APR was created by our government to help consumers select a mortgage rate. It was intended to be a tool that would allow someone to simply compare various mortgage scenarios and shop mortgage lenders for the “best rate” at the lowest cost. Unfortunately, APR is probably not providing an accurate view of what the true cost of the mortgage, whether it’s for a home purchase or refinance, is. [Read more…]

APR was created by our government to help consumers select a mortgage rate. It was intended to be a tool that would allow someone to simply compare various mortgage scenarios and shop mortgage lenders for the “best rate” at the lowest cost. Unfortunately, APR is probably not providing an accurate view of what the true cost of the mortgage, whether it’s for a home purchase or refinance, is. [Read more…]

APR is not the best tool for shopping mortgage rates

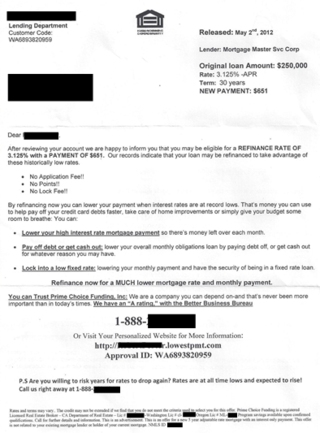

From the Mortgage Junk Mail Bag

It’s been a while since I’ve shared a POS (piece of solicitation) from the junk mail bag. I don’t have an issue with lenders trying to obtain business from home owners by mailing marketing pieces…although I do wonder why they must resort to marketing to strangers instead of working with past clients.

It’s been a while since I’ve shared a POS (piece of solicitation) from the junk mail bag. I don’t have an issue with lenders trying to obtain business from home owners by mailing marketing pieces…although I do wonder why they must resort to marketing to strangers instead of working with past clients.

This letter was sent last month. It was packaged in a folding security envelope to look as if it may have contained important information, such as the code to an ATM card. It was only a trick to get one to open it.

They start with quoting an APR of 3.125% for a 30 year fixed rate in the upper right corner with a very low payment of $651 on a $250,000 loan amount. That’s a great rate and an amazingly low payment! However if you read the very tiny print on the bottom of the page, you’ll see that what the rate offered is actually based on a 5 year interest only adjustable rate mortgage (ARM). Why not have that information in the upper right corner with the teaser rate and payment?

The lender who sent this is from a company in California. I really recommend working with lenders in your own state where processing and underwriting are done locally as well. Why would they have to mail to Washington state home owners to try to get refinance business?

I also recommend that you use the NMLS Consumer Access site to research any Mortgage Loan Originators you’re considering allowing to assist you with your refinance. The NMLS Consumer Access site will disclose their employment history and whether or not they’re licensed to originate mortgages in Washington. I think it’s also a good idea to “google” their name and the company’s name to learn more about them.

Instead of calling a stranger from out of state for your mortgage needs, do your own research.

If your home is located anywhere in Washington state, I’m happy to help you with your refinance or financing your home purchase. And by the way, I have never bought “a lead” or sent out a piece of junk mail to try to solicit a mortgage prospect.

HARP 2.0, Greedy Big Banks and….We NOW offer Higher Loan to Values!

It's been a bit disappointing that HARP 2 has not been made as available to consumers as it should be. First, underwater homeowners had to wait a couple months for the program to become available and now, those who have the more challenging HARP refi's (loan to values over 105% or with private mortgage insurance) are finding that their options are even more limited. In addition, many banks are "cherry picking" which of their consumers they'll help and who they'll pawn off to large internet mortgage companies.

NOTE: Mortgage Master Service Corporation has recently added new lenders that offer loan to values over 105%!! For your HARP 2.0 rate quote on your home located in Washington State, please click here.

According to this article in Housing Wire, banks are making huge profits by not allowing for more competition, enabling them to charge hire rates to consumers.

HARP demand is rising at the banks, and they are generating new profits from it. Revenue at the Wells Fargo ($33.84 0%) mortgage department jumped by $1.6 billion in the first quarter as originations spiked. The bank said 15% of the originations completed in the first three months of the year were refinances under the new HARP.

Anthony Sanders, a professor of finance at George Mason University, told the panel Bank of America ($8.27 0%) received more than 30,000 HARP applications since mid-January.

A Senate subcommittee is currently reviewing how to make HARP 2.0 more readily available to consumers who qualify. In order to qualify for the Home Affordable Refinance Program, the mortgage needs to have been securitized by Fannie Mae or Freddie Mac prior to June 1, 2009. Other conditions apply as well.

Expanded LTVs are available – just not as available as they should be if we really want our housing to have a chance to recover.

Mortgage Master Service Corporation has recently added new lenders who are offering loan to values over 105%. If I can help you with your HARP 2 refinance on your home located in Washington, click here.

I am required to have the language below if I am soliciting your Home Affordable Refi for your home in Washington…and yes, I would love to help you with your HARP (or any) refinance:

Freddie Mac and Fannie Mae have adopted changes to the Home Affordable Refinance program (HARP) and you may be eligible to take advantages of these changes.

If your mortgage is owned or guaranteed by either Freddie Mac or Fannie Mae, you may be eligible to refinance your mortgage under the enhanced and expanded provisions of HARP.

