This next section of HUD's new Good Faith Estimate covers the escrow account, also known as the reserve account. (Click the graphics for a larger picture).

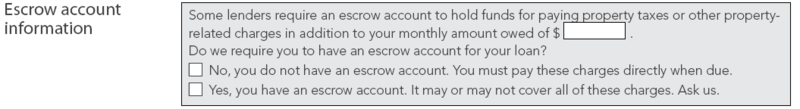

According to HUD's New RESPA FAQs, the block you see above does not include the taxes or insurance (the escrow/reserves portion of the payment).

"…the first block is for the monthly amount that will be owed for principal, interest and mortgage insurance only. Additional information on charges relating to the escrow account is in Block 9 on page 2 of the GFE."

This section primarily addresses whether or not there is an escrow reserve account. Borrowers may elect to waive their reserve account when they have conventional finanancing and at least 20% equity in their home. Most lenders charge a fee of 0.25% of the loan amount should a borrower elect to pay their own taxes and insurance. Having an escrow reserve account when a home owner has enough home equity is generally not "required" as stated on the new GFE, however the home owner will receive either a slightly better rate or lower cost opting to have taxes and insurance included in their payment.

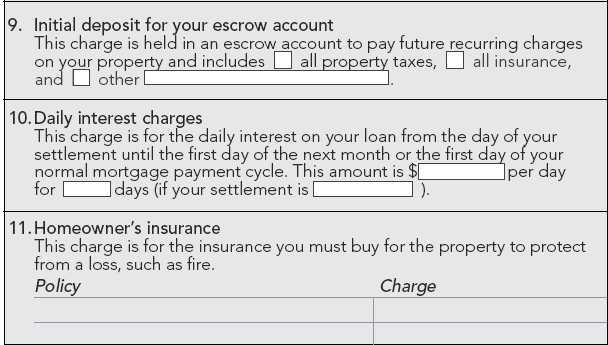

Hop on over to "Your Charges for All Other Settlement Services on page 2, Boxes 9 – 11 of the GFE to see how much will be collected to initiate your escrow reserves (boxes 9 and 11) account and prepaid interest (box 10).

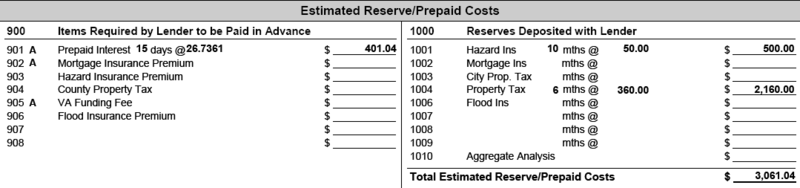

Our current good faith estimate (below) shows the escrow reserve account with a detailed account of how many months of taxes and insurance are due verses the dumbed down lumped version of the new GFE.

The current (soon to be retired) GFE includes taxes and insurance in the mortgage payment–even if the borrower has elected to waive the reserve account (pay taxes and insurance on their own) since borrowers are qualified based on the entire mortgage payment due (principal, interest, taxes and insurance).

Is this easier to understand so far? I don't think so…but I would love to hear from you.

Discover more from The Mortgage Porter

Subscribe to get the latest posts sent to your email.

Please leave a reply