Earlier this week I met with my team at Mortgage Master to review goals for this year. This past year at the company has been great. I added a Loan Officer Assistant, Crystal and our main office moved to a beautiful new office in a more central location. Mortgage Master has also added to their management team, which has been beneficial by providing extra support to our mortgage originators. I’ve added additional tools to what I offer clients as well and I’m eager to start better implementing them into our services. I am constantly reviewing and trying new programs with the goal of helping clients have better tools and information to help make informed decisions for their mortgage needs.

Earlier this week I met with my team at Mortgage Master to review goals for this year. This past year at the company has been great. I added a Loan Officer Assistant, Crystal and our main office moved to a beautiful new office in a more central location. Mortgage Master has also added to their management team, which has been beneficial by providing extra support to our mortgage originators. I’ve added additional tools to what I offer clients as well and I’m eager to start better implementing them into our services. I am constantly reviewing and trying new programs with the goal of helping clients have better tools and information to help make informed decisions for their mortgage needs.

Happy 2014

Been turned down by a big bank for a mortgage? You’re not alone!

A recent report from the Federal Financial Institutions Examination Council revealed that big banks have a very high cancellation rate for home loan applicants.

In 2012, according to this data, Chase declined almost a third of their mortgage applicants with Bank of America denying 25.6% and Wells Fargo rejecting 21% of their mortgage applicants. Quicken Loans and U.S. Bank turned down 17% of their mortgage applicants.

[Read more…]

Mortgage Interest Rate Locks 101: UPDATED

EDITORS NOTE: One of the joys of writing a mortgage blog is that guidelines and procedures change…and change often. This gives me a great opportunity to provide you with an updated post. With HUD’s creation of the 2010 Good Faith Estimate, a lot of the information in the original post is no longer relevant (relating to the GFE) from the original article I wrote on locking back in 2007. With that said, here’s my updated post…we’ll see if we need to revise this again once CFPB issues their version of the Good Faith Estimate!

EDITORS NOTE: One of the joys of writing a mortgage blog is that guidelines and procedures change…and change often. This gives me a great opportunity to provide you with an updated post. With HUD’s creation of the 2010 Good Faith Estimate, a lot of the information in the original post is no longer relevant (relating to the GFE) from the original article I wrote on locking back in 2007. With that said, here’s my updated post…we’ll see if we need to revise this again once CFPB issues their version of the Good Faith Estimate!

I love it when I’m asked an excellent question from a potential client. This person is still shopping for his next home and who the lender will be to provide financing. At this point, I have provided several good faith estimates and a total costs analysis to compare possible scenarios side by side along with how the mortgages may be working for him in 5 and 10 years.

Moving towards a Paperless Mortgage with e-sign

This week our company, Mortgage Master Service Corporation, has been upgrading our “loan operating system”. This will allow our clients to have the option of reviewing their loan documents and acknowledge (sign) them electronically with “e-signatures”. Of course our clients can still print or receive hard copies of their loan documents.

This step forward is not only “green” by reducing waste (it’s estimated a typical file uses around 400 pieces of paper); it will also help streamline the mortgage process. For our clients, instead of having to sign their names over and over again with their initial loan application documents, they will simply use their personal computer to securely access their loan documents and “click” their autographs.

E-signatures are allowed with conventional and VA mortgage loans. Currently it is not yet available for FHA or USDA mortgages. Hopefully this will change soon!

You may notice that my on-line loan application has changed – this is to support our new system.

Here is more information on how our e-sign process works.

If you’re considering buying or refinancing a home anywhere in Washington, I’m happy to help you!

Comparing Closing Cost

Sometimes I see quotes from competitors that befuddle me. This morning, a home owner in Maple Valley asked me to review their FHA streamlined refinance quote that they received from a big bank.

The great big bank not only has a much higher interest rate, their closing cost are more expensive too. In fact, when I review the closing cost, it makes me wonder if the loan officer has originated many FHA loans.

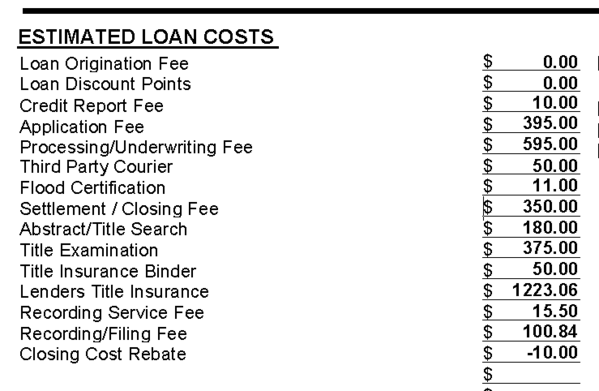

Here are the bank’s closing cost for an FHA streamline refi…

Big Bank’s Closing Costs

…and there’s only a $10 closing cost rebate with an interest rate that is 0.5% higher than mine!

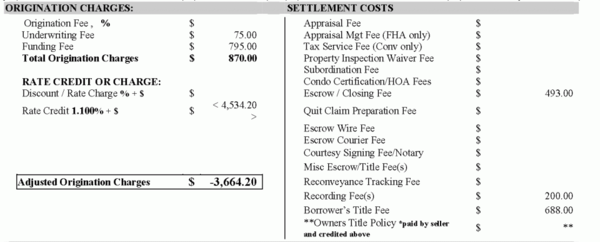

Compare this to my closing cost (BELOW), which are covered with a rebate credit (which also pays for my clients prepaids and reserves).

