I've been requested to repost the six part series I wrote about the HUD's new Good Faith Estimate which goes into effect on January 1, 2010. I like to keep my readers happy…so here it is:

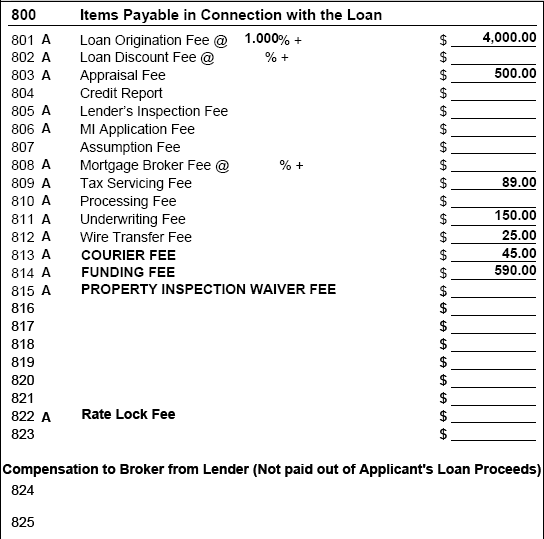

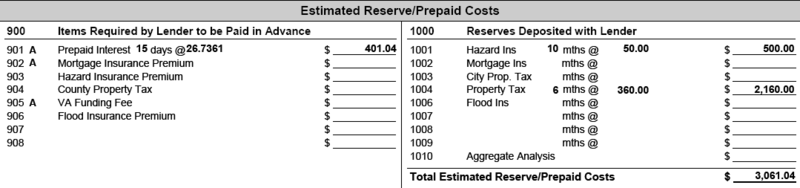

Part 1: Review of HUD's Good Faith Estimate

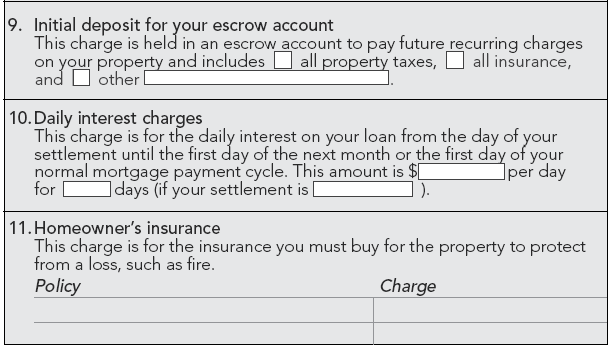

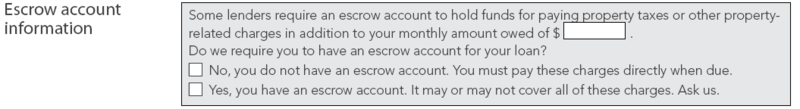

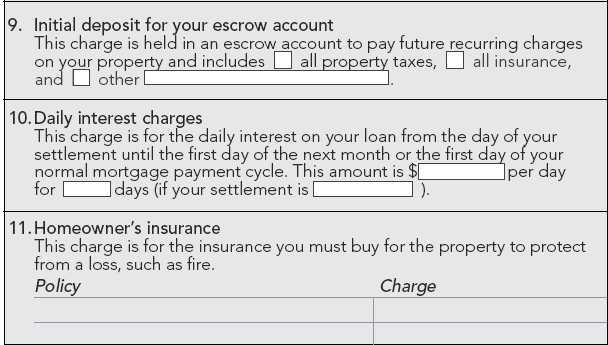

Part 3: Escrow Account Information

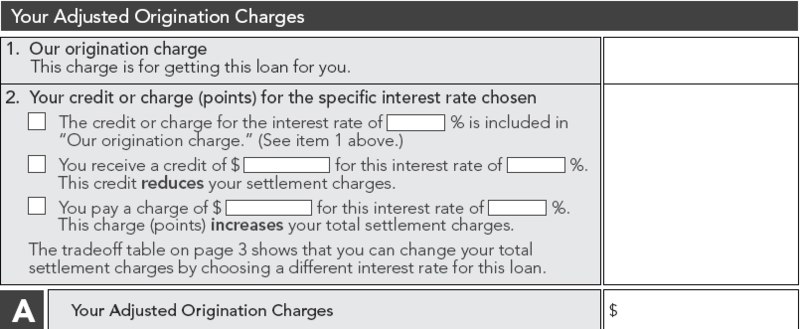

