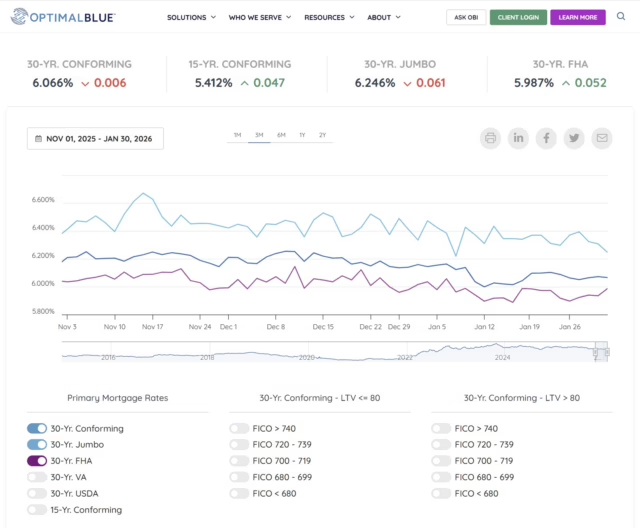

Mortgage rates moved a bit higher last week. As of Friday, February 6, 2026, the average 30-year fixed conforming rate was 6.083% per Optimal Blue. Optimal Blue’s mortage rate index is based on an average from rates that were locked by lenders who utilize OB. We don’t know what the factors are for pricing the rates and these rates are from Friday so they are expired. For current mortgage rates based on your personal scenario, please contact me.

Discover more from The Mortgage Porter

Subscribe to get the latest posts sent to your email.

Please leave a reply