This week’s episode of The Mortgage Porter – Mortgage Rates and More!

Learn what may impact mortgage rates this week, including two months of the backlogged BLS Jobs Report and more!

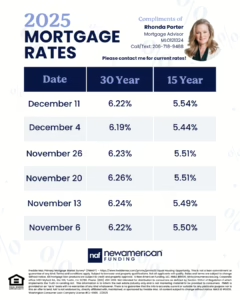

If you’re thinking about buying, selling or refinancing your home, I’m happy to help you!

Freddie Mac released the

Freddie Mac released the

Recent Comments