My closing costs

I really don’t understand how our quotes could be so far apart…but you can see, they are. Many consumers would trust their bank would provide the most competitive rates and closing cost. The quotes I’m looking at today illustrate this isn’t always true. If this Maple Valley homeowner did not shop his rate quote and only trusted his big bank, he would be paying a much higher rate over the life of the loan and overpaying in fees.

Yet those in Congress feel that mortgage originators who work for banks can be held to lower standards per the SAFE Act. Remember, bank mortgage originators are not required to be licensed, they are only registered. I recently met a nice loan officer who works for a different big bank and who presented herself to be NMLS licensed, when I asked her directly if she was “registered” or “licensed” she did correct herself. Believe me, there is a difference.

If you are considering refinancing or buying a home anywhere in Washington state and have a rate quote from another lender or bank, I’m happy to review it to see if I can offer a better rate and/or lower closing cost. Send me an email with a pdf of the rate quote you would like me to review. Remember, I can only help with homes located in Washington state, where I’m Licensed to originate mortgages.

Mortgage loans and the first Presidential Debate

Did you watch the Presidential debate last Wednesday? At one point, President Obama and Mitt Romney discussed regulations that are impacting getting a mortgage – namely: Dodd Frank. When you hear media discussing that some borrowers are having a difficult time qualifying for a mortgage or that the process is cumbersome, odds are it’s regulations like those you’ll find in Dodd Frank that are the cause.

Here’s a bit from the debate:

President Obama:

…the reason we have been in such a enormous economic crisis was prompted by reckless behavior across the board. Now, it wasn’t just on Wall Street. You had…loan officers…giving loans and mortgages that really shouldn’t have been given, because they’re — the folks didn’t qualify. You had people who were borrowing money to buy a house that they couldn’t afford. You had credit agencies that were stamping these as A-1 (plus) great investments when they weren’t. But you also had banks making money hand-over-fist, churning out products that the bankers themselves didn’t even understand in order to make big profits, but knowing that it made the entire system vulnerable.

So what did we do? We stepped in and had the toughest reforms on Wall Street since the 1930s. We said you’ve got — banks, you’ve got to raise your capital requirements. You can’t engage in some of this risky behavior that is putting Main Street at risk. We’re going to make sure that you’ve got to have a living will, so — so we can know how you’re going to wind things down if you make a bad bet so we don’t have other taxpayer bailouts.

Mitt Romney:

Let me mention another regulation of Dodd-Frank. You say we were giving mortgages to people who weren’t qualified. That’s exactly right. It’s one of the reasons for the great financial calamity we had. And so Dodd-Frank correctly says we need to… have qualified mortgages, and if you give a mortgage that’s not qualified, there are big penalties. Except they didn’t ever go on to define what a qualified mortgage was…

It’s been two years. We don’t know what a qualified mortgage is yet. So banks are reluctant to make loans, mortgages. Try and get a mortgage these days. It’s hurt the housing market…because Dodd-Frank didn’t anticipate putting in place the kinds of regulations you have to have. It’s not that Dodd- Frank always was wrong with too much regulation. Sometimes they didn’t come out with a clear regulation.

Read the full transcript of the Presidential Debate courtesy of NPR.

I was actually surprised to hear “qualified mortgages” (also referred to as QRM or qualified residential mortgage) brought up in the debate. Banks have been waiting for the definition of what constitutes a QRM for some time. One of the biggest concerns is if the government uses loan to value (how much down payment or home equity) to qualify as a QRM

It’s quite possible that in order for a mortgage to be classified as a QRM, a home buyer may have to come up with 10 or even 20% down payment when they’re buying a home. I would imagine that mortgages that fall outside of the QRM criteria will have much higher rates to compensate for the risk that bank will be taking. First time home buyers or those without larger down payments (assuming loan to value is one of the factors) will be penalized. Obviously this would not help the housing market’s recovery nor help our economy.

The Center for Responsible Lending reports:

QRM mortgages requiring a 10% down payment would lock 40% of all creditworthy borrowers out of the market. A 20% down payment would exclude 60% of creditworthy borrowers.

In my opinion, it’s time to move forward with common sense underwriting. We don’t need the government creating underwriting guidelines for those who are wanting to buy or refinance their home (the flaws with “net tangible benefit” requirements illustrates this).

Stay tuned…

A compromise for waiving your escrow reserve account

Tis the Season for Vacations

Many families are squeezing in a vacation during the remaining days of summer. I can’t blame them, I’m just back from one myself! If you are in the mortgage process, it’s critical that your let your mortgage originator know of any vacation (or business travel) plans.

If you’re going to be in a spot where you can receive important documents and respond to emails, it may not be a huge issue. If you’re going off the grid, it may impact your rate lock commitment if your loan is currently locked. Your mortgage originator will need to price out a long enough lock period for your loan (if you’re locking) or you may opt to float and not lock in the current rates available. And of course, if you run out of time with your lock, the rate lock commitment may be extended.

Another factor is signing your final loan documents. Escrow companies can email (I do not recommend sending final docs via email) or send your loan documents via something like FedEx or UPS. This can be a bit risky as well as if a signature is missed or something is not notarized properly, your transaction may be delayed.

The more notice you can provide your mortgage originator about vacation or business travel, the more time they will have to prepare your options for the mortgage process.

Recent Comments