Our current FHA and Conforming High Balance loan limits are scheduled to roll back on October 1, 2011 unless Congress decides to act quickly and extend them. In the greater Seattle area, the loan limit for a single family dwelling is $567,500, after September 30, 2011, the conforming limit is set to be reduced to $506,000. The difference of $61,500 will impact home owners, home buyers and sellers alike.

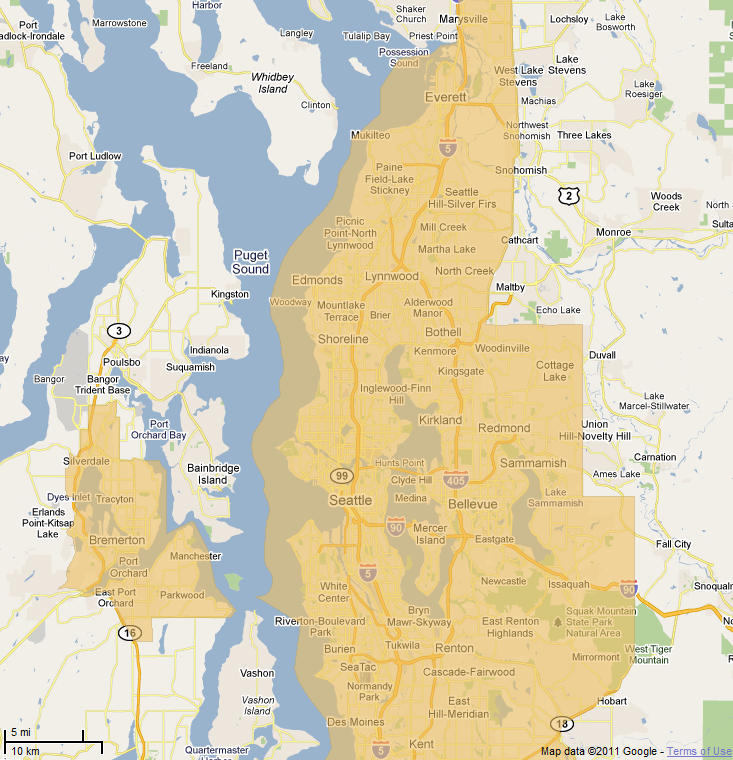

If you are a home owner in King, Pierce or Snohomish County considering a refinance and your loan amount is higher than $506,000; effective October 1, 2011 your loan amount will be considered a non-conforming (aka a jumbo). This will impact all counties in Washington State who currently have temporary "high balance" loan limits.

Notes dated after September 30, 2011, conforming loan limits are set to return to those as set forth per the Housing and Economic Recovery Act of 2008 (HERA). For single family homes, conforming loan limits look like this as of October 1, 2011:

King, Pierce and Snohomish Counties: $506,000 from the current $567,500, a $61,500 reduction.

San Juan County: $483,000 from the current $593,750, a $110,750 reduction in loan limit.

Kitsap County: $417,000 from $475,000, a $58,000 reduction.

All other counties will have a maximum conforming loan amount of $417,000.

Lenders will start to implement this well before the September 30th deadline as no one wants to be left holding yesterday's high balance loan amount when the limits have dropped as they'd have a jumbo mortgage with a conforming rate. Since the effective date is based on the Note date and not when an application is taken, this will cause the new loan amounts to appear sometime this summer in my estimation.

If you are considering a refinance and your loan amount is above the future loan limit and below the current (between $506,000 and $567,500 in Seattle or Bellevue) you don't want to delay! Having less financing options available for homes may also impact appraised values as fewer people will qualify based on the jumbo guidelines.

If you are considering buying a home and you're not wanting to come up with the additional down payment required to make up the "gap" between the loan limits, you may want to try finding that home by early summer and close well before September 30, 2011.

If you are selling a home that would be ideal for a "high balance conforming" borrower (in the Seattle/Bellevue area, that would be a sales price of $700,000 to $500,000), I suggest you make sure you price your home competitively and consider all types of financing (including FHA and VA). Once the new loan limits go into effect, you've lost a lot of potential buyers who may not be eager to come up with the additional funds to stay in the conforming or FHA market.

If you're a Listing Agent, please do your clients a favor and accept FHA and VA offers.

I'll continue to keep you posted as more information becomes available.

Recent Comments