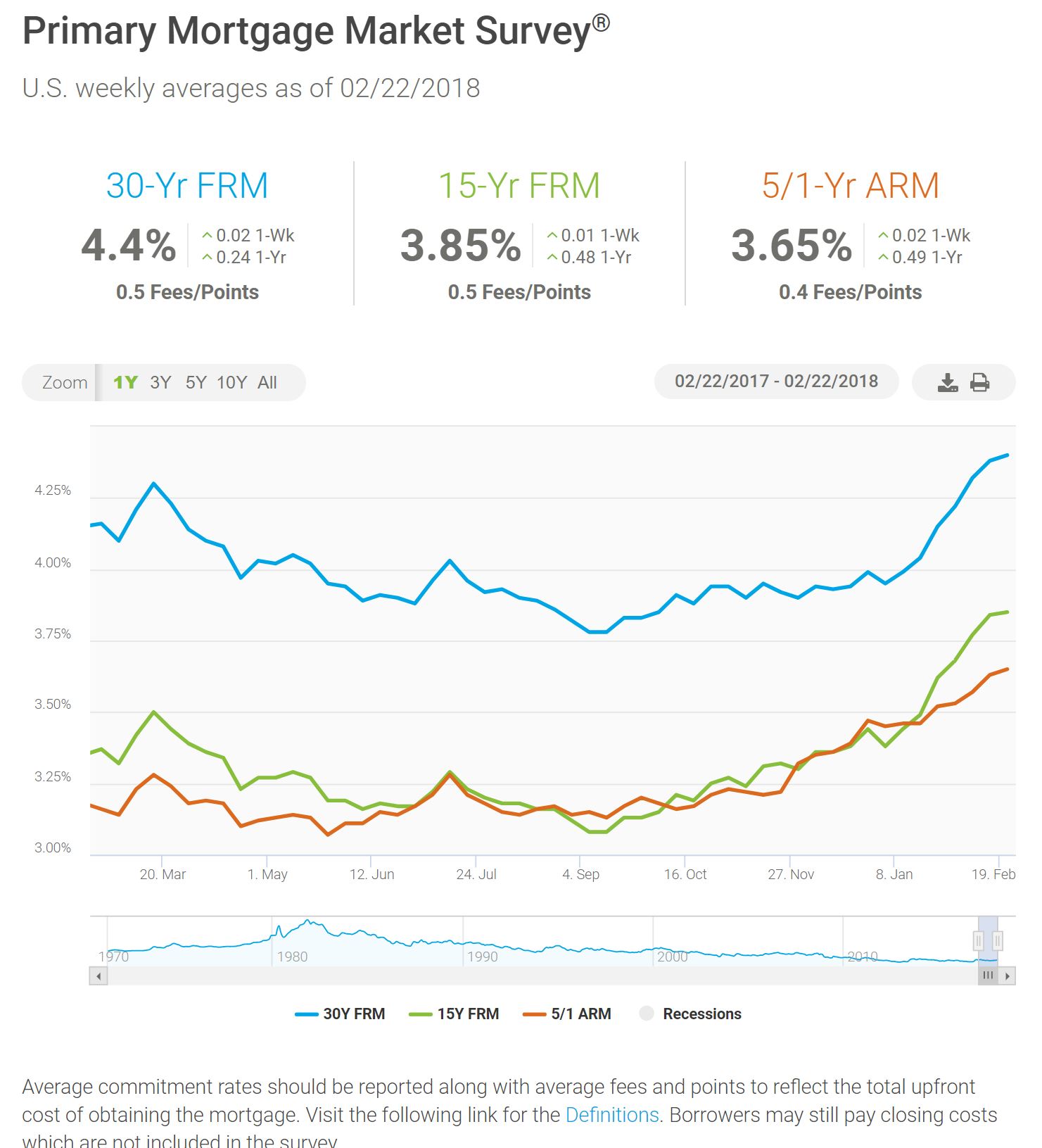

Freddie Mac released their Prime Mortgage Market Survey today showing mortgage rates continuing to trend higher.

The PMMS report is based on an average of conforming rates from last week. This is the seventh consecutive week that mortgage rates have moved higher based on this report.

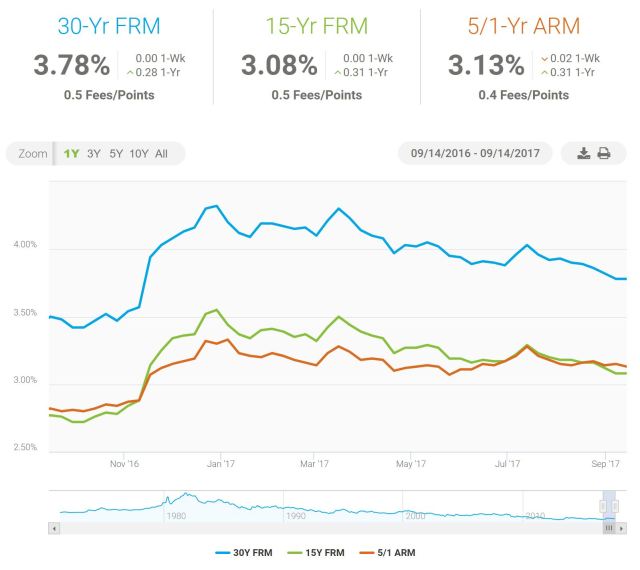

Historically, our rates are still very low. Don’t believe me? Check this out. [Read more…]

This week, a real estate agent asked me to prepare some financial flyers for listings in Pierce County. The homes are stunning – I live in Seattle and cannot imagine having a large garage for our cars…although before living in Seattle, I had a sweet 2 3/4 garage.

This week, a real estate agent asked me to prepare some financial flyers for listings in Pierce County. The homes are stunning – I live in Seattle and cannot imagine having a large garage for our cars…although before living in Seattle, I had a sweet 2 3/4 garage.

Recent Comments