Even though I’m on the road this week enjoying a little vacation time, I’m still keeping an eye on the mortgage market and the key economic reports that can influence interest rates.

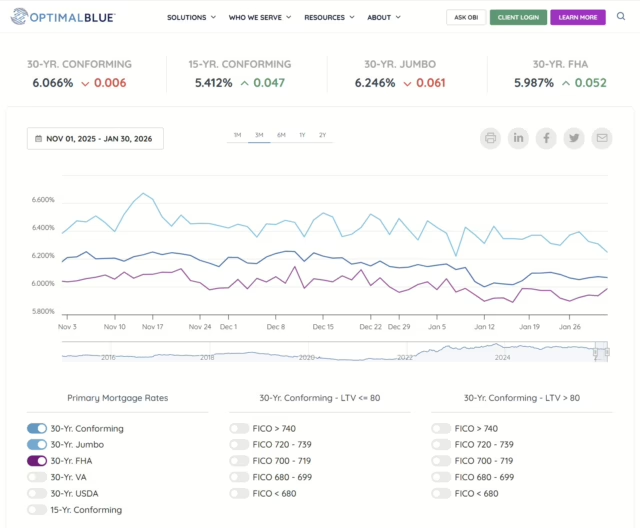

As of January 30, 2026, the **average 30-year fixed conforming mortgage rate is approximately 6.066%. Rates continue to move within a fairly tight range, but this week’s economic data could bring some volatility—especially toward the end of the week.

What the Market Is Watching This Week

Several labor-market reports are scheduled, and these are especially important because employment data plays a big role in how mortgage rates move.

Tuesday – JOLTS (Job Openings and Labor Turnover Survey)

This report gives insight into how strong the job market remains, including how many job openings employers are trying to fill.

Wednesday – ADP Employment Report

ADP provides an early look at private-sector job growth ahead of Friday’s government jobs report.

Thursday – Weekly Jobless Claims

This weekly snapshot helps gauge trends in layoffs and unemployment claims.

Friday – BLS Jobs Report (Employment Situation Report)

This is the big one. The Bureau of Labor Statistics report includes job growth, unemployment rate, and wage data—and it often has the biggest impact on mortgage rates.

What This Means for Homebuyers and Homeowners

When employment data comes in stronger than expected, mortgage rates often move higher. Weaker-than-expected data can help rates improve. With multiple labor reports packed into one week, it’s not unusual to see rates fluctuate—sometimes quickly.

If you’re:

- Thinking about buying a home

- Actively house hunting

- Considering a refinance

- Or simply keeping an eye on opportunities

It’s a good week to stay informed and be prepared to act if the market shifts in your favor.

Even while I’m away, I’m still available by email and will follow up as soon as I’m back. If you’d like a personalized mortgage check-up or want to be added to my Mortgage Rate Watch, just reach out—I’m always happy to help.

Discover more from The Mortgage Porter

Subscribe to get the latest posts sent to your email.

Please leave a reply