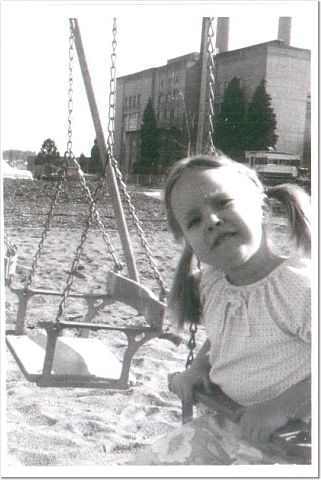

They did it…my family and friends SURPRISED me on my birthday! Not only did they throw a wonderful party…JP Patches, my childhood hero, was there.

I decided to take Friday off from work and blogging. All I wanted to do (to my husband’s dismay) was stay at home and work in the garden. Last Friday, it was beautiful out! My sister in law tricked me into a pedicure at Southcenter and forced me to have a margarita and an appetizer with her at Bahama Breeze (hey, how come I’m not sensing any sympathy from my readers?). I just wanted to get home and watch the sunset–relax! Plus, my husband and son were going to treat me to a nice dinner. NOT!!!

I should also mention…I believe in my quarterly newsletter, I printed that JP was not doing public appearances any more. This is not true. This was a story my husband had told me when we went to Fremont to see the unveiling of JP and Gertrude’s statue to trick me since he knew I’ve always wanted a JP Patches birthday party. Please do hire JP and be sure to buy a Patches Paver to help fund his statue and support Children’s Hospital.

This was such a treat. Cheers to JP, my husband, family and friends. Thank so much for making this a birthday I’ll never forget and will always cherish. Filed Under: Just for Fun

Recent Comments