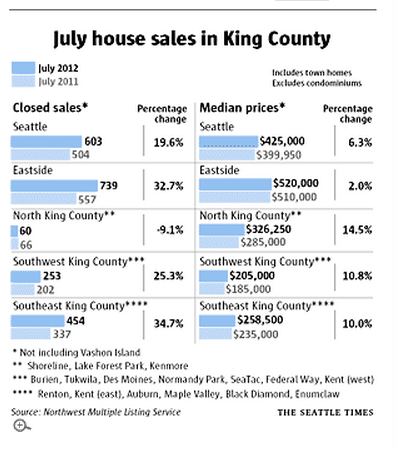

The Seattle Times reports that home prices for King County have jumped up 7.2% from July last year. This pencils out to $25,250 with the median sales price of $375,250. The article also notes that closings are up 26% YOY which is great news for the housing industry. It doesn’t matter how low mortgage rates or home prices are unless transactions can actually close.With less inventory, many buyers are finding themselves in bidding wars or having a property in contract before they can get their offer together. From the article:

“Another recurring theme is the dramatic drop in the number of homes for sale. Home listings have been sliding for a full year; in July the number of home listed for sale was down 38 percent year-over-year…

…distressed home listings — bank-owned properties and short sales — are down 60 percent from last year. This also contributes to the small number of listings and brings up home prices.”

Part of the reason for the low inventory, per Seattle real estate economist Matthew Gardner, is that many people are not able to sell because they are underwater with their mortgages and don’t want to go through a short sale.

If you’re considering selling and your property is non-distressed (you have enough equity to sell), this could be a great time with more buyers than sellers.

If you’re underwater with your home and would like to sell once you have equity, you might consider a HARP 2.0 refinance (if your last conforming mortgage closed prior to June 2009) or an FHA streamlined refi (if your existing mortgage is FHA). While you wait for home values to continue to trend higher, why not save on your monthly mortgage payments?

If you’re a home buyer, I cannot stress enough how important it is to be fully preapproved BEFORE you start shopping for a home. If you’re considering buying or refinancing a home in Seattle, King County or anywhere in Washington state, I’m happy to help you!