Just a beautiful day in Seattle…60 today…showers tomorrow night…and the day after that….

Archives for April 2007

No Jacket Required

When are you obligated to a Loan Originator?

Commitment…ah hah! I bet I just lost have of my readers out of fear from that one word! We’ve had a series of post recently at Rain City Guide that has developed some very interesting comments and dialog. Here’s are excerpts from a recent post of Ardell’s:

word! We’ve had a series of post recently at Rain City Guide that has developed some very interesting comments and dialog. Here’s are excerpts from a recent post of Ardell’s:

Me: “…if a buyer comes to you with a lender and has gone through the preapproval process, you might steer them to another one?”

Ardell: “Absolutely YES….Are you suggesting that the “pre-approval” comes with some kind of “obligation” to use that lender? “

A response from a real estate agent like this should not surprise me…but it did. This probably served as a much needed personal wake up call. I know when consumers are shopping me…and I have worked with a few real estate agents who have counseled their buyers to shop. They call me with the same script almost word for word, “All I want is a Good Faith Estimate…” I believe this agent (it’s not Ardell) is using my GFE to keep her preferred lender “honest” with his rates and costs.

As I’ve mentioned many times in this blog…odds are you cannot successfully shop interest rates–they are a moving target and change throughout the day. Any Joe Schmo L.O. can quote an enticing rate to get you drooling and then…when it’s time to lock (assuming he’s really locked in the rate and not gambling it) you may have your real rate. At closing, with Joe Schmo L.O. you’ll discover your real closing costs. (Always bring your GFE to your signing appointment).

The big issue I had with the post was the practice of going through the steps of getting preapproved with a Mortgage Professional just to drop them at the curb when you have a bona fide transaction. Ardell brought up an excellent question though, when are you committed to a Mortgage Professional?

When somebody contacts me for the first time. I’ll ask them a few questions, including what are their expectations of me at this point in time. Some just want rates, have questions or would like to have an idea of what they qualify for. This takes anywhere from five minutes to a half hour. I certainly hope that I’m beginning to develop a relationship and to show the client that I’m worthy of their business…but if they move on and elect to work elsewhere, that’s fine. There is no commitment at this stage. You’re just dating and getting to know each better.

Once you decide to move forward with a preapproval, if you are working with a  Mortgage Professional who has been referred to you, they are responsive to you, have earned your trust and you seem to have a decent relationship…I think you should “commit” to them. With the preapproval phase, you’re providing a Mortgage Professional with all of your income documentation for the past two years, savings and assets and allowing them to delve into your credit history. The preapproval process may take hours or it may take days (depending on the situation). This is a lot of work for Mortgage Professionals…and yes, this is what we do for a living. Keep in mind, as much as a Mortgage Professional would love you to feel like you are their only client, we are often juggling quite a few transactions along with various potential buyers who are just interested in quotes or are in the “dating phase” as I mentioned above.

Mortgage Professional who has been referred to you, they are responsive to you, have earned your trust and you seem to have a decent relationship…I think you should “commit” to them. With the preapproval phase, you’re providing a Mortgage Professional with all of your income documentation for the past two years, savings and assets and allowing them to delve into your credit history. The preapproval process may take hours or it may take days (depending on the situation). This is a lot of work for Mortgage Professionals…and yes, this is what we do for a living. Keep in mind, as much as a Mortgage Professional would love you to feel like you are their only client, we are often juggling quite a few transactions along with various potential buyers who are just interested in quotes or are in the “dating phase” as I mentioned above.

Once you are preapproved, the Mortgage Professional issues a preapproval letter in the buyers name stating they have gone through all of these steps and are committed to providing the buyer financing. We know this is not the perfect and that commitments from unsavory lenders or individuals are worthless…however if you have a solid Mortgage Professional, you as the client should honor that commitment as well. In addition to the time spent with the preapproval process, there are often countless emails, phone conversations, letters…you may have several weeks invested into each other. You are “going steady”. Please don’t date other LO’s behind your mortgage professionals back…at this stage. If there’s something you’re not happy with, communicate with them or move on before spending more of their time and resources.

Once you find your home and have an accepted offer (signed around purchase and sale agreement)…I hate to say the “m” word…if you’re still reading this…but you’re almost married! After a lot of hand holding, late night chats and frequent emails together, your transaction is coming to fruition. By now, you should really know your Mortgage Professional. If you doubt your rate when you’re locking in, you can always ask them. Tell them you noticed xyz rate at the bank this morning…what ever…kind of a “is that a blond hair on your collar” check.

Once you find your home and have an accepted offer (signed around purchase and sale agreement)…I hate to say the “m” word…if you’re still reading this…but you’re almost married! After a lot of hand holding, late night chats and frequent emails together, your transaction is coming to fruition. By now, you should really know your Mortgage Professional. If you doubt your rate when you’re locking in, you can always ask them. Tell them you noticed xyz rate at the bank this morning…what ever…kind of a “is that a blond hair on your collar” check.