You can determine whether your mortgage is owned by either Freddie Mac or Fannie Mae by checking the following websites:www.freddiemac.com/mymortgage or http://www.fanniemae.com/loanlookup/

The Day After the Fed’s Rule on Loan Originator Compensation

Like it or not, the Fed’s rule on how mortgage originators can be compensated is in full effect today. It’s hard to tell exactly how much this has impacted mortgage rates as mortgage backed securities are being beat up pretty hard from fears of inflation (rates would be higher today regardless of the Fed’s rule).

Like it or not, the Fed’s rule on how mortgage originators can be compensated is in full effect today. It’s hard to tell exactly how much this has impacted mortgage rates as mortgage backed securities are being beat up pretty hard from fears of inflation (rates would be higher today regardless of the Fed’s rule).

Mortgage Originators should only originate mortgages

I think it's unfortunate that the SAFE Act didn't address having professionals who are helping people with the possible largest transaction in their life be limited to originating mortgages. I feel quite strongly that it is NOT in a consumers best interest to use the same person to originate their mortgage AND sell them their home.

I think it's unfortunate that the SAFE Act didn't address having professionals who are helping people with the possible largest transaction in their life be limited to originating mortgages. I feel quite strongly that it is NOT in a consumers best interest to use the same person to originate their mortgage AND sell them their home.

There is simply too much to keep up with in this climate with both mortgage originating and being a real estate agent. New laws are constantly being created and underwriting guidelines change in a blink of an eye. How can someone doing two important jobs do either "one" full time job well if they're split between two? And I guess I also wonder "why" people who act as mortgage originators and real estate agents feel they must do this. I consider myself a fairly savvy mortgage professional and I'm sure I could sell a home–but I wouldn't dream of it. I'm dedicated fully to my profession: mortgage.

I cringe at the thought of a buyer disclosing all of their financial information to a real estate agent acting as a mortgage originator…especially if they don't want to buy the "maximum" they potentially qualify for. I often times work with buyers who could qualify to buy much more than their agent knows and they ask me to not reveal this information. If you're working with someone who is originating your mortgage and selling you a home, they can't keep this information separate – they know how much you can buy.

If you're considering using a mortgage originator who's also a real estate agent for your refinance, how do you know they won't try to sway you to selling (where they'l earn significantly more income) instead of refinancing?

It's almost a form a "dual agency" where you're having to rely a great deal on trust with the individual you've hired to care for your entire transaction. For the "professional" who is acting as both your real estate agent and loan originator, this is simply too much commission (what a buyers agent is paid and the mortgage origination compensation at stake) to truly trust they're working in YOUR best interest.

HUD is not a fan of FHA mortgage originators having other employment in real estate related fields either (from HUD Handbook 4060.1 Chapter 2: Section 2-9)

Full, Part-Time and Outside Employment. A mortgagee may employ staff full time or part time (less than the normal 40 hour work week). They may have other employment including self employment. However, such outside employment may not be in mortgage lending, real estate, or a related field. Direct endorsement underwriters are included in this provision.

In Washington State, Real Estate Agents acting a Loan Orinators in a transaction are required to provide this written language as a Dual Capacity Disclosure:

This is to give you notice that I or one of my associates have/has acted as a Real Estate Broker or Salesperson representing the Buyer and/or Seller in the sale of this property to you. I am also a Loan Originator and would like to provide mortgage services to you in connection with your loan to purchase the property.

You are not required to use me as al Loan Originator in connection with this transaction. You are free to comparison shop and to select any Mortgage Broker or Lender of you choosing.

If you're getting ready to buy a home. Select your professionals wisely. You deserve a to work with a team of individuals who are dedicated and focused on their sole career. This is a case where two heads are better than one.

If you're buying a home in the greater Seattle or Bellevue area, I'm happy to recommend a dedicated real estate agent and help you with your mortgage!

Click here if you would like a rate quote for a home located anywhere in Washington.

Related Post:

Who Does Your Loan Originator Really Work For?

My Thoughts on the Future of Home Mortgages and Home Ownership

Yesterday, I had the Future of Housing Finance playing in the background as I was working away on rate quotes and lock commitment confirmations for a few of my clients in the Seattle area. Oh how I wish that I, or a fellow mortgage origintor who has been originating mortgages since pre-subprime days could be on the panel. Since I'm not, I'm going to share a few of my thoughts on this post.

People who currently have a mortgage and who are credit and income qualified (have made their payments on time) should be allowed to refinance without an appraisal. This would not only help home owners save hundreds of dollars each month with their mortgage payment, the end benefit would be real stimulus for the economy.

I believe all mortgage originators, regardless of the type of institution they work for, should be held to the highest standards of the SAFE Act. (Currently mortgage originators who work for banks or credit unions are not licensed).

I also feel strongly that those who present themselves to be residential mortgage originators (licensed or registered) should not be allowed to also sell real estate. I'm concerned this has huge potential for fraud and the home buyer is not best served when a real estate agent knows the fine details of the buyers finances. I view this as a huge conflict of interest. HUD all ready has this standard: real estate agents cannot originate an FHA insured loan. I'd like to see this implemented with conventional financing.

Last but not least, not everyone in American needs to or should own a home. Owning a home is not a right, it's a privelidge that's one's personal financial choice. And there's nothing wrong with renting a home. Renting a home, like obtaining a mortgage, is a personal financial choice.

What are your thoughts?

Recent Comments