The Northwest Multiple Listing Service issued a press release indicating that we are finally seeing an increase in new listings being added to the market. The 14,524 new listings that came on during May, in the 23 counties that the NWMLS serves, are the most listings added in one month in 10 years. In King County, there were almost 1000 homes added to the market creating just over one month of inventory – the first time since September of last year. Here’s a link to the NWMLS market snapshot for May 2018. [Read more…]

The Northwest Multiple Listing Service issued a press release indicating that we are finally seeing an increase in new listings being added to the market. The 14,524 new listings that came on during May, in the 23 counties that the NWMLS serves, are the most listings added in one month in 10 years. In King County, there were almost 1000 homes added to the market creating just over one month of inventory – the first time since September of last year. Here’s a link to the NWMLS market snapshot for May 2018. [Read more…]

Possible Relief for Seattle – King County Home Buyers

S&P Case Shiller: Seattle home prices on the rise

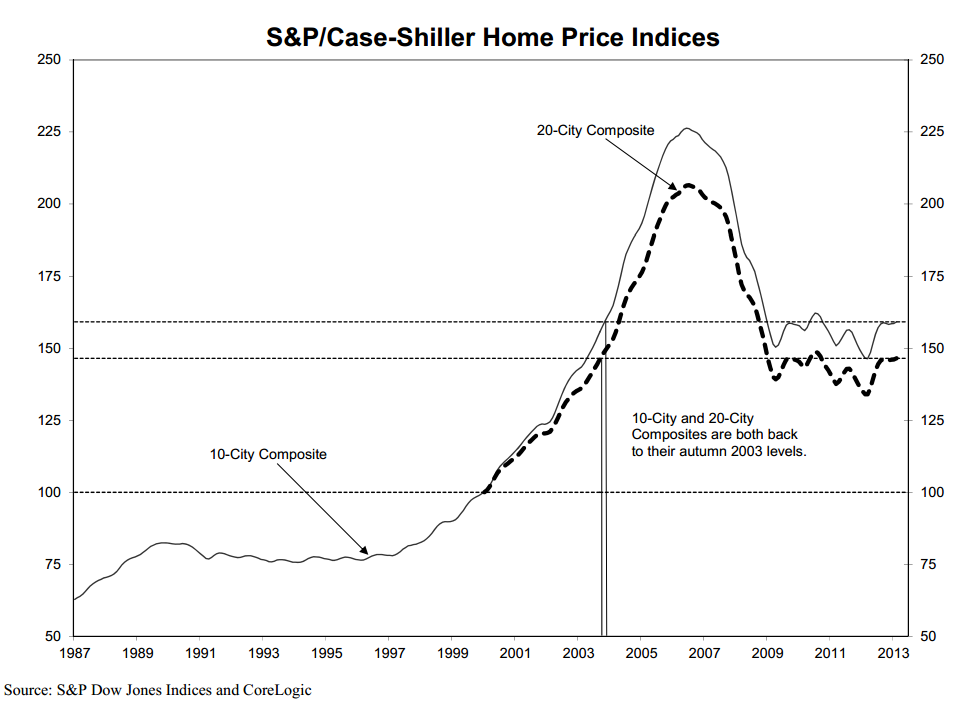

This morning the S&P/Case Shiller Home Prices Index was released revealing gains across the board for the 20 city index.

This morning the S&P/Case Shiller Home Prices Index was released revealing gains across the board for the 20 city index.

The report states that Seattle had their largest monthly gain to home prices since April 1990 of 3.15% from April to May.

Year over year, Seattle boasted double digit gains of 11.9% for May.

This can be good news for people in the greater Seattle area who are considering selling their home and for those who have been waiting for home values to improve so they can refinance.

Mortgage interest rates are off their record lows. However, they are still what would be considered historically low.

If you’re interested in getting preapproved to buy a home or refinancing your existing home located in Washington State, I’m happy to help you!

What May Impact Mortgage Rates the Week of May 27, 2013

We are back to work following the Memorial Day holiday and mortgage rates are trending higher this morning. Mortgage interest rates are still at historically low levels, however they are off their extreme lows.

