In Part 1 of this series, I reveal that home buyers qualify for the mortgage payment first based on their income. The next major factor is the down payment and funds for closing. Some may say that the down payment more important than the mortgage payment, however the down payment actually can be a variable; one may be able to obtain gift funds to increase a down payment. You cannot change your income unless you add more qualified borrowers.

In Part 1 of this series, I reveal that home buyers qualify for the mortgage payment first based on their income. The next major factor is the down payment and funds for closing. Some may say that the down payment more important than the mortgage payment, however the down payment actually can be a variable; one may be able to obtain gift funds to increase a down payment. You cannot change your income unless you add more qualified borrowers.

What Determines How Much Home You Qualify For – Part 2: Funds for Closing

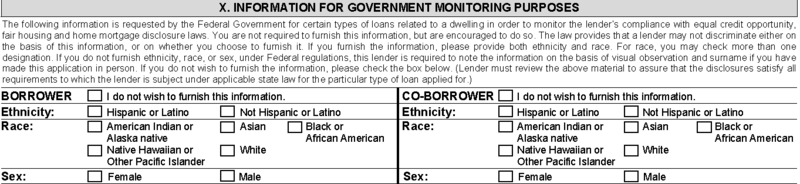

Your Ethnicity and Race on the Loan Application: Section X

Back on "Section X" of a residential mortgage loan application, borrowers are asked to check boxes to indicate what their ethnicity and race are.

It's not unusual when I take a loan application and the borrower wants to mark the box that it's none of the the government's business. I don't blame them…but I wonder if they're aware that when they check "I DO NOT WISH TO FURNISH THIS INFORMATION" that mortgage originators may be required to guess depending on how the application is taken.

Check out the fine print on the loan application:

"If you do not furnish ethnicity, race, or sex, under Federal regulations, this lender is required to note the information on the basis of visual observation and surname if you have made this application in person."

I can tell you from days in the escrow biz, this can be kind of awkward when you're signing someone and the person across from you says "why is this box marked stating that I'm ….?!!" Your loan originator probably had to make their best guess.

The Home Mortgage Disclosure Act (also referred to as HMDA, pronounced hum-da) along with Regulation C requires lenders to collect this information to make sure that lenders are not discriminating.

From Fannie Mae:

X. Information for Government Monitoring Purposes

This section is included to aid the federal government in monitoring compliance with equal credit opportunity, fair housing and home mortgage disclosure laws. Supplying this information is strictly voluntary on the part of the applicant, but lenders should ask all applicants to provide it, including those who apply by telephone and through the Internet, and should describe the reason for collecting this data. Race and ethnicity are separate categories, and although the lender should ask applicants to furnish information for both, applicants may furnish one but not the other. Note that there is no longer a place for applicants to indicate race as "Other" but applicants may check as many races as apply.

The Home Mortgage Disclosure Act and its implementing Regulation C generally require Lenders to collect sex, race and ethnicity data on all applications.

When an application is taken in person and an applicant elects not to provide some or all of this information, federal law requires the lender to note the applicant's sex, ethnicity, and race on the form, based on the lender's visual observation or the applicant's surname. To aid in identifying applicants who may be of Hispanic ethnicity and who elect not to self-identify, the lender may wish to consult the list of Spanish surnames developed by the U.S. Bureau of the Census. Furthermore, the lender may wish to advise the applicant that he may complete or change the information in this section after the application is approved, at any time up until closing.

And from HMDA:

If an application is taken entirely by mail, Internet, or telephone, and the applicant declines to provide information on ethnicity, race, or sex, the lender must use the code for "information not provided by applicant in mail, Internet, or telephone application."

The only way to not participate in disclosing your ethnicity or race on a loan application is to completely apply on line or mail. I'm wondering, if a person understands why this information is being collected, why would they not want to participate?

