UPDATE DEC 19, 2013: New (more expensive) LLPA’s have been released.

UPDATE JAN 3, 2011: Not all lenders are implementing this fee increase (yet). This is perfect example of an advantage of working with a correspondent lender since we work with more than one bank or one banks products/rates.

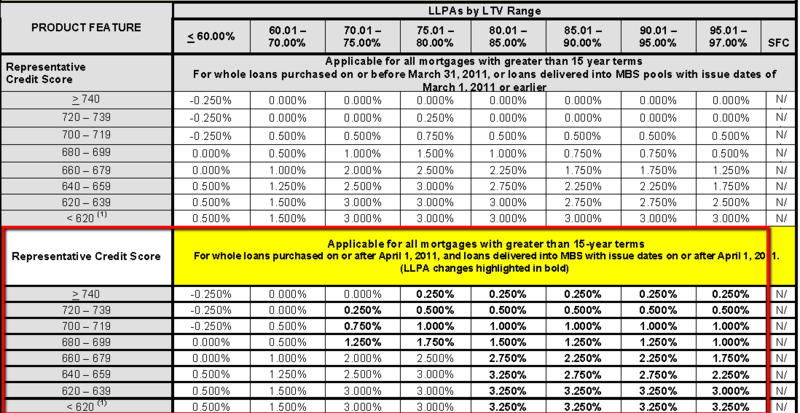

Conventional mortgages (Fannie Mae and Freddie Mac) are increasing their LLPA, also known as “Loan-Level Price Adjustment” effective on all mortgages with a term greater than 15 years on loans they purchase on April 1, 2011 or later. Although this doesn’t go into effect until April Fools, wholesale lenders will make these adjustments to their rate sheets well in advance so that they don’t have to take the price hit when the sell the loan to Fannie or Freddie. I am receiving memos from the lenders we work with stating that these price adjustments will go into effect on loans locked January 3, 2011.

The new price adjustments are outlined in the red box below. The changed adjustements are in bold in the red box (click on image to enlarge). You can view Fannie Mae’s complete LLPA schedule here – there are additional hits that may apply depending on your scenario (such as condos, subordinate financing, etc.).

LLPA’s are nothing new. We’ve had them for the past couple of years and the adjustments are typically factored into your rate. Remember, typically (but not always) 1% in fee equals 0.25% in rate. So if your “low-mid” credit score is 700 – 719 and your loan to value is 75.01% or higher, your interest rate is going to be about 0.25% higher in rate than someone with a 740 or higher credit score with a loan to value of 60.01 – 75%.

The hardest hit with this adjustment is borrowers with credit scores of 699 – 640 with loan to values over 80%. These borrowers should consider FHA insured loans for financing which do not have the same level of price hits as conventional (at this time).

The best pricing is for borrowers with credit scores 700 or higher AND a loan to value of 60% or lower. Borrowers with a 740 or higher credit score and less than 25% down payment or home equity will now be hit with a 0.25% adjustment.

These price hits impacts loan amounts of $567,500 or lower for homes located in King, Snohomish and Pierce Counties. For a complete list of Washington state conforming loan limits, click here.

Risk based pricing is one more reason why people who are considering a mortgage, regardless of if it’s to purchase a new home in Seattle or refinance their existing home in Bellevue, should start early with the preapproval process. Just being one digit off on your low-mid credit score may cost you. A qualified mortgage professional can help you make the right moves with the goal of improving your credit score if given enough time.

If you need a mortgage for a home located in Washington State, I’m happy to help you. I’ve been originating mortgages at Mortgage Master Service Corporation since April 2000 and I’ve been licensed since 2007 (when mortgage originator licensing was first mandated in Washington).

I recently met with a couple who had relocated to the Seattle area and were ready to make an offer on a home. They’re very qualified with their income stability and enough savings to put a twenty percent down payment on their next home. What surprised them was the credit report.

I recently met with a couple who had relocated to the Seattle area and were ready to make an offer on a home. They’re very qualified with their income stability and enough savings to put a twenty percent down payment on their next home. What surprised them was the credit report.

Recent Comments