When checking around for who has “the best mortgage rate” or just getting an idea of what mortgage rate you may qualify for based on your personal scenario, many will obtain a “mortgage rate quote“. Mortgage rates change constantly, similar to the stock market, as they’re based on mortgage backed securities (bonds).

When I provide a mortgage rate quote for a Seattle area home, it’s possible the rate may have changed by the time I prepare the quote and calculate the APR! Your mortgage rate is not locked in by a written rate quote nor is it locked in by the Good Faith Estimate. Just because you’ve received a written rate quote, the rate is not locked until you’ve requested a rate lock and your mortgage originator has issued you a rate lock commitment.

A written rate quote or rate worksheet (this form goes by several names and is the result of HUD’s 2010 Good Faith Estimate) is NOT a guarantee of interest rate. It illustrates the current interest rate based on the information provided to the mortgage originator and includes the APR, total monthly mortgage payment, detailed closing cost and funds due or received at closing.

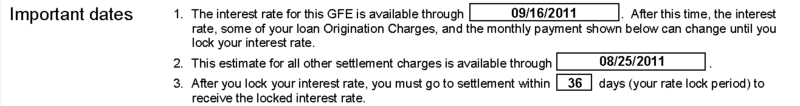

The Good Faith Estimate is also NOT a guarantee of interest rate. It does disclose how long the rate is good for on the first page under “Important Dates” on Line 1.

With this scenario, the interest rate for this Good Faith Estimate is actually locked which is illustrated on Line 3 (the rate lock period). If this rate was unlocked, it’s not uncommon to see the time issued following the date on Line 1. This is because a mortgage rate may be expired (no longer available) once the document is issued however it’s quite possible that minutes or hours after a Good Faith (or rate quote) is issued, the rate at the same price may be available.

Mortgage rates start fresh with the opening of each business day. Lenders issue their rate sheets and reissue them throughout the day reacting to the markets. If you follow me on Twitter, you may see me tweet about lenders reissuing rate sheets with pricing for the better or worse or commenting on how many rate sheets I’ve received that day. It’s not uncommon to have anywhere from 2 – 5 different rate sheets (rate changes) per day, especially if the stock market is being volatile.

Mortgage rates start fresh with the opening of each business day. Lenders issue their rate sheets and reissue them throughout the day reacting to the markets. If you follow me on Twitter, you may see me tweet about lenders reissuing rate sheets with pricing for the better or worse or commenting on how many rate sheets I’ve received that day. It’s not uncommon to have anywhere from 2 – 5 different rate sheets (rate changes) per day, especially if the stock market is being volatile.

It used to be easier for a mortgage originator to say “yes, the rate I quoted you last week is still the same as what I can offer you today”. This was before the Fed changed how mortgage originators are compensated (divorcing our pay from how rates are priced). If a mortgage originator quoted you X% at 1 point last week and today X% actually cost a little more or a little less, the mortgage originator could absorb the difference. Now the difference is the consumers, for better or worse, in the form of rebate or discount pricing. Rates may be roughly the same, but odds are, they’re at least slightly different, even if it’s 0.0125% if fee/pricing.

Bottom line: until you have locked your rate and received a rate lock commitment, your rate is not “your rate”. It’s just a quote or a “floating” rate.

Discover more from The Mortgage Porter

Subscribe to get the latest posts sent to your email.

Please leave a reply