My point is…in this post that is all ready too long (my apologies), when you have a signed around purchase and sale agreement on your home is NOT the time to begin shopping for lenders. Especially if you all ready have, as Brian Brady put it, used someone else to do all of “the grunt work” to get you preapproved. Now is when the Mortgage Professional who has worked with you to get your loan approved really has a chance to do their job and see your transaction through to closing.

And, ideally, I hope to maintain my relationship with my clients long after closing. I hope they will continue to rely on my expertise when they have mortgage needs in the future, whether that just be a simple question or if they need to refinance or buy their next home.

This is a relationship business and it’s a two way street. If you expect to have your Mortgage Professional to be devoted and available at your beckon call, shouldn’t they be able to have a little faith in the borrower?

Did You Get Your Tax Refund or…

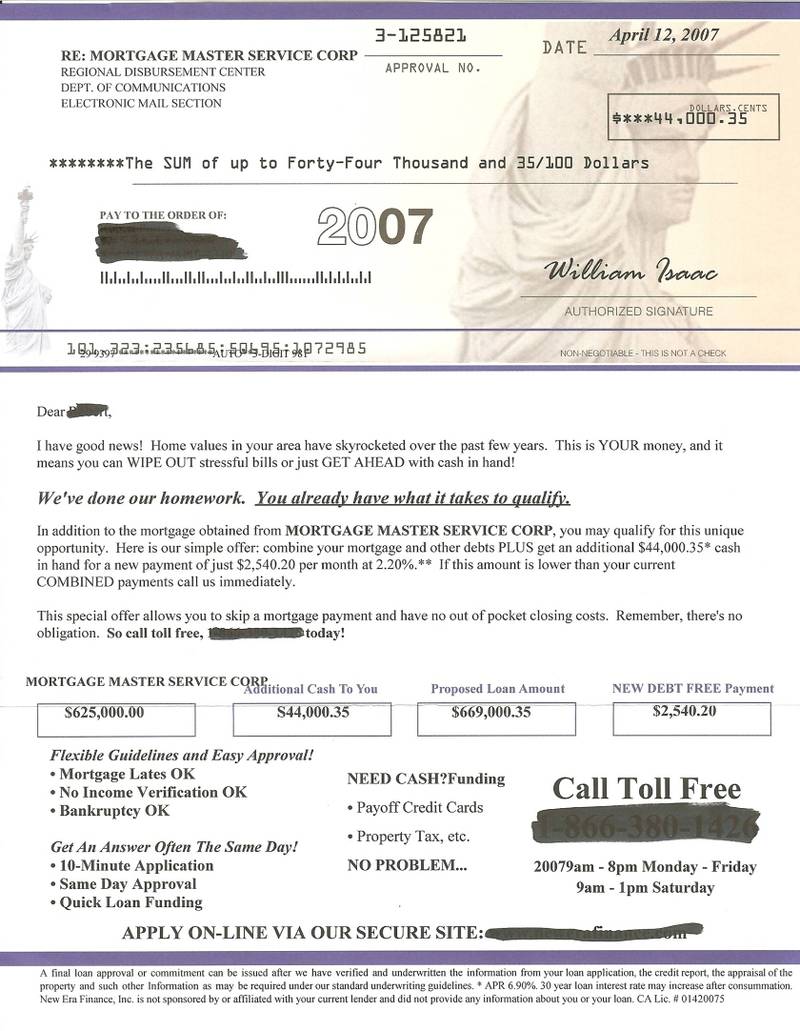

How about something that looks like one? This arrived the other day to our home in a gold envelope looking very much like an income tax refund. Per Washington State law, this form of advertising from a mortgage company is illegal.

That’s just the beginning of what is wrong with this advertisement. This company appears to be offering to refinance our current mortgage plus give us $44,000.35 (don’t forget that 35 cents) cash in hand at the low rate of 2.20% (obviously a negative amortized/deferred interest ARM)! The ad shows two asterisks next to the rate… on the bottom of the flier, there is an * in very fine print disclosing an "APR of 6.90% 30 year loan interest rate may increase after consummation". Duh…ya think? The fine print also shows this lender is licensed in California, not Washington, to provide mortgages.

My point is, whenever a mortgage company has to resort to "cold marketing"… whether that be phone calling or deceitful pieces of mail aimed to look like something other than what it is (such as your IRS refund), they are not worth trusting your largest asset (your home) and debt (your mortgage) with.

I always advise getting a referral from someone you trust. Do your own homework. If it seems too good to be true, it is.

How Did You Find Mortgage Porter?

One of the features of having a Typepad blog is that I can see what the input was for Google and various other search engines.