Part 4: Your Adjusted Origination Charges

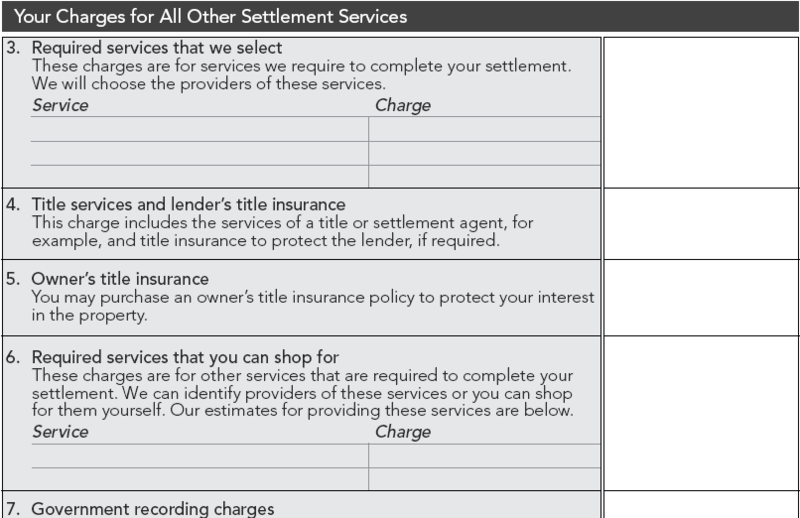

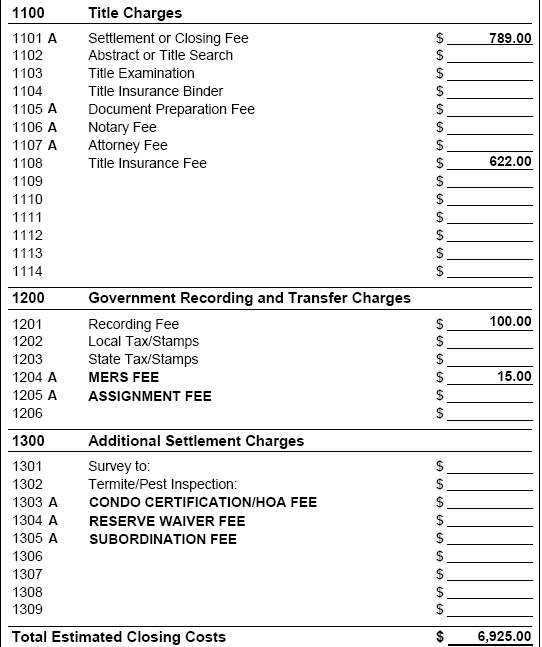

Part 5: Your Charges for all other Settlement Services

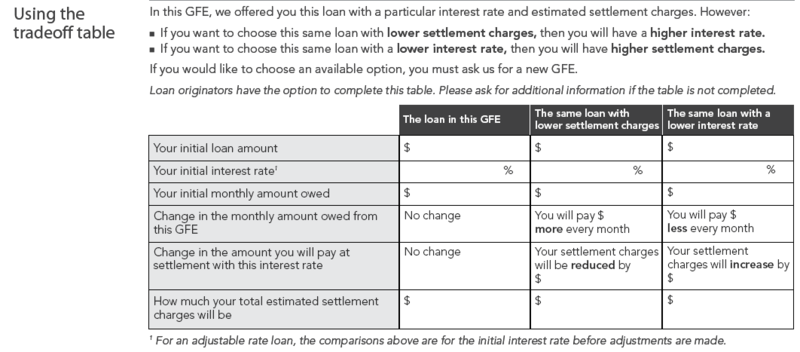

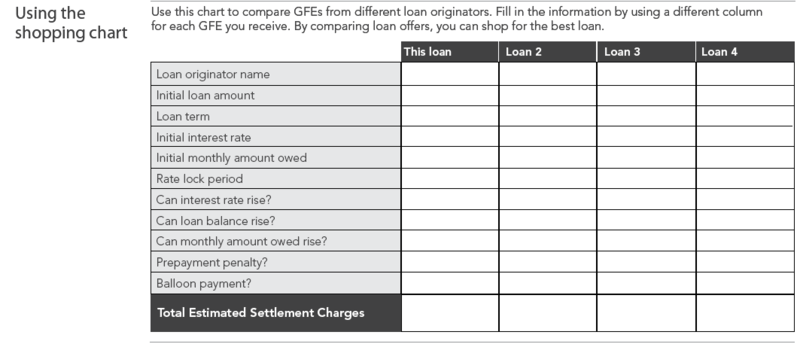

Part 6: Page 3 of the Good Faith Estimate

Please keep in mind that HUD has issued several revisions to their RESPA FAQs and I'm sure we're not done seeing additions and revisions since January 1 is still a couple months away.

Recent Comments