LQI: The Potential Kiss of Death for On-Time Closings

If you're planning on getting a mortgage to purchase a home or for a refinance, please do not obtain ANY credit, increase your credit debts (use your credit accounts) or please don't even THINK of applying for new credit until your new mortgage loan has funded and closed. Why hold off on shopping for your new fridge or washer and dryer that you're going to need or that new sofa from Pottery Barn? Because it could delay your funding (i.e. closing) or worse–it could disqualify you for your loan (kill your deal) right when you're expecting your transaction to close!

If you're planning on getting a mortgage to purchase a home or for a refinance, please do not obtain ANY credit, increase your credit debts (use your credit accounts) or please don't even THINK of applying for new credit until your new mortgage loan has funded and closed. Why hold off on shopping for your new fridge or washer and dryer that you're going to need or that new sofa from Pottery Barn? Because it could delay your funding (i.e. closing) or worse–it could disqualify you for your loan (kill your deal) right when you're expecting your transaction to close!

Fannie Mae has created Loan Quality Initiative (LQI). According to Fannie Mae, LQI is intended to prevent mortgage lenders from having to buy-back mortgages by increasing the quality of the loan that is being sold to Fannie Mae. LQI addresses more than undisclosed debts on the loan application, including occupancy and borrower identification issues. However in my opinion, the re-verification of credit prior to funding has the potential to impact a transaction more often.

LQI requires that if new debt is discovered when the credit is reviewed, that it be disclosed on the final application. New debt is not limited to a new credit card you used to purchase appliances, it could be that you made a charge on an existing credit card that increased your monthly payment. Maybe you simply filled up your gas tank at $3.00 a gallon…this could possibly trigger a delay in a transaction closing if the borrower has higher debt-to-income ratios or average credit scores. If new debt or inquires are discovered just prior to funding, the loan may have to be sent to underwriting again to include the new debts payments.

Most lenders are doing "soft pulls" on the credit (without the credit score) also referred to as a credit "refresh". However, if new debt is discovered and the loan is sent back to underwriting, a new full credit report may be pulled. If the borrowers mid-credit scores have dropped, this may impact qualifying and possibly the interest rate since conforming rates are based on credit scores. Not so refreshing, is it?

So if you are considering buying a home or refinancing, please do not:

- apply for any credit or loans after you've completed a loan application;

- use your credit cards during the transaction (increasing your borrowed amount on your credit line);

- pay off or close any debts during your transaction without first speaking to your mortgage originator (this can actually drop your credit score).

As tempting as it might be to purchase your fridge (or what ever) so it's ready for your new home when you move in–please don't!! It may cause a delay in your closing or cost your mortgage approval and at this point in the transaction, your financing contingency is most likely waived!

I understand Fannie Mae wanting higher quality loans and that the loan application should reflect the borrower. However everyone knows that the day after closing, the new home owner is probably going to purchase some new appliances and maybe make a trip or two to Pottery Barn or Restoration Hardware. This is a classic example of how the underwriting pendulum is swinging too far. I can tell you that my typical client today is more qualified than those of the subprime era, our current guidelines alone (pre-LQI) have done this. NOTE: Please be responsible whenever using credit…especially after just taking on the largest debts you may have in your lifetime: a mortgage.

PS: Real Estate Agents: please be sure to make your buyers aware of this newer policy.

Photo credit: Rob Young via Flickr

The Cash-In Refi

You’ve probably heard of a “cash-out” refinance where a home owner is taking equity out of their home for home improvements, debt consolidation or if they’re paying off a second mortgage that was not obtained when they purchased their home. A “cash-in” refinance is a fairly new term and something I’m seeing first-hand due to the current insanely low mortgage rates.

Freddie Mac reports that “in the second quarter of 2010, 22 percent of homeowners who refinanced tehir first-lien home mortgage lowerd their principal balance…this ties the record for the third highest “cash-in” share since Freddie Mac began keeping records on refinancing patterns in 1985. The revised cash-in share in the first quarter was 18 percent.”