Here’s a recent sample from today (in chronological order):

- Lying on a 4506

- Wells Fargo Loan Officer ethics and conduct

- Douglas Andrew Missed Fortune

- Prepayment penalties and selling a home

- Countrywide misleading advertisement no closing costs

- Will my payment go up when my ARM adjust

- 30 Year Interest Only and 10 year interest only

- 4506 reveals borrower didn’t file tax returns

- Fannie Mae Flex

I like to read how viewers have discovered Mortgage Porter. The search phrases are helpful as it shows me what is currently on people’s mind. And provides me with ideas for future posts.

There is a definite ethics theme with both lenders and consumers and there are general searches about mortgages. I’ve added the links to the pages the visitors were referred to (there are a couple links I had to make an educated guess on).

I wish Typepad had a way to show what the most viewed pages are in Mortgage Porter’s history…I’ll have to send them an email! Meanwhile…I’m just scanning the information as much as possible to get a glimpse of how people are finding this site.

Not Feeling Funny on a Friday

This is my second day of having a bug. Not the type Larry Cragun likes! I’m sick at home. Luckily, I’m usually pretty healthy. When I’m not feeling at my best, I don’t know why, but I like to stretch out on the couch and fall asleep watching something stupid on the TV. I was just getting ready to take a cat nap…and I see one of my cat’s (we have three) has beat me to my spot on the sofa.

Thelma is almost the size of my Pug. I think I’ll let her have the couch…for now.

Is it better to buy or rent?

An article in the New York Times was brought to my attention from Tim at Seattle Bubble on whether or not you should buy or rent. The article is very slanted towards renting and considering the part of the country it’s originating from, they are right. Our local economy and housing market remains strong and is not experiencing any sort of a slump.

What I really liked about the article is the on-line calculator to help you determine if you should rent or buy. The calculator is flexible and friendly with adjusting appreciation, down payment, rent increases and the costs associated with owning a home (funny how many potential home buyers forget about that). If you’re considering buying a home, I encourage you to check it out.

Tim, where was this calculator when I did my post at Rain City Guide and Seattle Bubble Blog countered it?

Subprime LTVs and Credit Scores

Yesterday I received an email a subprime lender promoting their new loan to value (LTV) limits based on credit scores. I thought it was a good reflection of the current LTV/credit score guidelines for this current market.

100% LTV @ 660 Credit Score

95% LTV @ 580 Credit Score

90% LTV @ 560 Credit Score

85% LTV @ 540 Credit Score

80% LTV @ 520 Credit Score

Interest rates were not provided with the email that I received, however, I would be they’re undesirable.

Someone with a 660 credit score, depending on what their actual credit history and financial portfolio looks likes, should actually be able to obtain other financing besides subprime, such as FHA or a Flex type program.

This is a sharp contrast to what was available a few months ago for subprime borrowers. And I’m amazed at how many phone calls I’m still receiving from people who know they have a credit score in the 500 range wanting zero down who are living paycheck to paycheck. I don’t blame anyone for wanting to own a home, it is touted as the "American Dream". But a 2-3 year prepayment penalty with a double-digit mortgage interest rate, is not.

A Room with a View: The Inn at El Gaucho

My husband and I received a wedding gift to stay at the Inn at El Gaucho in the Bell Town district of Seattle. Saturday night, we had tickets to see Greg Brown and Bo Ramsey at the Moore Theatre, so we decided to use our present.

My husband and I received a wedding gift to stay at the Inn at El Gaucho in the Bell Town district of Seattle. Saturday night, we had tickets to see Greg Brown and Bo Ramsey at the Moore Theatre, so we decided to use our present.

Since we were staying there, we also made reservations for dinner prior to our show. I have to tell you, I was so impressed with the service. The food was outstanding too. We had the New York for Two–prepared perfectly. It’s not cheap–but hey, we don’t go out much and the room was paid for!

We caught a cab to the show at the Moore. The Moore Theatre was built in 1907 and is the oldest remaining theater in Seattle. It is certainly not as flashy as The Paramount and is in need of some TLC. Regardless, the Moore is an amazing venue.

We had the fortune to see Greg Brown and Bo Ramsey at the Tractor Tavern a few years ago. That was an incredible concert. Greg made you feel like he was long time old friend and was very interactive with the crowd. His performance then was passionate and lively. I probably went into this concert with too high of expectations because this show seemed to be lacking that. It was a bit disconnected and, although he is very talented and has a one of a kind voice, it appeared to me that he just wanted to get the gig down and call it a night.

We walked back to El Gaucho and finished our evening with a flaming Spanish Coffee. The photo above I snapped with my Treo from our suite, is of The Cyclops bar (it’s a blinking neon eye). While relaxing in our room, I had a chance to read Seattle Metropolitan Magazine’s list of the Top 10 Neighborhoods…click here to read more.

We should go out more often!

Recent Comments