Archives for October 2008

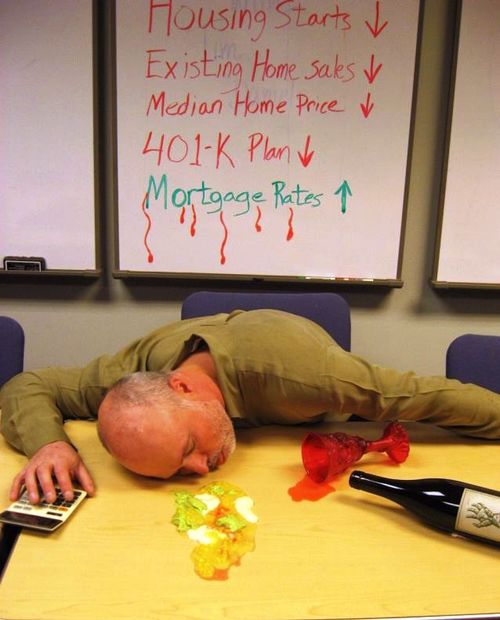

A Freakish Friday Funny

Game plan for preparing to buy a home when you’re credit score is low

I don’t blame anyone for wanting to own a home. Sometimes when I meet with clients and review their current scenario, a game plan needs to be created so they can work on getting themselves into a better position to buy a home. The last thing anyone wants is to cram themselves into a mortgage they cannot afford or to commit to a long term payment when they don’t have a great track record of making payments on time. Some times a plan may take 6 months or a year or longer before someone is ready to buy a home.

I have someone with low credit scores who wants to buy a home. She knows she will probably be a candidate for FHA financing because she has little down payment and her credit. Although FHA is not as persnickety about credits scores as conventional financing, they scrutinize credit history: especially the last 12 months.

This person has a few late payments this year, the last one being as recent as August. FHA financing is most likely out of the question for her until August next year assuming she does not make any other late payments between now and then. She can work on her credit for the next 10-12 months (until she has 12 months since her last late payment). She doesn’t have any collections but she does have a few small accounts that are “maxed out”.

- Credit card “A” with a balance of $477 and a limit of $500.

- Credit card “B” with a balance of $323 and a limit of $300.

- Credit card “C” with a balance of $215 and a limit of $300.

- The first thing she should do is focus on getting card “B” under the limit of $300. She’s getting whammo’d with her credit scores for being extended beyond what her credit limit is with this account (in addition to being maxed out). She should at least pay it down enough to make sure that her interest fees won’t keep popping her over her limit.

- Next she should select one of her two smallest cards to pay down to at least just below 50% of her card limit. Card “C” would only take about $65 to bring her debt down to 50% of the line limit (300 x 50% = $150).

- Then pay down the next card to at least 50% of the limit. “Card B” will take $150 (assuming she’s paid the extra $23 that has pushed her over the limit) to be at 50% of the credit line limit.

- Credit card “A” will take a little extra cash at $227. (500 limit x 50% = $250. 477 – 250 = 227).

She needs to keep her credit below 50% of the credit line at the very minimum. I know I said FHA is not as picky as conventional. However, you do want your credit scores above 600 in order to receive better pricing (620 and higher is even better).

Not only will this help her with qualifying for FHA financing, she’s probably also paying higher insurance rates due to her current credit scores.

She has a decent income and no savings. She needs to use this time of working on her credit to also build up her reserves. Not only for what the lender will require (3.5% minimum down payment for FHA as of January 1, 2009); but for her sake should her income change or issues arise, she should have a minimum of 6 months worth of living expenses saved (FHA does not require this, I’m suggesting it).

She has been considering homes priced around $275,000. FHA’s minimum required investment for this home next year will be $9,625. The seller can pay the remaining closing costs and prepaids as long as she has met the above requirement (which can be a gift or loan from family members)–this would need to be negotiated in the purchase and sale agreement.

The proposed mortgage payment would be around $2,000 (including taxes, home owners insurance and mortgage insurance). This is $700 more per month than what she is currently paying for rent. Once she has corrected her credit, she should practice making a $2000 mortgage payment by paying the difference ($700) into a savings account that she leaves untouched for her down payment and to hopefully create a savings cushion. $12,000 in savings would be ideal (6 months of mortgage payment) but not required. If she has no savings, it will take her just over a year to pay $700 per month to come up with the down payment (9625 divided by 700 = 13.75). Another 17 months to have a savings cushion of $12,000.

I know this isn’t instant gratification. It is developing responsible financial habits. There are expenses to owning a home beyond renting. One of my last homes required a new roof just months after moving in to the tune of $15,000. Savings has always been important and it’s even more true in our current economy.

She’s all ready moving in the right direction by contacting a Mortgage Professional who is interested in her long term financial well-being and is willing to help her create a game plan.

Check out my related article: Getting on Track to Buy Your First Home.

Can I buy a $620,000 home with a low credit score?

My wife and I found a house we are in love with. I wanted to write and tell you our situation, maybe you can tell us if we are even in the "ballpark". The house we like is 620,000. We have 20% to put down. We have very little debt and well documented income. I have a low credit score, 660 or lower. Is this worth pursuing or is the credit score too low?

- Credit history.

- Loan limits.

Unfortunately the loan limits where this couple are considering to purchase are much lower than what we have in the King County area. They’re wanting to buy in Clark County which currently has a temporary jumbo limit of $418,750. They would need about $200,000 for their down payment with the seller paying closing costs and prepaids (est. at $12,000). Or they could opt for conforming financing with a loan amount of $417,000 and try to get a conventional approval (with a larger down payment, it’s possible).

If they were buying in King, Pierce or Snohomish County, the loan limit is currently $567,500 and would have the option of putting less than 20% down (as low as 3.5%), should they wish assuming they qualify for the payment.

Regardless of where the property is located, the last 12 months of credit history is more critical than credit score (as long as the credit scores are 600 or higher) for a purchase using an FHA insured loan.

FHA loans are full doc and will need to be sourced and seasoned. Buyers should be prepared to provide their last 2 years of W2s (and possibly tax returns) as well as at least 30 days of income on their paystubs.

Remember, we should be learning in early November what the new jumbo loan limits will be. I’ll keep you posted!

Financing Investment Properties

EDITORS NOTE: This post was written during the subprime era and may not apply to current lending.

Many folks are taking advantage of this market by purchasing investment properties. Before you do, I strongly recommend getting preapproved with a Mortgage Professional and reviewing your options. There have been serveral changes to guidelines.

Rates on Bank Websites

How to Read a Title Report

My title and escrow partners at The Talon Group are at it once again. This time, they’ve produced an entertaining video on how to read your title commitment. Whenever you buy, sell or mortgage your home, odds are you receive a title commitment (aka title report). It’s important to take a few moments to review what’s showing against your property.

Do You Pay Property Taxes On Your Own?

If you have elected to not have your property taxes included in your monthly mortgage payment (no reserve account), second half taxes are due for King County by October 31, 2008. For more information, or to pay on line, click here.

If you have property taxes included in your mortgage payment, you shouldn’t need to do anything at all. Just sit back and take it easy.

Recent Comments