“Cash-in” means that the home owner is bringing funds to escrow for closing. Their loan amount is not high enough to cover closing costs and prepaids. Sometimes home owners, with a healthy savings, will opt to pay for closing costs separately instead of financing it into the new loan but a majority of home owners opt to have the cost added to their payoff amount, thus increasing their original principal balance. Some are deciding to plunk down enough cash to reach a certain loan amount or loan to value to obtain an improved interest rate. For example, a Seattle area homeowner with a current loan balance of $575,000 might decide to use $10,000 towards her loan amount to obtain a high balance conforming mortgage rate instead of a higher non-conforming/jumbo rate. (Current loan limits in King, Snohomish and Pierce County for a single family dwelling for high balance is $567,500). UPDATE 1/1/2012: Loan limits currently $506,000 for conventional and $567,500 for FHA (and may change following years).

Some home owners are doing this because of loan to value issues–not because they have an extra grand or two burning a hole in their pocket. I’ve had a few clients who have paid off and closed their home equity lines of credit to qualify. Or perhaps they have an appraisal come in slightly lower than expected, exceeding the allowed loan-to-value guidelines. For example, if a home owner in Bellevue was anticipating a minimum appraised value of $380,000 for his home to finance his Home Affordable Refinance loan amount of $399,000 with a 105% loan to value yet his appraisal comes in at $376,000; he could have his loan amount adjusted to 105% loan to value at $393,750, bringing in $5,250 to closing.

Funds for closing will need to be documented, just as they would a mortgagae being used a home purchase, with statements from the accounts the funds came from.

Frank Nothaft, Freddie Mac Vice President and Chief Economist states:

“Interest rates on fixed-rate mortgages are at 50-year lows, making refinancing attractive if borrowers qualify, and similarly rates on savings instruments like CDs are also very low, which makes the choice of paying down mortgage principal very attractive to borrowers with extra cash reserves.”

I’m happy to review your current mortgage scenario at no obligation to help determine if refinancing makes sense for you. The only catch is, your property needs to be located in located in Washington state since that’s where I’m licensed.

Moms-to-Be CAN Qualify for a Mortgage

Recently the New York Times published an article stating that expectant mothers were being denied mortgages partially due to guidelines such as Fannie Mae's Lender's Quality Initiative. I'm not sure if this was a case of bad reporting or a bit of fear from the lenders part of LQI, where loans may possibly be denied at closing if the loan application changes. HUD has announced they are investigating this as discrimination against expectant mothers and new parents.

Recently the New York Times published an article stating that expectant mothers were being denied mortgages partially due to guidelines such as Fannie Mae's Lender's Quality Initiative. I'm not sure if this was a case of bad reporting or a bit of fear from the lenders part of LQI, where loans may possibly be denied at closing if the loan application changes. HUD has announced they are investigating this as discrimination against expectant mothers and new parents.

From HUD's Press Release:

"…FHA requires its approved lenders to review a borrower's income to determine whether they can reasonably be expected to continue paying their mortgage for the first three years of the loan. FHA-insured lenders cannot, however, inquire about the future maternity leave. If a borrower is on maternity leave at the time of closing, lenders must document the borrower's intent to return to work, that the borrower has the right to return to work, and that the borrower qualifies for the loan taking into account any reduction of income due to their leave. Meanwhile, HUD is currently reviewing Fannie Mae and Freddie Mac's underwriting guidelines to determine if they satisfy the Fair Housing Act, including income verification of persons taking parental or disability leave…"

The New York Times article references a mother from Washington State who's mortgage was almost denied due to her maternity leave:

Elizabeth Budde, a 33-year-old oncologist who lives in Kenmore, Wash. She nearly lost her mortgage after a loan officer learned she was home with her newborn.

With stellar credit and a solid job, Dr. Budde said she had been notified via e-mail that she was approved for a loan on June 15. But that note prompted an automatic, “out of the office” e-mail reply from Dr. Budde’s work account, which said she was out on maternity leave.

