Hat tip to Larry for sharing this link with me on where to find the cheapest gas by zip code. I’ve published more tips on how to ease the pain at the gas pump in my latest issue of The Mortgage Porter Quarterly, 2nd Issue 2008 which should be arriving in mail boxes soon.

This issue features:

- FHA is Back and Better than Ever

- Tips for Beating High Gas Prices

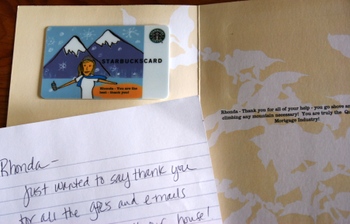

- What’s New with Rhonda (me)

- Credit Card Crackdown Making Headlines

- A recipe for Thai Lettuce Wraps

- Coupon towards Closing Costs

With every issue of The Mortgage Porter, I recommend that readers check their credit utilizing one of the three bureaus via www.annualcreditreport.com. Since The Mortgage Porter is currently published 3x per year, I rotate the bureau and in this issue, I suggest you check your credit utilizing your annual free Equifax report.

If you’re a Washington State homeowner (present or future) who would like to be added to my mailing list, please contact me with your name and full address.

Recent Comments