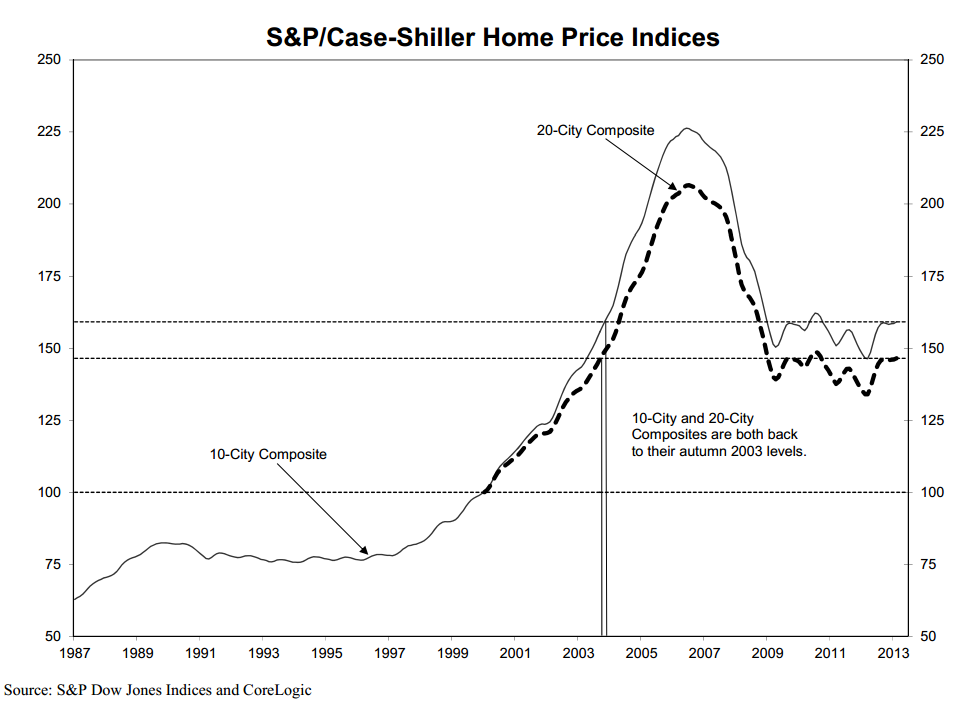

The S&P/Case-Shiller Home Price Index was released this morning showing that home prices across the country are up 9.3% year over year through February based on the 20-City Composite. All 20 cities in the composite have reported increases in home prices over the last two months.

Some cites are experiencing double digit increases. Seattle’s home prices are up 9.3% year over year per this report.

From the report:

“Home prices continue to show solid increases across all 20 cities,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “The 10- and 20-City Composites recorded their highest annual growth rates since May 2006; seasonally adjusted monthly data show all 20 cities saw higher prices for two months in a row – the last time that happened was in early 2005….”

If you are considering buying a home in Seattle or anywhere in Washington state, I strongly recommend that you meet with a licensed mortgage originator and start the preapproval process early. I’ll often meet with home buyer six months to a year before they’re planning on buying a home. If I can help you, please let me know!