Yesterday, markets were closed in observance of Memorial Day. Here are some of the scheduled economic indicators that may impact mortgage rates this week:

- Monday, May 27: Memorial Day

- Tuesday, May 28: S&P/Case Shiller Home Price Index and Consumer Confidence

- Thursday, May 30: Initial Jobless Claims, Gross Domestic Product (GDP), GDP Chain Deflator and Pending Home Sales

- Friday, May 31: Personal Consumption Expenditures (PCE), Personal Income, Personal Spending, Chicago PMI and Consumer Sentiment (UoM)

This morning, the S&P/Case-Shiller Home Price Index for March revealed that year over year, home prices went up 10.9% based on the 20 City Composite. This is the largest increase to home prices since 2006. Seattle’s home prices, according to this report, were up 10.6% year over year.

As I write this post (6:52 am), the DOW is up 171 points and, as I mentioned earlier, mortgage backed securities (bonds) are getting beat up. Remember, investors will trade the safety of bonds for the potentially quicker return found with stocks. As the stock market continues to rally, you can anticipate mortgage rates to continue to trend higher.

You can still have a 30 year fixed rate in the “3’s” as of this morning…you’ll just have to pay more for it. As of 7:00 am, I’m quoting:

3.875% priced with 0.719% in discount points based on a loan amount of $400,000 with a sales price of $500,000 (80% loan to value) and 740+credit scores (apr 4.005%). Based on a 30 year fixed rate for a purchase in greater Seattle closing July 5, 2013 or sooner.

DON’T FORGET: this is your last week to start an FHA loan and still have mortgage insurance that will terminate. FHA case numbers issued after this will have mortgage insurance on the life of the loan.

If you would like me to provide you with a mortgage rate quote for your home located anywhere in Washington state, where I’m licensed, click here.

S&P Case-Shiller reports homes prices up in Seattle

The S&P/Case-Shiller Home Price Index was released this morning showing that home prices across the country are up 9.3% year over year through February based on the 20-City Composite. All 20 cities in the composite have reported increases in home prices over the last two months.

Some cites are experiencing double digit increases. Seattle’s home prices are up 9.3% year over year per this report.

From the report:

“Home prices continue to show solid increases across all 20 cities,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “The 10- and 20-City Composites recorded their highest annual growth rates since May 2006; seasonally adjusted monthly data show all 20 cities saw higher prices for two months in a row – the last time that happened was in early 2005….”

If you are considering buying a home in Seattle or anywhere in Washington state, I strongly recommend that you meet with a licensed mortgage originator and start the preapproval process early. I’ll often meet with home buyer six months to a year before they’re planning on buying a home. If I can help you, please let me know!

Mortgage rate update for the week of April 8, 2013

Mortgage rates continue to remain at historically low levels. Homeowners who have not recently refinanced may want to contact their mortgage professional to see if they can reduce how much they’re paying on interest.

Something that’s not staying low in the Seattle/King County area is home prices. The Seattle Times reports that in March, home prices are up 20% year over year. The median price for a home sold last month in Seattle jumped to $462,375. This is largely due to a lack of inventory. If you’ve been considering selling your home, now may be a good time.

Here are some of the economic indicators scheduled to be released this week:

Wednesday, April 10: FOMC Minutes

Thursday, April 11: Initial Jobless Claims

Friday, April 12: Retail Sales; Producer Price Index (PPI); Consumer Sentiment Index (UoM)

Also important to note: there has been some confusion as to the recent changes to mortgage insurance premiums on FHA loans regarding when the coverage terminates. FHA mortgage insurance will not become permanent until June 2013 and impacts newly originated FHA loans only with case numbers issued after May 31, 2013.

If I can help you with your home purchase or refinance for your home located anywhere in Washington state, please contact me. Have a great week!

Median Home Prices up 18.5% in King County

A few days ago, I shared an article about how the greater Seattle – Bellevue – Everett area is one of the top 5 places in the country to be a home seller. Yesterday’s article in the Seattle Times appears to back that up.

