Even though I’m on the road this week enjoying a little vacation time, I’m still keeping an eye on the mortgage market and the key economic reports that can influence interest rates.

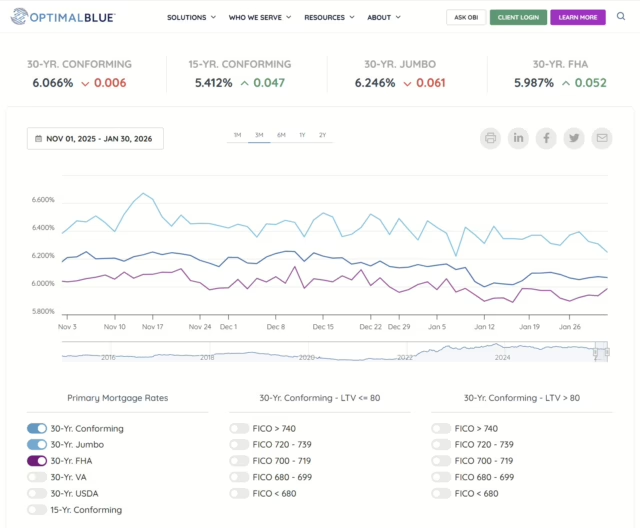

As of January 30, 2026, the **average 30-year fixed conforming mortgage rate is approximately 6.066%. Rates continue to move within a fairly tight range, but this week’s economic data could bring some volatility—especially toward the end of the week.

Mortgage rates have been moving fast and unpredictably. One day they’re up, the next day they dip just enough to make refinancing worthwhile—but only if you’re ready to act. For many homeowners, the challenge isn’t wanting to refinance, it’s knowing exactly when to move.

Mortgage rates have been moving fast and unpredictably. One day they’re up, the next day they dip just enough to make refinancing worthwhile—but only if you’re ready to act. For many homeowners, the challenge isn’t wanting to refinance, it’s knowing exactly when to move. Mortgage rates continue to be one of the most talked-about topics for homebuyers and homeowners across Washington State. Whether you’re hoping to buy your first home, move up, or refinance, it’s natural to wonder: where are mortgage rates headed in 2026?

Mortgage rates continue to be one of the most talked-about topics for homebuyers and homeowners across Washington State. Whether you’re hoping to buy your first home, move up, or refinance, it’s natural to wonder: where are mortgage rates headed in 2026? How Do I Compare Mortgage Lenders or Loan Officers?

How Do I Compare Mortgage Lenders or Loan Officers?

Recent Comments