LIBOR rate EXCEPT the rate will be no lower than 4.625% and no higher than 8.625% due to the 2% adjustment cap.

Best case scenario at first adjustment date with current mortgage:

Rate: 4.625% with principal and interest payments for 12 months of $2,780. Note: If the mortgage was adjusting today, the rate would be closer to the best case scenario at 4.875% (2.25% plus 2.637% = 4.887% rounded to the nearest 0.125%). Alas…they have 65 more months before knowing what the going rate for the 1 Year LIBOR will be.

Worse case scenario at first adjustment date with current mortgage:

Rate: 8.625% with principal and interest payments for 12 months of $3,937.

Possible scenarios that I suggested:

Refinancing into a conforming-jumbo mortgage 30 year fixed at 6.375%. This would provide a principal and interest payment of $3,232. With closing costs at $2900, they will break even on this scenario in 30 months. From 30 months (the break even point) to when the fixed period of the ARM is over, the savings based on the monthly payment would be $3430.

Restructuring the existing mortgage into two mortgages with a conforming first at $417,000 at 5.875% and second mortgage paying off the balance (they can opt for a fixed second or a HELOC). With a principal and interest payments of $3,194 and closing costs of $3,200; it will take 24 months to break even on this scenario. From 24 months to when the fixed period of the ARM is over, the savings based on the difference between the monthly payments would be $5,576.

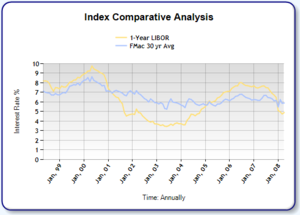

This chart, which I created utilizing The Mortgage Coach, is factoring in the 2.25% margin to the LIBOR rate back to January 1999. You can see there is a significant range with the rate. Home owners with ARMs based on the LIBOR rate from 2002 to 2004 were probably grinning from ear to ear (depending on what their margin was) when you see what their rate was compared to the 30 year fixed. Timing is everything with an adjustable rate mortgage.

This chart, which I created utilizing The Mortgage Coach, is factoring in the 2.25% margin to the LIBOR rate back to January 1999. You can see there is a significant range with the rate. Home owners with ARMs based on the LIBOR rate from 2002 to 2004 were probably grinning from ear to ear (depending on what their margin was) when you see what their rate was compared to the 30 year fixed. Timing is everything with an adjustable rate mortgage.

What ever the home owner decides to do is completely up to them. Of course one of their options is to not refinance and wait to see what the new rate (LIBOR) will be in 65 months. If they wound up with a "best case scenario" new payment, it would be pretty sweet however the cost of paying the higher payment for 65 month and we don’t know what the index will be at the date of adjustment. Understanding your mortgage and knowing your available options just starts with contacting your local Mortgage Professional.

By the way, if you are a Washington State home owner who has not heard from your loan originator lately or if you would like me to adopt your mortgage, please contact me. Many LO’s have left the industry or do not provide service once the loan has closed. I’m happy to review your ARM (or fixed rate mortgage) without any obligation to refinance.

Every so often, someone will be interested in financing for a home they will not be living in 100% of the time…they want the best rate which is “owner occupied”. It’s crucial to know the difference in your lenders eyes and to be completely upfront so you avoid committing fraud. Bottom line, the property and situation needs to make sense to the underwriter. Here are some basic definitions:

Every so often, someone will be interested in financing for a home they will not be living in 100% of the time…they want the best rate which is “owner occupied”. It’s crucial to know the difference in your lenders eyes and to be completely upfront so you avoid committing fraud. Bottom line, the property and situation needs to make sense to the underwriter. Here are some basic definitions:

Recent Comments