Mike Kreidler, Insurance Commission for the State of Washington, would like Stewart Title to pay one-point-nine MILLION dollars for exceeding the $25.00 per year amount allowed to be spent on their customers. Again, this is just for Snohomish County other Puget Sound title insurers are under investigation.

Mike Kreidler, Insurance Commission for the State of Washington, would like Stewart Title to pay one-point-nine MILLION dollars for exceeding the $25.00 per year amount allowed to be spent on their customers. Again, this is just for Snohomish County other Puget Sound title insurers are under investigation.

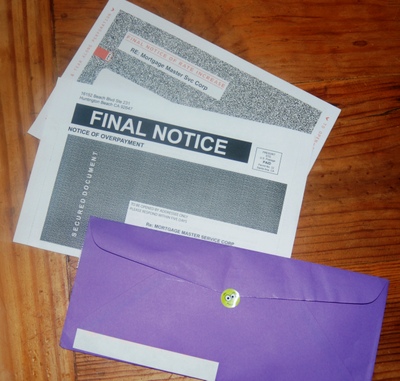

The Notice of Hearing, which was filed today, includes a details of each violation dating back from December 2006. The list also discloses line by line advertising infractions including the real estate offices name and the initials of the real estate agents receiving the illegal inducement for business.

The read the Notice of Hearing, Download insurance_commissioner.pdf

Recent Comments