A record-low inventory of homes for sale in King County, very low interest rates and a growing Puget Sound economy combined to push the median price of houses sold in February to $365,000, an 18 percent jump over a year ago.

Only 2,947 homes were listed for sale in King County last month, down from 5,178 a year ago, according to Tuesday’s report by the Northwest Multiple Listing Service.

I’m currently working with several pre-approved buyers who are ready, able and wanting to buy a home in this area. What they need is more inventory.

If you have been considering selling your home, now could be the time. You may find that you have an advantage being listed before other homes plan to go on the market for Spring.

If you are planning on buying a home, I cannot stress enough how important it is to be prepared for competition. It’s crucial to be fully preapproved with a local, reputable mortgage professional.

If you’re considering buying a home in King County, or any county in Washington state, I’m happy to help you with your mortgage needs.

Seattle PI reports Surging Home Prices in King County

This week Aubrey Cohen from the Seattle PI reported that sales prices in King Count jumped up just shy of 20% last month:

The median price of a King County house that sold in November was $385,000, up 19.7 percent from a year earlier and 4.1 percent from this October, the Northwest Multiple Listing Service reported Wednesday. The median price in Seattle was $425,000, up 18.1 percent from last November and 1.2 from October.

Some non-distressed homes continue to experience bidding wars as inventory remains low. Here are some tips on what you can do to prepare for a “bidding war”.

Experts speculate that part of the jump in sales price could be from home buyers taking advantage of extremely low mortgage rates to buy a higher priced home.

If you are interested in buying a home, whether it’s your primary home, a vacation home or an investment property, I strongly recommend getting preapproved first. Being preapproved will help give you an advantage over unprepared buyers.

If you are considering buying a home anywhere in Washington, I’m happy to help you with your mortgage needs. I have helping people buy and refinance homes in Washington at Mortgage Master Service Corporation since April 2000.

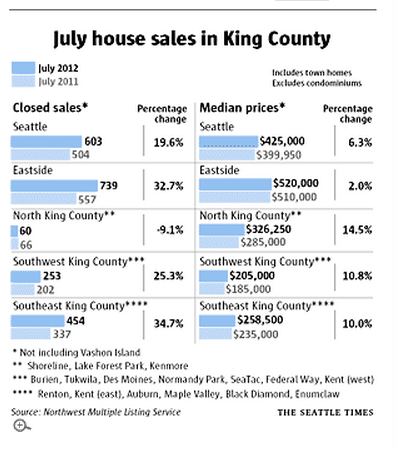

King County Home Prices are up 7% from last year

The Seattle Times reports that home prices for King County have jumped up 7.2% from July last year. This pencils out to $25,250 with the median sales price of $375,250. The article also notes that closings are up 26% YOY which is great news for the housing industry. It doesn’t matter how low mortgage rates or home prices are unless transactions can actually close.With less inventory, many buyers are finding themselves in bidding wars or having a property in contract before they can get their offer together. From the article:

“Another recurring theme is the dramatic drop in the number of homes for sale. Home listings have been sliding for a full year; in July the number of home listed for sale was down 38 percent year-over-year…

…distressed home listings — bank-owned properties and short sales — are down 60 percent from last year. This also contributes to the small number of listings and brings up home prices.”

Part of the reason for the low inventory, per Seattle real estate economist Matthew Gardner, is that many people are not able to sell because they are underwater with their mortgages and don’t want to go through a short sale.

If you’re considering selling and your property is non-distressed (you have enough equity to sell), this could be a great time with more buyers than sellers.

If you’re underwater with your home and would like to sell once you have equity, you might consider a HARP 2.0 refinance (if your last conforming mortgage closed prior to June 2009) or an FHA streamlined refi (if your existing mortgage is FHA). While you wait for home values to continue to trend higher, why not save on your monthly mortgage payments?

If you’re a home buyer, I cannot stress enough how important it is to be fully preapproved BEFORE you start shopping for a home. If you’re considering buying or refinancing a home in Seattle, King County or anywhere in Washington state, I’m happy to help you!

Recent Comments