This week is packed full of scheduled economic indicators that may impact mortgage rates. Mortgage rates are based on mortgage backed securities (bonds). Typically, good news for stocks means that mortgage rates may rise as investors will trade the safety of bonds for a greater return received from stocks. The reverse is also true. Signs of inflation will also impact mortgage rates for the worse. Here are some of the scheduled reports to be released this week:

Archives for May 2011

Happy Memorial Day

Three years after the Civil War, Memorial Day began as Decoration Day to be "a time for the nation to decorate the graves of the war dead with flowers" The end of May was considered a time where blooms would be readily available.

General Orders No. 11, Grand Army of the Republic Headquarters.

I. The 30th day of May, 1868, is designated for the purpose of strewing with flowers, or otherwise decorating the graves of comrades who died in defense of their country during the late rebellion, and whose bodies now lie in almost every city, village and hamlet churchyard in the land. In this observance no form or ceremony is prescribed, but Posts and comrades will, in their own way arrange such fitting services and testimonials of respect as circumstances may permit.

We are organized, Comrades, as our regulations tell us, for the purpose among other things, "of preserving and strengthening those kind and fraternal feelings which have bound together the soldiers sailors and marines, who united to suppress the late rebellion." What can aid more to assure this result than by cherishing tenderly the memory of our heroic dead? We should guard their graves with sacred vigilance. All that the consecrated wealth and taste of the nation can add to their adornment and security, is but a fitting tribute to the memory of her slain defenders. Let pleasant paths invite the coming and going of reverent visitors and fond mourners. Let no neglect, no ravages of time, testify to the present or to the coming generations that we have forgotten as a people the cost of a free and undivided republic.

If other eyes grow dull and other hinds slack, and other hearts cold in the solemn trust, ours shall keep it well as long as the light and warmth of life remain in us.

Let us, then, at the time appointed, gather around their sacred remains, and garland the passionless mounds above them with choicest flowers of springtime; let us raise above them the dear old flag they saved; let us in this solemn presence renew our pledge to aid and assist those whom they have left among us a sacred charge upon the Nation's gratitude—the soldier's and sailor's widow and orphan.

II. It is the purpose of the Commander‑in‑Chief to inaugurate this observance with the hope that it will be kept up from year to year, while a survivor of the war remains to honor the memory of his departed comrades. He earnestly desires the public press to call attention to this Order, and lend its friendly aid in bringing it to the notice of comrades in all parts of the country in time for simultaneous compliance therewith.

III. Department commanders will use every effort to make this Order effective.

By Command of:

John A. Logan

Commander in Chief

May 5, 1868

Does Your Loan Officer Attend Signings?

This past month, I have met with more clients than "usual". A typical transaction for me has been pretty much completed over the internet via my secure on-line loan application, with email and over the phone. It was an exception for me to meet clients. This was not because I didn't want to, I simply wasn't asked to and clients opted for the convenience offered by the internet.

This month, I had a spike in face to face meetings with clients. I'm not sure if this is going to be a continued trend or if May's meetings have been some sort of fluke…I do know I really enjoy meeting my clients "IRL" when our schedules allow. Three of these meetings took place when I attended the signings at escrow offices from Federal Way to Lynnwood, and one at a restaurant near SeaTac Airport. All three were first time home buyers. I wasn't really "needed" beyond being there. With having the background of managing an escrow branch for Washington Title, it's crucial to me by the time my clients reach the signing table, their questions about mortgage have been answered. A home buyer or someone who's refinancing shouldn't have to ask their escrow officer about the terms of their mortgage…their mortgage originator should have fully educated their client well before this point. With that said, I see nothing wrong with a borrower asking the signer to explain the terms – the borrower should, however, already understand their loan program.

Regardless of if I'm attending a signing or not, I'm always available to answer any questions that may pop up. And my Processor and I always review the estimated HUD-1 Settlement Statement before my client's appointment to make sure it's as accurate as possible (assuming the escrow company provides it to us, which they do 99% of the time).

Will your mortgage originator join you at the signing table? If this is important to you, then it is something you need to ask a potential mortgage originator BEFORE you decide on which lender you're going to work with. Here are more tips on things to consider when selecting the mortgage professional who will be helping you with your next home purchase or refinance.

RIP Mark Haines

Many of my mornings have been spent watching CNBC's Mark Haines with Erin Burnett and I'm saddened to learn that Mark passed away at the young age of 65. I loved his wit, humor and ability to cut through political bolony.

Here's one of my favorite Mark Haines moments.

My heart goes out to his family and friends.

You Have Until Friday to Voice Your Opinion on the Proposed Good Faith Estimates

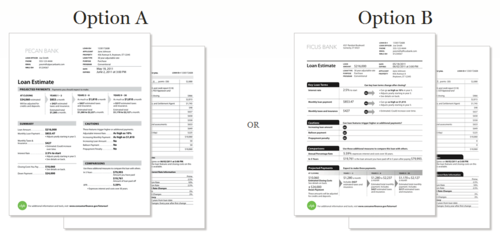

The Consumer Protection Financial Bureau would like you to vote on two different proposed mortgage disclosure forms created to replace the current Good Faith Estimate and Federal Truth in Lending documents. You have until Friday to make your selection between the Pecan Bank or the Ficus Bank examples. Both contain (and are missing) the same information.

I personally prefer Ficus Bank (the darker example) as it discloses key information at the top of the form, including the interest rate and monthly payment. The Pecan example features projected payments along the top section along funds due at closing being the very first box on the form. I've written more about the proposed disclosures at Rain City Guide. It's really a choice of style and arrangement of content.