The next day, Dr. Budde received a second e-mail message from the lender, this time denying her loan approval. Since “maternity leave is classified as paid via short-term or temporary disability income,” the e-mail message said, it could not be used because it would not continue for three years.

The message also said the lender could not consider her regular, salaried income because she was not on the job. “I was really shocked,” Dr. Budde said. “At the time, they didn’t know how I was getting paid for my leave.”

In the case of this new mom, her base salary would have sufficed for her loan approval to not be in jeopardy had she disclosed this to the mortgage originator assuming this mortgage originator knew their underwriting guidelines. (Sounds like this mortgage originator either didn't know her guidelines or her lender has very strict underwriting overlays, in my opinion).

It's assumed there are no changes to your loan application between the time of application and closing. If you have changes to your employment, income, assets or credit during your transaction, you need to let your mortgage originator know as soon as possible. Verification of employment (VOE's) are performed prior to closing (funding) and in some cases, credit may be re-verified. LQI (Loan Quality Initiative) requires that lenders do pre-funding reviews to make sure that the loan application is accurate prior to funding. Per Fannie Mae:

The pre-funding review process should include controls or checks that test the accuracy of the loan data to ensure the information obtained is correct (e.g. borrower identity, employment, financial information, property information).

Anyone, man or woman, planning on taking any leave from their employment during their loan transaction should let their mortgage originator know.

Photo: My brand new Mom (with me).

Paying Alimony? You May Want to Consider an FHA Insured Mortgage

UPDATE: You no longer have to FHA if you’re paying alimony... Fannie Mae and Freddie Mac have updated their guidelines. Check it out here!

Most mortgage originators know that if you have less than 10 payments remaining with alimony or child support payments, it may not have to be factored into your qualifying ratios (debt to income) as long as the payment doesn’t impact your ability to pay the mortgage following closing. A borrower needs to be well qualified with plenty of savings for an underwriter to support this guideline. [Read more…]

Can I Convert My Existing Home to an Investment Property to Buy My Next Home?

EDITORS NOTE: These guidelines have changed. If you’re buying a home in Washington state, please contact me for current guidelines.

This is a common question I’m asked these days…mostly because many home owners don’t have as much equity as they would need in order to sell their current residence. With home prices being at their lowest in years, many want to take advantage and buy their next home and simply rent out their current residence.

More Changes Coming to FHA Insured Mortgages

Federal Housing Commissioner David Stevens has released a letter confirming that the upfront mortgage insurance premiums on FHA insured loans will increase effective on case numbers issued on April 5, 2010 and after. Most FHA transactions will see an increase of 50 basis points to 2.25%. Currently the upfront mortgage insurance premium (which is typically financed–added to the loan) is 1.75% of the loan amount. This was issued in a Mortgagee Letter in late January and is "old news".

His letter also provides notice that other changes that were discussed by HUD earlier (but not included in that mortgagee letter) will be posted in the Federal Register soon and will go into effect this summer.

What will impact most FHA borrowers this summer is the decrease in allowed seller concessions. Currently FHA allows sellers to pay up to 6% of the sales price towards allowable closing costs. In a few months, this will be reduced to 3%.

Also this summer, FHA will require borrowers with a credit score of less than 580 to have a 10% down payment. Most lenders, including Mortgage Master, have a minimum credit score of 620 currently for FHA loans.

Commissioner Stevens also addresses a recent announcement:

FHA has waived the regulation that prohibits the use of FHA financing to purchase properties that are being resold within 90 days of previous acquisition. The waiver of regulation took effect for all sales contracts executed on or after February 1, 2010.

A Mortgagee Letter which will have more details, will follow and there are certain conditions that must be met for a property to be eligible for the property waiver.

As you can see, mortgage guidelines are still very much in a tightening mode. It's hard to say just how long this trend will continue or how long it will last.

Recent Comments