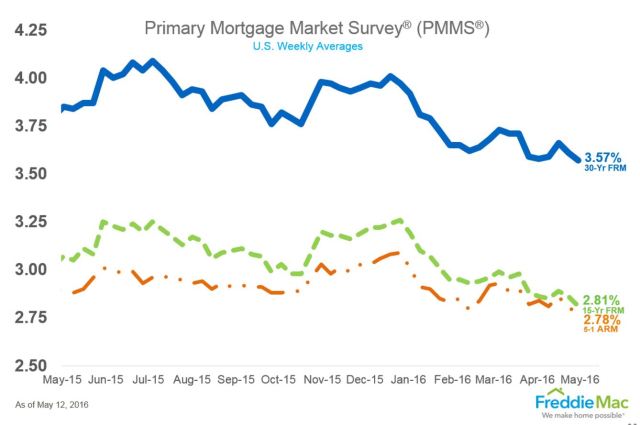

According to Freddie Mac’s Prime Mortgage Market Survey that was released today, mortgage rates for the 30 year fixed conventional are at their lowest in 3 years.

The 30 year fixed averaged 3.57% with an average of 0.5 point for the week ending May 12, 2016.

From Freddie Mac’s Chief Economist, Stan Becketti

“Disappointing April employment data once again kept a lid on Treasury yields, which have struggled to stay above 1.8 percent since late March. As a result, the 30-year mortgage rate fell 4 basis points to 3.57 percent, a new low for 2016 and the lowest mark in 3 years. Prospective homebuyers will continue to take advantage of a falling rate environment that has seen mortgage rates drop in 14 of the previous 19 weeks.”

Mortgage rates are extremely low right now. You may want to considering refinancing if:

- Your current 30 year rate is in the mid-4’s or higher;

- You have mortgage insurance;

- You would like to shorten your mortgage term;

- You would like to get rid of your adjustable rate mortgage

- You have a second mortgage you would like to combine;

- You would like to make home improvements;

- You would like to eliminate debt;

- You would like to take equity for other reasons.

If I can help you with your refi or purchase of a home located anywhere in Washington state, where I am licensed, I am happy to help you! Click here for your personal rate quote.

Discover more from The Mortgage Porter

Subscribe to get the latest posts sent to your email.

[…] Freddie Mac’s PMMS report was released this morning showing that mortgage rates are trending higher from the 3 year lows. […]