Fannie Mae’s HomeReady Mortgage program offers low down payment, reduced mortgage insurance and no price adjustments (LLPA) translates to lower mortgage interest rates…AND is not just for home buyers. Fannie Mae’s HomeReady mortgage program is also available for home owners interested in refinancing. [Read more…]

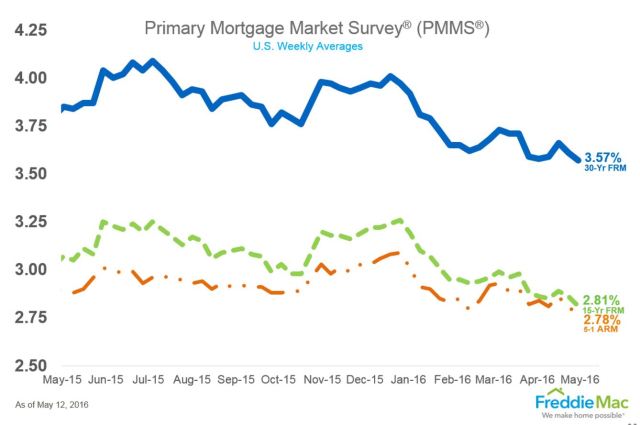

Freddie Mac reports 30 year mortgage rates at lowest level in 3 years!

According to Freddie Mac’s Prime Mortgage Market Survey that was released today, mortgage rates for the 30 year fixed conventional are at their lowest in 3 years.

30 Years in the Real Estate Industry

It’s taking me a couple days to write this post because it’s hard for me to fathom that this month marks my 30th year in the real estate industry. Thirty years ago, I was hired to be a doc puller at Safeco Title Insurance Company. I was promoted to Customer Service and promoted again to work in the title units. This picture of me is from a calendar that Chicago Title created to promote “Unit 5”. And yes, that is Chuck Knox, Coach of the Seattle Seahawks, and my hair was as big as the shoulder pads!

It’s taking me a couple days to write this post because it’s hard for me to fathom that this month marks my 30th year in the real estate industry. Thirty years ago, I was hired to be a doc puller at Safeco Title Insurance Company. I was promoted to Customer Service and promoted again to work in the title units. This picture of me is from a calendar that Chicago Title created to promote “Unit 5”. And yes, that is Chuck Knox, Coach of the Seattle Seahawks, and my hair was as big as the shoulder pads!

I worked at a couple title companies over the years…the last one was my favorite, Washington Title Company. I was one of the first people recruited to launch Washington Title. It was a great time to be a “title rep” and I worked with a great team.

Mortgage Rates are LOW!! It’s time to refi…again!

Mortgage rates have been very low the past couple of days creating a flurry of refinances.

Mortgage rates have been very low the past couple of days creating a flurry of refinances.

Just how low? Try 3.500% for a 30 year fixed conventional mortgage (apr 3.652%) priced with 1.152 points.

And how about 2.750% for a 15 year fixed conventional mortgage (apr 3.022%) priced with 1.199 points.

Rates quoted above are as of May 6, 2016 as of 12:30 pm PST and are subject to change at any time and are subject to credit approval. Click here for your no hassle mortgage rate quote for homes located anywhere in Washington state.

Not so good karma for your credit?

I just received an email from a popular credit reporting service suggesting that I open new accounts.

Friday Funny on Debt

https://vimeo.com/41152287

All sarcasm aside, if you want to buy or refinance a home, think twice before going deeper into debt.

If buying or refinancing a home in Washington state is on your radar, please contact me – I’m happy to help you with your mortgage needs and develop a game plan.

Freddie Mac PMMS: Lowest Rates since May 2013

This morning Freddie Mac released their Prime Mortgage Market Survey which revealed that last weeks rates hit another low for this year.

If you are interested in seeing if refinancing makes sense, I am happy to review your scenario and provide you with a no-hassle rate quote. Of course I’m happy to help you buy a home too. 🙂 Click here to start the preapproval process.

Recent Comments