Fannie Mae and Freddie Mac (regulated by the Federal Housing Finance Agency) announced they are adding an “Adverse Market Refinance Fee” of 50 basis points that is effective on refinance mortgages delivered to Fannie Mae or Freddie Mac starting September 1, 2020. This is a huge hit to mortgage lenders across the country. [Read more…]

Federal Housing Finance Agency issues half-point fee on conventional refinances

Surprise! It’s a strong Jobs Report

May’s Jobs Report came in much better than expected this morning with 2.51 million jobs ADDED vs the anticipated the 8.5 million jobs lost. Personally, this sounds too good to be true to me and I’m thinking that we’ll see corrections in the months to come…of course, I hope I’m wrong and that an economic (and health) recovery is here. [Read more…]

Forbearance Guidelines Updated for Conventional Financing

This week Fannie Mae and Freddie Mac updated guidelines for how soon home owners can obtain a new mortgage if they have entered into a forbearance agreement with their current lender. Most of the focus with this program is that it’s not suppose to impact their credit score. Although the credit score may not be impacted, the credit report reflects that payments were not made on the mortgage. It seems that many home owners are not aware that taking advantage of not having to make mortgage payments will impact their ability to get a new mortgage for refinancing or buying a new home [Read more…]

This week Fannie Mae and Freddie Mac updated guidelines for how soon home owners can obtain a new mortgage if they have entered into a forbearance agreement with their current lender. Most of the focus with this program is that it’s not suppose to impact their credit score. Although the credit score may not be impacted, the credit report reflects that payments were not made on the mortgage. It seems that many home owners are not aware that taking advantage of not having to make mortgage payments will impact their ability to get a new mortgage for refinancing or buying a new home [Read more…]

