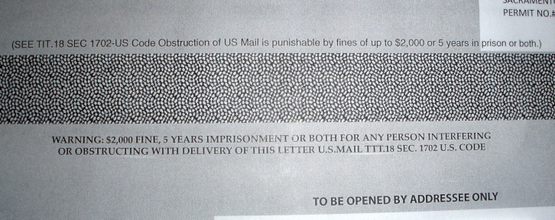

I actually thought this piece of mail was legit…until we opened it. This piece of junk was threatening of a possible fine and imprisonment OR BOTH if anyone interfered with it’s delivery.

Once you open the mailer, you quickly see that it’s from a mortgage company that is so desperate, it must utilize trickery to try to obtain new business.

We have good news about your loan originally funded at:

MORTGAGE MASTER SERVICE CORP

After reviewing your account history we are happy to inform you that you have been preapproved for a new mortgage at a lower monthly payment. This offer makes you eligible for a modified mortgage at a lower monthly payment regardless of credit, mortgage payment history, or other financial hardships. If you are in an adjustable loan, this offer makes you eligible to convert to our fixed product line.

There is no rate in this promotion…however it actually states that we’ve been preapproved for a new mortgage with a lower payment. What a bunch of baloney.

When I receive a piece of junk mail such as this, I forward it to the Department of Financial Institutions in Olympia. I hope you’ll do the same too. Misleading advertising in mortgages must stop. I encourage you to forward your mortgage junk mail (Washington State only) to:

Enforcement Unit, Division of Consumer Service

DFI, P.O. Box 41200, Olympia, WA 98504

Please don’t ever select your Mortgage Professional by something you receive in the mail or hear on the radio. And remember, rates that are advertised in radio and newspaper print are not current. Rates change constantly (especially these days).

Recent Comments