Last week I had fun creating a spoof where I’m consoling a drunk racoon, Rocky. Rocky has the blues because he decided to chase a low rate with an online lender and now his home purchase transaction is on a rocky road. All joking aside, I actually have saved several purchases where clients who first opted for an online lender with a slightly lower rate discovered that the loan officer and their lender could not close their transaction. It’s easy to promise a low mortgage rate but that low rate doesn’t matter at all if your transaction doesn’t close. [Read more…]

Last week I had fun creating a spoof where I’m consoling a drunk racoon, Rocky. Rocky has the blues because he decided to chase a low rate with an online lender and now his home purchase transaction is on a rocky road. All joking aside, I actually have saved several purchases where clients who first opted for an online lender with a slightly lower rate discovered that the loan officer and their lender could not close their transaction. It’s easy to promise a low mortgage rate but that low rate doesn’t matter at all if your transaction doesn’t close. [Read more…]

Working with a Local Lender vs. an Online Lender for your Mortgage

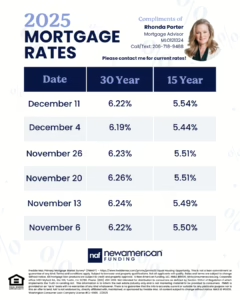

Freddie Mac PMMS Shows Mortgage Rates in Tight Range

Freddie Mac released the PMMS (Prime Mortgage Market Survey) today showing that mortgage rates for the 30-year fixed averaged 6.22% last week. Really, the best use of Freddie’s survey is to show how mortgage rates are trending because you can’t lock in last week’s rate UNLESS they just happen to be the very same rate as what’s available to you at the moment you’re ready, willing and able to lock. [Read more…]

Freddie Mac released the PMMS (Prime Mortgage Market Survey) today showing that mortgage rates for the 30-year fixed averaged 6.22% last week. Really, the best use of Freddie’s survey is to show how mortgage rates are trending because you can’t lock in last week’s rate UNLESS they just happen to be the very same rate as what’s available to you at the moment you’re ready, willing and able to lock. [Read more…]

The Mortgage Porter: Mortgage Rates for the Week of November 24, 2025

This week’s episode of The Mortgage Porter reviews current mortgage rates and what may impact rates this short holiday week. Plus, we review recent changes to Fannie Mae’s guidelines that removes the minimum credit score requirement of 620.

If you or anyone you know are thinking about buying or refinancing a home, I am happy to help! Feel free to contact me to review your scenario.

Fed Drops Funds Rate a Quarter Point

The Fed cut rates to the Funds Rate by 25 basis points today, as expected. Although the Fed Funds rate is lower, mortgage rates are actually moving higher as I’m writing this. Mortgage rates are NOT controlled by the Fed.

The Fed cut rates to the Funds Rate by 25 basis points today, as expected. Although the Fed Funds rate is lower, mortgage rates are actually moving higher as I’m writing this. Mortgage rates are NOT controlled by the Fed.

Mortgage-backed securities are down about 32 basis points.

PMMS Reports Mortgage Rates at the Lowest Level in Over a Year

Freddie Mac released their weekly Prime Mortgage Market Survey this week showing the lowest rates for the 30-year fixed in over a year.

The Mortgage Porter Weekly Mortgage Rate Update for September 22, 2025

How are mortgage rates fairing following last week’s Fed meeting and quarter point rate reduction to the Fed funds rate and what may impact the direction of mortgage rates this week?

Check out my latest episode of The Mortgage Porter Weekly.

For current mortgage rates based on your personal scenario, please reach out to me!

PROOF that the Fed Rate Cut did not bring down Mortgage Rates

Click this link to watch my take on what happened with mortgage rates since the Fed lowered the Fed Funds rate by a quarter point on Wednesday.

If you’re curious how today’s market affects your home purchase or refinance, let’s connect—I’d be happy to run the numbers for your situation.

It’s FED DAY! [Live Post] FED DROPS RATE QUARTER POINT

It’s finally here. The day we think we’ve been waiting for…the wrap up of the two day FOMC meeting where it is highly expected that Fed Chair Powell will announce that the fed funds rate will be reduced 0.25. As I write this (9:45 am Seattle time) MBS (mortgage-backed securities, which mortgage interest rates are based on) are pretty flat – up about 1 basis point. They’re flat because the markets have already priced in the quarter point rate reduction by the Fed. So if the Fed announces that there is not going to be a reduction to the funds rate or if they decide to cut 0.50 – we will see some serious market reaction. [Read more…]

It’s finally here. The day we think we’ve been waiting for…the wrap up of the two day FOMC meeting where it is highly expected that Fed Chair Powell will announce that the fed funds rate will be reduced 0.25. As I write this (9:45 am Seattle time) MBS (mortgage-backed securities, which mortgage interest rates are based on) are pretty flat – up about 1 basis point. They’re flat because the markets have already priced in the quarter point rate reduction by the Fed. So if the Fed announces that there is not going to be a reduction to the funds rate or if they decide to cut 0.50 – we will see some serious market reaction. [Read more…]

Recent Comments