EDITORS NOTE: This post by yours truly was originally published at Rain City Guide. Since I'm taking a blogging break, I thought I'd share it with you here. To read the original post along with the comments, please visit Rain City Guide.

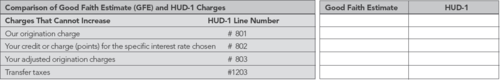

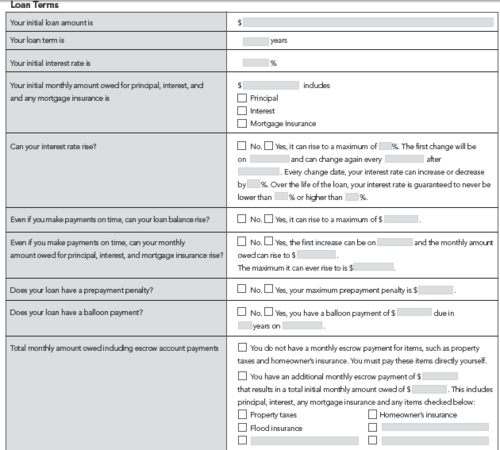

Okay, I admit…I’ve been groaning, sniveling and bitching along with many other mortgage originators about HUD’s 2010 Good Faith Estimate. The document has it’s faults and was created pretty much because of the faults of loan originators who used the GFE as a tool for bait and switch. We’ve had a month to mourn the loss of the old good faith estimate, which was an asset in how I explained scenarios to my clients…it’s gone. Get over it.

I’m hearing from consumers that many mortgage originators are refusing to issue Good Faith Estimates – even if they have provided the “six points of information” which HUD uses to define a loan application. A mortgage originator has three business days to provide you with a good faith estimate or deny your “application” if you have provided the following:

- the borrower(s) name

- monthly income

- social security number to obtain a credit report

- property address

- estimated value of the property

- loan amount

HUD has added an additional item (which can be vague): any other information deemed necessary by the loan originator.

Per HUD’s most recent RESPA FAQs that were updated on January 28, 2010, a mortgage originator cannot refuse to issue a good faith estimate if they do not have supporting documentation (such as income or assets documentation) or verification disclosures signed by the borrower. If after providing a GFE to a borrower, it is discovered that their income they provided is not how an underwriter would view it, this may constitute a “changed circumstance” allowing a revised good faith estimate to be issued. If you read the FAQs, you can tell that HUD is well aware that consumers have been having a real challenging time getting their hands on the 2010 GFE.

Update from HUD’s RESPA FAQs (page 11, #33)

“In order to prevent over burdensome documentation demands on mortgage applicants, and to facilitate shopping by borrowers, the final rule specifically prohibits the loan originator from requiring an applicant, as a condition for providing a GFE, to submit supplemental documentation to verify information provided by the applicant on the application…

Similarly HUD has long supported a public policy goal of creating a circumstance where consumers can shop for a mortgage loan among loan originators without paying significant upfront fees that impede shopping”. (Only a credit report can be charged to a borrower at this point).

So dry your eyes, my fellow mortgage professionals, the Good Faith Estimate IS a tool for consumers to use for shopping…whether we like it or not. It’s time to open our arms wide and embrace it.

PS LO’s: This post (and any of my articles) are not a replacement to your employer’s compliance department or legal advice.

Happy Valentines Day

Recent Comments