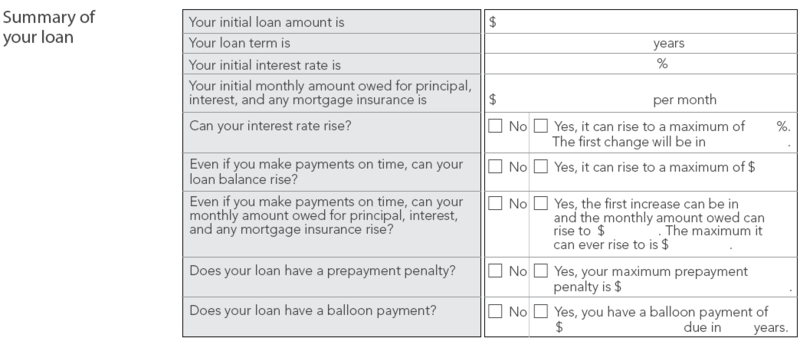

The next session of the new Good Faith Estimate that I'm reviewing is the "Summary of your loan".

If you're working with a mortgage originator in Washington State who's regulated by DFI, then a lot of this information is included on the Loan Application Disclosure Form.

The first three lines are pretty straight forward; covering your initial loan amount, the term and initial interest rate if you have a conforming mortgage. I'm not sure how FHA, VA and USDA loans will be disclosed where there are upfront mortgage insurance or funding fees that are often financed (added to the "base" loan amount).

What blows me away is the next line which addressed the mortgage payment.

Your initial monthly amou nt owed for prinicpal, interest, and any mortgage insurance is: $_____ per month.

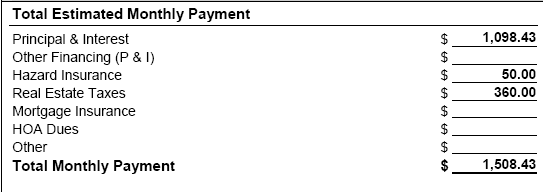

Currently, Good Faith Estimate itemizes the monthly mortgage payment and includes property taxes and home owners insurance (PITI).

I have reviewed the new three page GFE over and over again and cannot find a total estimated monthly payment. Consumers will have to add in their estimated property taxes and home owners insurance to determine what their actual monthly mortgage payment will be.

The line "Can your interest rate rise?" addresses having an adjustable rate mortgage. You should also have additional disclosures that will explain how your ARM adjusts if you are selecting this type of mortgage. (Washington State's Loan Application Disclosure Form covers this).

The following two lines regarding loan balances increasing have to do with negative amortized mortgages such as option ARMs and reverse mortgages.

The last two lines are clearly disclosing whether or not the mortgage has a prepayment penalty or a balloon payment.

Per HUD's New RESPA Rule FAQs, the initial loan amount and initial interest rate are based on the figures that are applicable on the date of closing.

NOTE: If you have a mortgage where the balance or payment may change–it is YOUR responsibility to understand the terms and all the possiblities may be presented to you with your mortgage payment. If the terms are too complicated, please consider selecting a 30 year fixed rate mortgage (or a similar mortgage).

Post from this series:

Discover more from The Mortgage Porter

Subscribe to get the latest posts sent to your email.

Please leave a reply