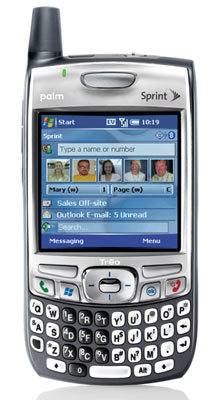

I was literally counting the days of being able to trade in my Treo 650 for a new phone. I wasn’t sure if I was going to stick with a Treo or what type of phone I would wind up with. I love gadgets! For my phone, beyond the obvious receiving and sending phone calls, I also need:

I was literally counting the days of being able to trade in my Treo 650 for a new phone. I wasn’t sure if I was going to stick with a Treo or what type of phone I would wind up with. I love gadgets! For my phone, beyond the obvious receiving and sending phone calls, I also need:

- To send and receive emails

- Manage task/to-do list

- Calendar

- Web capability (a girl’s got to blog and research if she has any "down time)

- Contact/data base management

- Camera/Video

- Loads of memory

- Text messaging (for my Mortgage Market Guide updates on rates)

- Having the phone backed up to my pc

I decided on the Treo 700wx.

My previous Treo was Palm based. I’ve been a Palm user for so long that I get a little sentimental tear in my eye when I think back to my first Palm Pilot and having to learn the graffiti in the pre-keyboard days. With this phone, I made the leap to Microsoft Mobile.

I love having Word, Excel, PowerPoint and Outlook. My goal is to consolidate the number of programs that I currently use on a daily basis. I am longing for Palm’s Task List (you can designate task with different priorities from A-C and then number them within the assigned letter) and the calendar which I had color coded for events and people.

I’m hoping I’ll be happy with my decision to leave Palm for Windows. I’ve only had the phone for a couple of days and I’m trying to not accidentally call people since I’m learning where all of the new buttons are.

I’m still trying to figure out a few simple things, like how I can add a signature to my email within the new Treo and if there’s a better way to manage my task. Currently, they are all on the present day, instead of having them just show on what ever day I plan to do a specific task (such as needing to follow up on something for a mortgage in process).

If any readers have one of the new Treo’s with Windows Mobile…and you have some advice for me…I’m all ears (or thumbs)!

Recent Comments