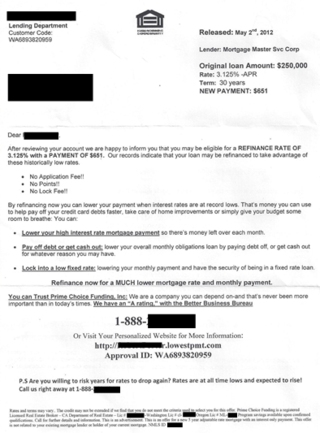

It’s been a while since I’ve written about mortgage junk mail. Today I have been presented the opportunity as a client I helped with their mortgage a few years ago reached out to me regarding some mail they recently received that appeared to have possibly come from our company, Mortgage Master.

It’s been a while since I’ve written about mortgage junk mail. Today I have been presented the opportunity as a client I helped with their mortgage a few years ago reached out to me regarding some mail they recently received that appeared to have possibly come from our company, Mortgage Master.

The P.O. J. (piece of junk) appears to know a lot of information about the home owner – this is because your mortgage and original loan amount are public record. This type of marketing also tends to offer lower than available interest rates and things like “no payments for two months”…perhaps it features an offer code or a limited time offer. [Read more…]

Recent Comments