This morning FOMC announced no changes to the current Fed Funds rate (this is no surprise). The Fed has decided to keep the Fed Funds rate at 0 – 0.25% until the unemployment rate is under 6.5%. This may be some good news to home owners who have HELOCs as many of them have rates tied to the prime rate, which is based on the Fed Funds rate.

This morning FOMC announced no changes to the current Fed Funds rate (this is no surprise). The Fed has decided to keep the Fed Funds rate at 0 – 0.25% until the unemployment rate is under 6.5%. This may be some good news to home owners who have HELOCs as many of them have rates tied to the prime rate, which is based on the Fed Funds rate.

The Fed says….Mortgage Rates to Remain Low

Mortgage Update for the Week of December 12, 2010

Mortgage rates continue to be very low levels. Freddie Mac has been reporting average interest rates for 30 year at under 4% for the last year with 15 year fixed rates being under 3% for the last six months.

Mortgage rates continue to be very low levels. Freddie Mac has been reporting average interest rates for 30 year at under 4% for the last year with 15 year fixed rates being under 3% for the last six months.

While the Fed works at keeping rates at artificially low levels, Congress is considering increasing the guarantee fees to new conventional mortgages to help fund programs that have nothing to do with Fannie Mae, Freddie Mac or even the housing recovery. The guarantee fees (aka g-fees) are factored into the pricing of a mortgage rate. FHA mortgage loans are also becoming more expensive in 2013 with the increase of mortgage insurance premiums.

Mortgage rate update for the week of October 1, 2012

I cannot believe it’s October, can you? Perhaps it’s our extended summery weather we are experiencing in Seattle. This being the first week of a month means that we have the Jobs Report being released this Friday. The Jobs Report tends to impact mortgage rates as it indicates how the economy is doing and the potential for wage inflation. It is anticipated that 120k jobs were added last month – we’ll see how the numbers pencil out on Friday when September’s Jobs Report is released. Wednesday is loaded with both the ADP National Employment Report and the release of the FOMC minutes.

I cannot believe it’s October, can you? Perhaps it’s our extended summery weather we are experiencing in Seattle. This being the first week of a month means that we have the Jobs Report being released this Friday. The Jobs Report tends to impact mortgage rates as it indicates how the economy is doing and the potential for wage inflation. It is anticipated that 120k jobs were added last month – we’ll see how the numbers pencil out on Friday when September’s Jobs Report is released. Wednesday is loaded with both the ADP National Employment Report and the release of the FOMC minutes.

The Fed Says…Let’s Twist

No surprise that the FOMC is not making any changes to the Fed Funds rate. What may have surprised some is the Fed’s focus on trying to keep mortgage rates low with it’s purchase of mortgage backed securities. From today’s press release:

To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee agreed today to increase policy accommodation by purchasing additional agency mortgage-backed securities at a pace of $40 billion per month. The Committee also will continue through the end of the year its program to extend the average maturity of its holdings of securities as announced in June, and it is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities. These actions, which together will increase the Committee’s holdings of longer-term securities by about $85 billion each month through the end of the year, should put downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative.

….If the outlook for the labor market does not improve substantially, the Committee will continue its purchases of agency mortgage-backed securities….

The efforts to keep mortgage rates low will be in contrast to the increase in the “g-fees” by Fannie Mae and Freddie Mac. It will be interesting to see how much of an impact the Feds efforts will make.

Stay tuned for Ben Bernanke’s press conference happening in a few hours. Meanwhile… let’s twist!

What may impact mortgage rates the week of September 10, 2012

Although at first glance, this week may seem like there’s not a lot scheduled that may impact mortgage rates, what is scheduled is significant. We have the FOMC meeting winding up on Thursday following last Friday’s weaker than expected Jobs Report. Friday is packed with reports that may reveal signs of inflation, which tends to drive mortgage rates higher.

Here are some of the economic indicators scheduled for this week:

Thursday, Sept. 13: FOMC Meeting; Producer Price Index (PPI); Initial Jobless Claims

Friday, Sept. 14: Retail Sales; Consumer Price Index (CPI); Consumer Sentiment Index (UoM)

For your personal mortgage rate quote for your home located anywhere in Washington state, please contact me.

You can also follow me on Twitter or Facebook where I provide live rate quotes and mortgage tid-bits throughout the day.

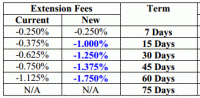

Extension Fees 001

Mortgage rate update for the week of August 20, 2012

Mortgage rates have been trending higher over the past few weeks (they are still very low). Here are some of the scheduled economic indicators that may impact mortgage rates this week:

- Wednesday, August 22: Existing Home Sales and FOMC Minutes

- Thursday, August 23: Initial Jobless Claims and New Home Sales

- Friday, August 24: Durable Good Orders

As I write this post (9:00 am PST) the DOW is at a 4.5 year high (13,260). Remember that as the stock markets improve, you will see investors trade the safety of bonds (like mortgage backed securities) for the possibility of higher returns of stocks. This will cause mortgage rates to trend higher as will signs of inflation or that the economy is improving.

Clients often ask me if the government controls mortgage rates and are surprised to learn they do not. The government has been involved with buying mortgage backed securities which is manipulating mortgage rates to lower levels however, they do not directly set mortgage rates. The Fed does set the Fed Funds Rate, which impacts the rates for HELOCs but not mortgage rates.

Mortgage rates often change throughout the day. Last week, there were days where one of the lenders I work with issued three to five changes in just one day.

Santa Ben and the FOMC Deliver Lower Rates

Just in time for the holidays, the FOMC surprised everyone by cutting the Fed Funds  rate to a range of zero to 0.25%. This 0.75-1.00 reduction is more than the widely anticipated 0.50% rate cut. The Fed also reduced the Discount Rate by 0.75% to 0.50%.

rate to a range of zero to 0.25%. This 0.75-1.00 reduction is more than the widely anticipated 0.50% rate cut. The Fed also reduced the Discount Rate by 0.75% to 0.50%.

Bernanke and the FOMC didn’t stop with the giving there…they reiterated their commitment to buying mortgage backed securities which keeps mortgage interest rates low.

Recent Comments