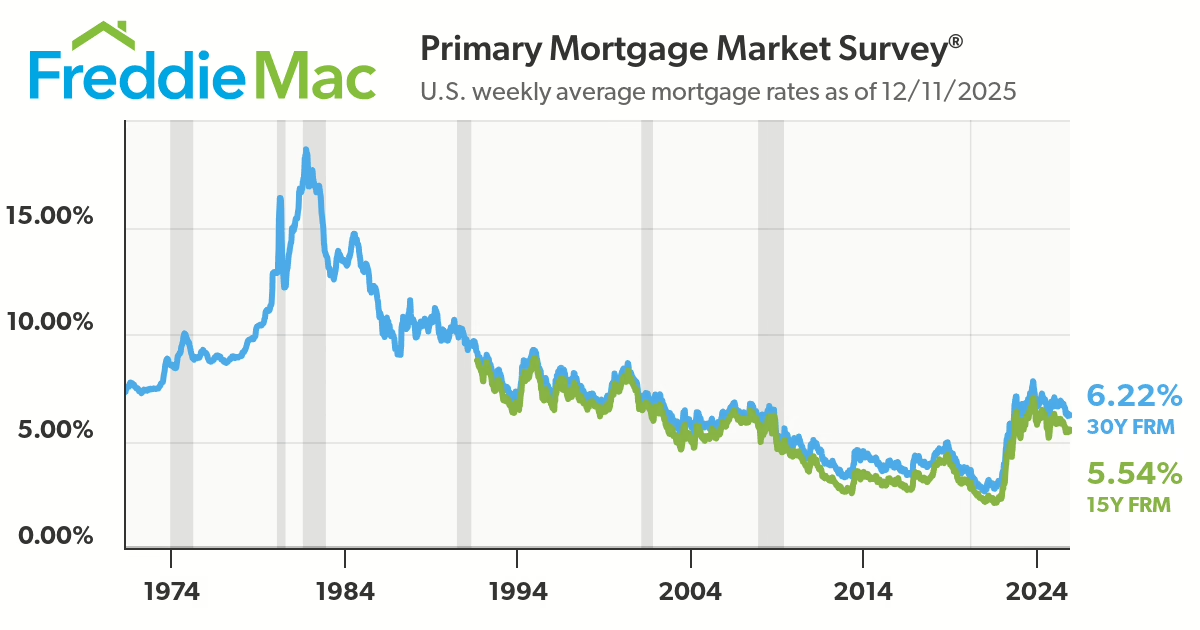

Freddie Mac released the PMMS (Prime Mortgage Market Survey) today showing that mortgage rates for the 30-year fixed averaged 6.22% last week. Really, the best use of Freddie’s survey is to show how mortgage rates are trending because you can’t lock in last week’s rate UNLESS they just happen to be the very same rate as what’s available to you at the moment you’re ready, willing and able to lock.

Freddie Mac released the PMMS (Prime Mortgage Market Survey) today showing that mortgage rates for the 30-year fixed averaged 6.22% last week. Really, the best use of Freddie’s survey is to show how mortgage rates are trending because you can’t lock in last week’s rate UNLESS they just happen to be the very same rate as what’s available to you at the moment you’re ready, willing and able to lock.

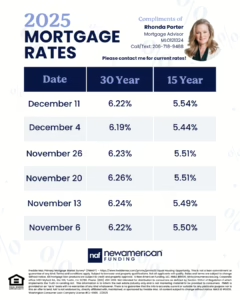

Looking back from October 30 to the December 4 results, mortgage rates for the 30-year and 15-year conforming (Freddie Mac) have been in a pretty tight range.

Freddie Mac has been collecting and sharing data on average mortgage rates since 1971.

As I mentioned, these rates are literally from last week and are averaged. There are several factors involved with pricing out a mortgage interest rate, such as your credit score, how much equity is in the home and type of program.

If you would like to have a no-hassle rate quote for your home purchase or refinance, I’m happy to provide that for you.

Discover more from The Mortgage Porter

Subscribe to get the latest posts sent to your email.

Please leave a reply