I've been working with a home owner in West Seattle who has an adjustable rate mortgage that she obtained almost five years ago from a big "local" bank. She contacted me to obtain rate quotes for refinance because her ARM is set to adjust soon. Here's what a review of her Note reveals:

The Note rate is 4.125% for five years with the first adjustment coming up on May 1, 2009. The index is based on the 1 Year Treasury (CMT) and her margin is 2.75%.

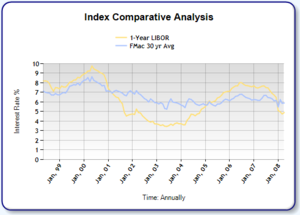

If her ARM were set to adjust today, her new rate would be based on adding the margin of 2.75% to the 1 Year Treasury rate of 0.49% rounded to the nearest 0.125% = 3.25%. (Indices are changing dramatically in our current climate–it's hard to say where the CMT will be on May 2009).

This rate is amortized based on the remaining term of 25 years and every May her ARM will continue to adjust based on where the current index is (1 year Treasury – CMT) plus the margin of 2.75%. This is also limited to specific caps that her Note features of 2% annually and a lifetime ceiling of 10.125%.

Let's assume her rate adjust to 3.25% in May 2009. The highest her rate could be on May 2010 is 5.25% and the lowest is 2.75% (the lowest the rate may ever be is limited to the margin of 2.75%). If rates continuing rising, the worse case scenario would look like this: May 2011 = 7.25%; May 2012 = 9.25%; May 2013 = 10.125% (because of the lifetime cap of 10.125%).

If worse case scenario, the CMT climbs dramatically over the next few months, the highest her rate could be is 6.125% based on her 2% rate caps.

Should this home owner refinance with her adjustment date looming near? It really depends on what her personal financial plans are and if she can tolerate having her rate change annually. Her main risk is where rates may be in the future. The choice is hers.

What would you do?

Are you a Seattle area home owner with an ARM? I'm happy to review your Note for you–no refinance required.