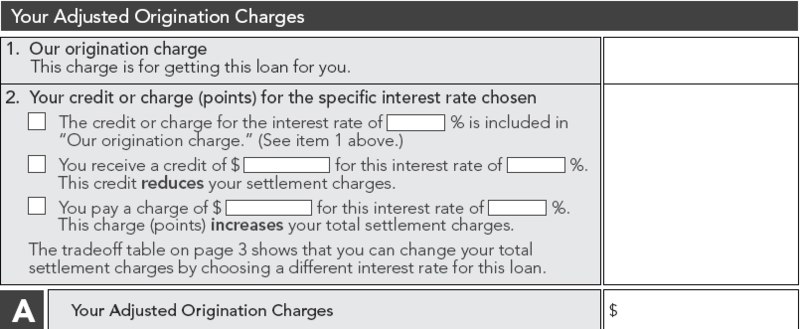

Page 2 of HUD's new Good Faith Estimate which will be mandatory effective January 1, 2010 begins with addressing the origination charges associated with the proposed mortgage.

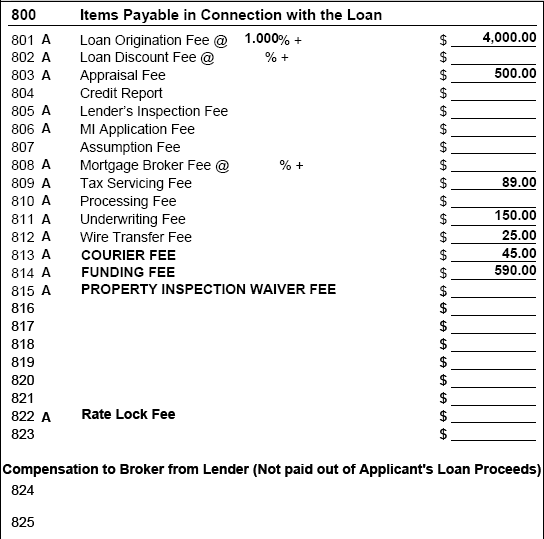

The origination charge shown in Block 1 includes the following:

The origination charge shown in Block 1 includes the following:

- Origination fees (currently shown on line 801, or 808 if you're working with a mortgage broker). Origination fees do not include "discount points" which are paid to buy the rate down.

- All originator charges (as what is currently itemized in Section 800 of the GFE, shown below). According to HUD's New RESPA FAQs, these fees include:

- Processing

- Administration

- Underwriting

- Document Preparation

- Wire

- Lender Inspection

- and other misc. fees.

So instead of seeing an itemized list as we currently do on the soon to be extinct GFE (above), you're going to have this cost lumped together in Box 1 above. In some ways I think this is good–I've recommended many times that consumers who are shopping lenders should do so by the total closing costs shown in Section 800. Now consumers won't have a choice but to view those fees as one lump sum in relation to rate.

The total sum of closing costs in Section 800 of the "old GFE" is $5318. This is what you will find on the new GFE "Block 1".

Block 2 of Your Adjusted Origination Charge is intended to help consumers understand how their rate is priced.

The first line "The credit or charge for the interest rate of X% is included in "our origination charge". For example, if on Block 1 above, I had $4000 listed (as I do on the old GFE line 801); the borrower can assume there are $1318 of lender charges in addition to the origination fee.

The second line states "You receive a credit of $Y for this interest rate of X%. This credit reduces your settlement charges". This section would be used in the event there is Yield Spread Premium/YSP (rebate pricing) or if the mortgage is being priced as a "no cost" loan.

The third line "You pay a charge of $Y for this interest rate of X%. This charge (points) increases your total settlement charges". Of course this is referring to discount points which are intended to buy your rate down.

What are your thoughts about the new changes? Would you rather see your closing costs from Section 800 itemized or lumped together? My next post will cover "Other Settlement Charges".

Discover more from The Mortgage Porter

Subscribe to get the latest posts sent to your email.

I would rather see a breakdown of charges like our old good faith estimate.

sandy, I completely agree. Lumping everything together doesn’t seem very transparent or full disclosure, does it?