Just a reminder to set your clocks back one hour before you go to bed tonight or you could always stay up until Sunday, November 2, 2008 at 2:00 am in observance of Day Light Saving Time.

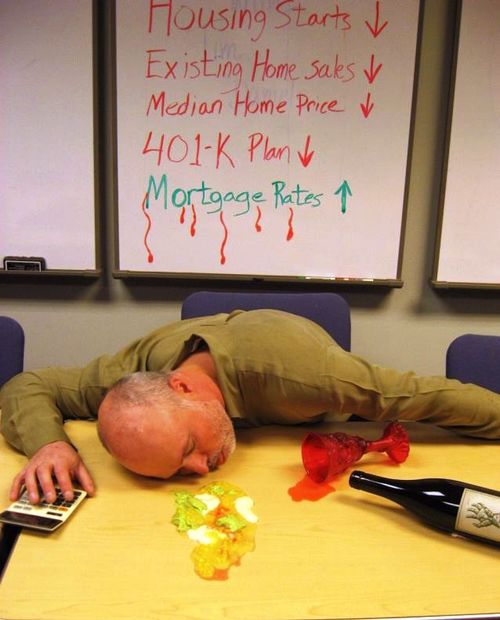

Financing Investment Properties

EDITORS NOTE: This post was written during the subprime era and may not apply to current lending.

Many folks are taking advantage of this market by purchasing investment properties. Before you do, I strongly recommend getting preapproved with a Mortgage Professional and reviewing your options. There have been serveral changes to guidelines.

Rates on Bank Websites

How to Read a Title Report

My title and escrow partners at The Talon Group are at it once again. This time, they’ve produced an entertaining video on how to read your title commitment. Whenever you buy, sell or mortgage your home, odds are you receive a title commitment (aka title report). It’s important to take a few moments to review what’s showing against your property.

Recent Comments