Mortgage rates are priced with rebate, a credit towards closing cost, or discount points, an additional cost paid to reduce the interest rate (Note rate). The amount of the rebate or discount is based on a percentage of the loan amount. The difference in pricing (rebate or credit) varies throughout the day, just as mortgage interest rates change. In fact, it’s not so much that the mortgage rates change throughout the day, it’s actually the cost or credit associated with that rate.

Using Rebate Pricing to Reduce Closing Cost on your Refi or Home Purchase

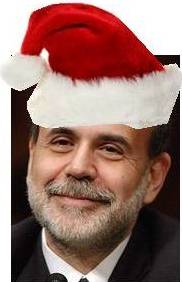

Santa Ben and the FOMC Deliver Lower Rates

Just in time for the holidays, the FOMC surprised everyone by cutting the Fed Funds  rate to a range of zero to 0.25%. This 0.75-1.00 reduction is more than the widely anticipated 0.50% rate cut. The Fed also reduced the Discount Rate by 0.75% to 0.50%.

rate to a range of zero to 0.25%. This 0.75-1.00 reduction is more than the widely anticipated 0.50% rate cut. The Fed also reduced the Discount Rate by 0.75% to 0.50%.

Bernanke and the FOMC didn’t stop with the giving there…they reiterated their commitment to buying mortgage backed securities which keeps mortgage interest rates low.

Recent Comments