I still believe that most consumers would rather return to a detailed Good Faith Estimate featuring all closing cost itemized instead of having certain cost lumped together where it's hard to see exactly what they're paying for. Why not have the Good Faith Estimate resemble an estimated HUD-1 Settlement Statement so that there is congruency between the beginning of the transaction and closing?

I've provided my opinions and vote to the CFPB, have you?

After you visit CFPB's site and have voiced your opinion, I'd love to know which selection you made and why.

“Going Above and Beyond” is Doing Our Jobs

I received a really nice thank you card from Shannon Ressler at Findwell Realty last week that I want to share with you. We recently helped Shannon's clients buy a vintage bungalow that was a short sell in the Magnolia neighborhood of Seattle using an FHA insured mortgage. Being a short sell and an FHA insured loan, there was no shortage of paper work and the transaction was coming "down to the wire".

I received a really nice thank you card from Shannon Ressler at Findwell Realty last week that I want to share with you. We recently helped Shannon's clients buy a vintage bungalow that was a short sell in the Magnolia neighborhood of Seattle using an FHA insured mortgage. Being a short sell and an FHA insured loan, there was no shortage of paper work and the transaction was coming "down to the wire".

Closing was set to take place on Friday…and early Thursday morning, I received a message from one of our buyers saying he was flying out at noon for a family event…he'd be back on Monday. Luckily Mike was able to reschedule his flight until four, however, we were still in a crunch to get docs out. NOTE: I normally like to have loan docs out several days before signing…but sometimes transactions (especially short sales) don't happen that way.

Extentending contracts with short sales can be a chore since in addition to dealing with a buyer and a seller, you also have the seller's lender. Adding to this, I had renegotiated our clients interest rate lock lower and the lender I had the rate locked with charges a higher extension fee once a rate lock has been renegotiated. We really needed to close on time.

We were able to rush loan docs out to the escrow company. As a correspondent lender, we prepare our loan docs at our main office in Kent and we make our own underwriting decisions (following guidelines, of course)…escrow was gracious receiving loan docs last minute AND THEN, their system crashes. I have to say, I've never had this happen! Mike's flight out was rapidly approaching. We were running out of time and escrow's computers were not cooperating.

Marilyn Porter, President of Mortgage Master Service Corporation (and my sister-in-law) had an additional set of their loan docs printed and we arranged to meet our buyers at Sharps Roasters by SeaTac Airport. While we were heading to Sharps, Mike and Mary obtained their cashiers checks for the estimated amount due for closing. Marilyn even had a couple orders of sliders and fries waiting for everyone…figuring with all the rushing around, they'd probably be hungry.

By the time we were done with the signing, escrow's system was back up and they emailed their docs (escrow instructions, estimated HUD-1 Settlement Statement) to our clients to sign and return. I created a video review of their estimated HUD since escrow was not able to review it with them.

Our job wasn't over. Escrow needed the buyer's cashiers checks before 4:00 that day in order to have them in time for funding tomorrow. We wound up having the wire instructions emailed to our phones and we deposited the buyers checks directly into escrow's accounts.

And, I'm happy to say that we DID fund and close on time.

I am so proud of the crew I work with at Mortgage Master Service Corporation.

Thank YOU Shannon, for your recommendation and thoughtful card! Shannon was an asset throughout this transaction, it was a great team effort from all.

Fannie Mae issues FAQs on the Pending Expiring Loan Limits: 2012 Limits Could Be Lower

A couple days ago, Fannie Mae addressed questions regarding the high balance loan limits that are set to expire effective with Notes dated October 1, 2011 or later. The current (technically "temporary") high balance limit in the greater Seattle – Bellevue area is $567,500, the new loan limit ("permanent") after September 30, 2011 is $506,000.

Here are some points from Fannie Mae's FAQ's:

Q2. Are the loan limits definitely expiring? What would it take to get them extended or changed from the permanent loan limits?

Congress would have to take action to extend or revise the temporary loan limits, which were originally put in place through the Economic Stimulus Act of 2008 and have been extended through a series of additional legislative actions to provide support to the mortgage market…. The February report to Congress by the Departments of Treasury and [HUD] stated "the Administration recommends that Congress allow the temporary increases in limits that were approved in 2008 to expire as scheduled on October 1, 2011 and revert to limits established under HERA [Housing Economic Recovery Act]." As such, we do not expect any further extensions.

Q3. What will happen in 2012? Could permanent loan limits go down?

…the Federal Housing Agency (FHFA) is required to evaluate loan limits annually, and then revise limits accordingly. The first set of HERA loan limits (a.k.a. "permanent" loan limits) was established for calendar year 2009 based on the median home prices….While there have been median home price declines over the past three years, FHFA followed a policy to "not permit declines relative to the prior HERA [permanent] limits."

…no changes are expected to those permanent limits between October 1, 2011, and December 31, 2011. FHFA has not indicated whether it will continue its policy of not permitting declines in HERA-based limits beyond 2011…2012 loan limits could decline from those that will apply in the fourth quarter of 2011.

Loan limits for 2012 are expected to be released by FHFA in mid-November of this year. Current counties that have temporary "high balance" loan limits in Washington State are:

- King

- Snohomish

- Pierce

- San Juan

- Kitsap

- Jefferson

- Clark

- Skamania

Only King, Snohomish, Pierce and San Juan Counties will continue to have high balance loan limits from October 1, 2011 to December 31, 2011. The other Washington counties listed (and all counties not listed) above will be returning to a conforming loan limit of $417,000 through December 31, 2011.

We don't know what 2012 brings for loan limits. We should learn more in November.

If you would like me to provide a rate quote for your home located anywhere in Washington, click here.

Recent Comments