Yesterday I was following up with a home buyer who I wrote about previously at Mortgage Porter. They wanted a second opinion on their Good Faith Estimate which I provided. It’s really hard to beat "builder credits" for working with their preferred lender when the purchase and sale agreement is all ready written. If you have not presented the offer, you can always have the offer presented with the same credit and using YOUR lender…especially these days!

I was truly pleased to hear that the home buyer did indeed close and receive the rate they were expecting. Here is their response:

"…The lender was nice enough to waive the processing fees ($750) after I complain about the high fees, however they did charge me the discount point fee. I guess it never hurts to compare and complain. I was able to utilize all the $8000 toward closing.

The only thing that shock me was the property tax. All the time I was quoted the land value property tax only. I chose to pay the land plus home value property tax at closing because I had to utilize all of the $8000 closing credit. It added up to be 1.27% of my purchase price of $455,000. How is property tax calculated?"

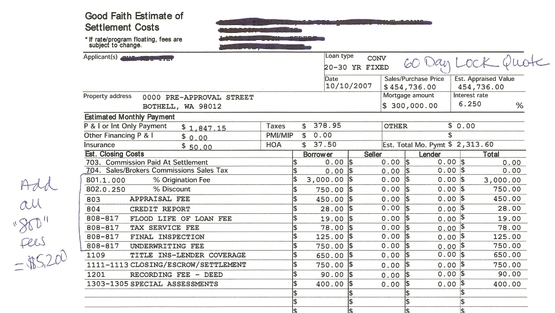

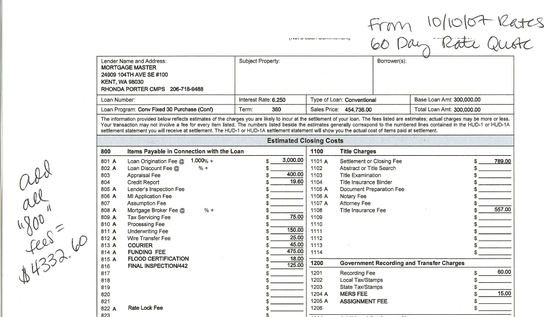

I always say to focus on the total costs shown on Section 800 and compare that with the rates of others…but you do need to be aware of other "tricks" that may happen. Loan Officers should not under estimate property taxes. Unless you provide your LO with a property address and the home has been assessed (not new construction), the going estimate in our neck of the woods is 1.25% of the sales price.

For example, if your buying a newly constructed home with a sales price of $500,000; the monthly taxes should be $520.83. (500,000 x 1.25%/12 months).

If your estimate is lower; you may want to question the lender and/or real estate agent. It’s possible that if the seller may be receiving a Senior Citizen tax exemption greatly reducing the amount they pay; unless you qualify for their exemption, you’ll have the full bill.

With new construction, it’s very important to make sure enough taxes are collected to cover what will be due once the Tax Assessor decides how much your lovely new home is worth. If there is a difference in what was collected, you will be paying if it’s short (aka omit taxes) and you may receive a refund from your lender when your escrow/reserve account is reviewed or King County will refund overpaid taxes when more than the full year was paid.

When I provide a Good Faith Estimate I request the property address so that I can research what the property taxes are. Most local counties have this information available on-line for consumers, too.

I’ll do a post in the future addressing how property taxes on existing homes are calculated.

By the way, I always welcome your questions. If you’re wondering about a certain mortgage or home purchase issue, chances are someone else is too. Your question may help someone else in your shoes.