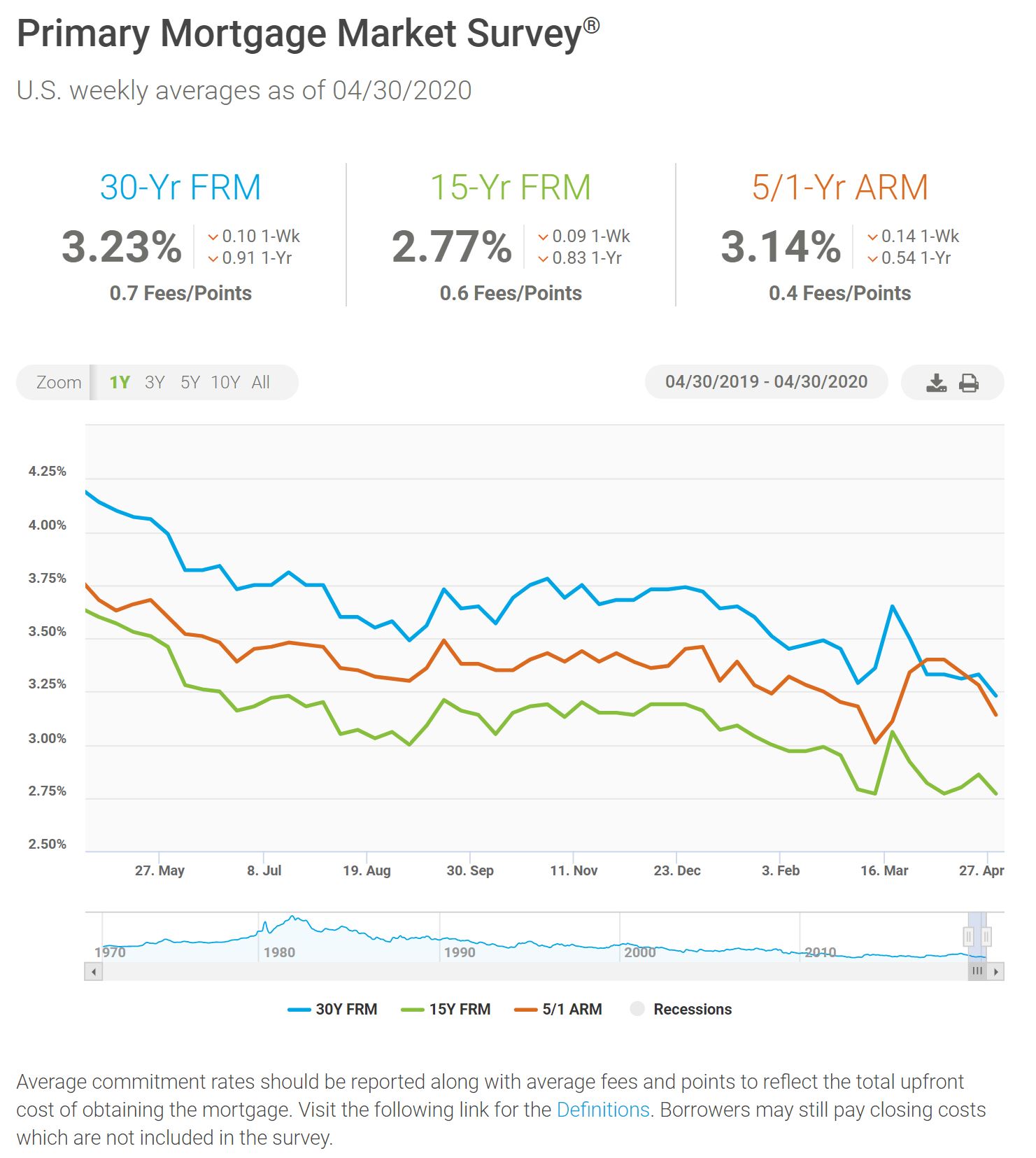

Mortgage Rates at an All Time Low

Freddie Mac’s weekly mortgage rate survey, Prime Mortgage Market Survey (aka PMMS) revealed the lowest mortgage rates since Freddie Mac started tracking interest rates in 1971.

“The size and depth of the secondary mortgage market is helping to keep rates at record lows. These low rates are driving higher refinance activity and have modestly helped improve purchase demand from their extremely low levels in mid-April,” said Sam Khater, Freddie Mac’s Chief Economist.

Remember, Freddie Mac’s PMMS report is based on mortgage rates from last week. Last week’s rates are old news and no longer available…although with that said, mortgage rates are still extremely low right now

We are open for business and here to help you with your refinance or home buying needs for homes located in Washington state. Please contact me if I can help you! Click here for a no-hassle mortgage rate quote or here to start a loan application.

Some things to Consider before you do Forbearance with your Mortgage

Politicians and the media have made it sound like entering into a forbearance with your mortgage because of the pandemic is something that many Americans are taking advantage…and maybe you should too, right? Well…maybe not. [Read more…]

Politicians and the media have made it sound like entering into a forbearance with your mortgage because of the pandemic is something that many Americans are taking advantage…and maybe you should too, right? Well…maybe not. [Read more…]

Governor Jay Inslee clarifies requirements for Loan Officers and Real Estate Agents during the Pandemic

Last Friday, Governor Inslee issued clarification to real estate agents and lenders regarding real estate and mortgage transactions during the corona virus pandemic. Originally, real estate agents were clarified as “non-essential” which caused a bit of an uproar in the real estate industry. [Read more…]

Mortgage Rates at Extremely Low Levels

Freddie Mac’s PMMS report was released this morning showing just how low mortgage interest rates have dropped during the pandemic. Remember, the Prime Mortgage Market Survey’s rates are last week’s news as they are based on an average of mortgage rates from last week.

Getting a Mortgage During the Coronavirus

What strange times we’re in! Last night, Governor Inslee declared we are in a minimum two week “shelter in place” with only essential businesses allowed to operate, unless you can work from home.

What strange times we’re in! Last night, Governor Inslee declared we are in a minimum two week “shelter in place” with only essential businesses allowed to operate, unless you can work from home.

Mortgage companies are currently considered essential and Mortgage Master Service Corporation is open to help you with your mortgage needs. I am currently working from my home office as I navigate mortgage rates that are off the charts! We are still helping people with their refinances and home purchases. [Read more…]

Recent Comments